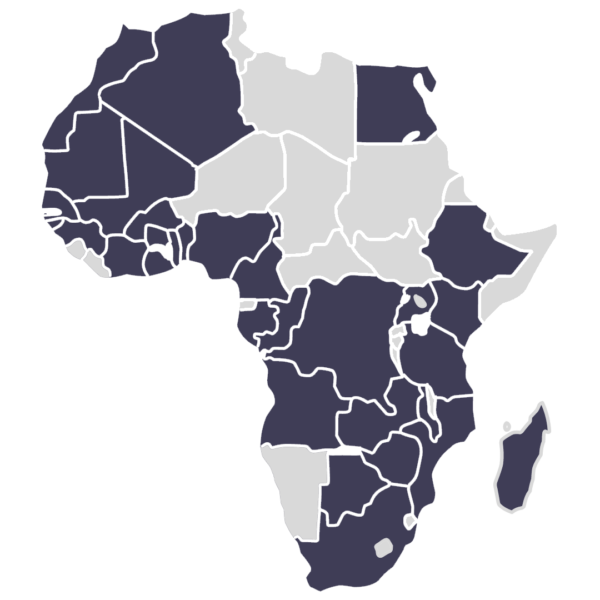

Access our online panel in 34 countries across Africa.

Our online panel and data collection capabilities helps businesses understand consumers across the continent.

Our representative African online panels are mobile based to ensure deep reach and fast turnaround times. You will be able to have thousands of respondents in a highly engaged online panel, and detailed answers to your questions – with results available in a few days.

Representative consumer panel in Africa with a robust quality

With the Sagaci Research pan-african online samples in Africa you will have a robust quality control process that allows seamless and comparable multi-country studies.

Our representative consumer panels are mobile-based to ensure deep reach and fast turnaround times. This means that in a few hours you will be able to have thousands of respondents in a highly engaged online panel, and detailed answers to your questions – with results available in a few days.

How can you target specific respondents using our online sample in Africa?

Target specific locations (regions, cities, districts…)

Target specific household characteristics (eg. number of kids, age of kids,…)

Target consumers of specific FMCG categories (food & non-food)

Target owners of appliances, electronics or vehicles

Target users of specific financial products (including insurance)

Target specific occupations (eg. farmers, IT professionals, shop owners, SMEs…)

Reach out to a representative panel of consumers in 34 countries in Africa

Why should you trust our online panel in Africa?

Diversified members recruitment channels: Advertising campaigns, social-network influencers, referrals, offline ambassadors, direct sign-up,…

Detailed demographic characteristics available: All panelists profiled during initial sign-up

Strong engagement: Panelists are encouraged to visit the app on a daily basis, with daily surveys available for them

Controlled environment: Panel sign-up with the members’ Google / Android account (unique)

Quality-focused panel: Panelists are scored based on the overall quality of their answers. Priority is given to higher-score panelists during survey assignment

See below the benefits of having a quality sample provider with Sagaci Research - Your expert tool to quick and cost-efficient representative surveys :

Reach

Access customers in 34 countries through a simple point of contact

Accurate

Trusted and engaged members providing high-quality answers

Representative

Nationally representative sample cutting across all socio-demographics: age, gender, income, urban / rural,…

Reactive

Gather massive amounts of data in a short-time frame

Targeted

Leverage profiling data to target specific groups

Fast

Quick-turn around times and accelerated fieldwork

Download our panel book now!

Do you want to know the number of members in our online sample in Africa?

Get started

Reach out to our team now to request feasibility and costs

Our insights from consumer panel in Africa

-

Lip Products market in Angola

Detailed insights on the lip products market in Angola Explore in-depth insights into the lip products market in Angola, drawn from real consumer data. This market report analyzes key consumption trends, top lip products brands, packaging preferences, and shopper behaviour within the lip products category. Built from our proprietary data tools, it provides a detailed

04/07/2025 -

Liquid Soap market in Angola

Detailed insights on the liquid soap market in Angola Explore in-depth insights into the liquid soap market in Angola, drawn from real consumer data. This market report analyzes key consumption trends, top liquid soap brands, packaging preferences, and shopper behaviour within the liquid soap category. Built from our proprietary data tools, it provides a detailed

04/07/2025 -

Vodka market in Angola

Detailed insights on the vodka market in Angola Explore in-depth insights into the vodka market in Angola, drawn from real consumer data. This market report analyzes key consumption trends, top vodka brands, packaging preferences, and shopper behaviour within the vodka category. Built from our proprietary data tools, it provides a detailed look at market dynamics,

04/07/2025 -

Preserved Meats market in Angola

Detailed insights on the preserved meats market in Angola Explore in-depth insights into the preserved meats market in Angola, drawn from real consumer data. This market report analyzes key consumption trends, top preserved meats brands, packaging preferences, and shopper behaviour within the preserved meats category. Built from our proprietary data tools, it provides a detailed

04/07/2025