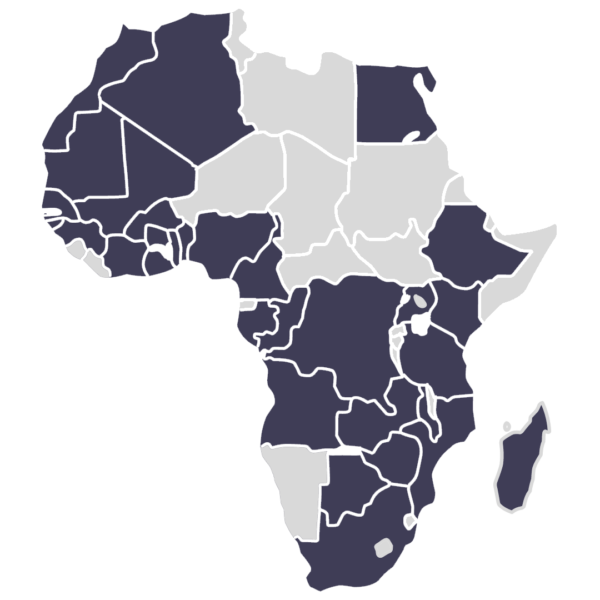

Access our online panel in 30 countries across Africa.

Our online panel and data collection capabilities helps businesses understand consumers across the continent.

Our representative African online panels are mobile based to ensure deep reach and fast turnaround times. You will be able to have thousands of respondents in a highly engaged online panel, and detailed answers to your questions – with results available in a few days.

Representative consumer panel in Africa with a robust quality

With the Sagaci Research pan-african online samples in Africa you will have a robust quality control process that allows seamless and comparable multi-country studies.

Our representative consumer panels are mobile-based to ensure deep reach and fast turnaround times. This means that in a few hours you will be able to have thousands of respondents in a highly engaged online panel, and detailed answers to your questions – with results available in a few days.

How can you target specific respondents using our online sample in Africa?

Target specific locations (regions, cities, districts…)

Target specific household characteristics (eg. number of kids, age of kids,…)

Target consumers of specific FMCG categories (food & non-food)

Target owners of appliances, electronics or vehicles

Target users of specific financial products (including insurance)

Target specific occupations (eg. farmers, IT professionals, shop owners, SMEs…)

Reach out to a representative panel of consumers in 30 countries in Africa

Why should you trust our online panel in Africa?

Diversified members recruitment channels: Advertising campaigns, social-network influencers, referrals, offline ambassadors, direct sign-up,…

Detailed demographic characteristics available: All panelists profiled during initial sign-up

Strong engagement: Panelists are encouraged to visit the app on a daily basis, with daily surveys available for them

Controlled environment: Panel sign-up with the members’ Google / Android account (unique)

Quality-focused panel: Panelists are scored based on the overall quality of their answers. Priority is given to higher-score panelists during survey assignment

See below the benefits of having a quality sample provider with Sagaci Research - Your expert tool to quick and cost-efficient representative surveys :

Reach

Access customers in 34 countries through a simple point of contact

Accurate

Trusted and engaged members providing high-quality answers

Representative

Nationally representative sample cutting across all socio-demographics: age, gender, income, urban / rural,…

Reactive

Gather massive amounts of data in a short-time frame

Targeted

Leverage profiling data to target specific groups

Fast

Quick-turn around times and accelerated fieldwork

Download our panel book now!

Do you want to know the number of members in our online sample in Africa?

Get started

Reach out to our team now to request feasibility and costs

Our insights from consumer panel in Africa

-

Consumer sentiment in Africa 2026: trends, outlook, and FMCG impact

Consumer sentiment in Africa in 2026 reveals a complex picture. While concerns around jobs and the future remain high, optimism has not disappeared. Based on SagaCube, our consumption tracker across 30 African countries, this latest wave highlights a key reality for FMCG brands in Africa: consumers are navigating economic pressure, yet still projecting themselves forward.

26/02/2026 -

Retail audits in Kenya: why FMCG brands need continuous retail tracking

Examples of retail audits in Kenya reveal how FMCG brands actually win or lose at shelf level, where distribution gaps, pricing execution and channel strategy often determine performance more than demand alone. In markets where traditional trade remains dominant, sales data alone rarely reflects true performance. Without reliable retail tracking, brands risk navigating complex retail

17/02/2026 -

Top banks in South Africa: Customer satisfaction and brand performance

Top banks in South Africa remain closely watched as customer expectations evolve and competition between established players and challengers intensifies. The latest wave of our ongoing SagaBrand tracker provides an updated view of how leading institutions perform today, highlighting shifts in customer satisfaction, brand strength and perception across the market. While this article focuses on

05/02/2026 -

Pet Care In Africa: Key consumer insights

This article explores pet care in Africa, drawing on recent data from SagaCube, the continuous consumption tracker across the continent. This survey captures pet ownership, attitudes, and pet care related purchasing behaviours, offering insight into how the pet food market in Africa is structured. We also explore top pet care brands based on SagaProduct, Sagaci

21/01/2026