- 18/04/2024

- Posted by: Janick Pettit

- Categories: Articles, Consumer Goods / FMCG, Online Panels, SagaCube, SagaProduct, Spread

This article looks into Africa’s bread spread market. With increased exposure to global food trends and the diversification of bread spread options in Africa, consumers are more inclined to try new flavours and products, driving demand for a wider variety of spreads.

Our latest report explores more specifically:

- Ranking of the most preferred spreads throughout the continent

- Preferred spreads at the country level highlighting the different bread spread consumption habits

- Top bread spread brands across markets

These insights come from a combination of tools developed by Sagaci Research. In this report we use the online consumption tracker in Africa (SagaCube) and the Product Scan functionality.

So read on to discover some of the key highlights of our report on Africa’s bread spread market or download it here directly.

The favourite bread spread in Africa

Across the various bread spread options available on the continent, the thousands of surveyed members of our online panel in Africa made their preferences clear:

Butter / margarine has emerged as the most popular choice among African consumers according to a recent SagaCube survey. 25% of Sagapoll panel members across 34 African markets declared it their favourite product to spread on bread.

List of the top bread spreads in Africa in preference order:

- Butter / margarine

- Cheese

- Peanut butter

- Mayonnaise

- Honey

- Chocolate spread

- Jam

In second position comes cheese (15%), followed by peanut butter (14%) and mayonnaise (12%).

Preferred bread spreads across African markets

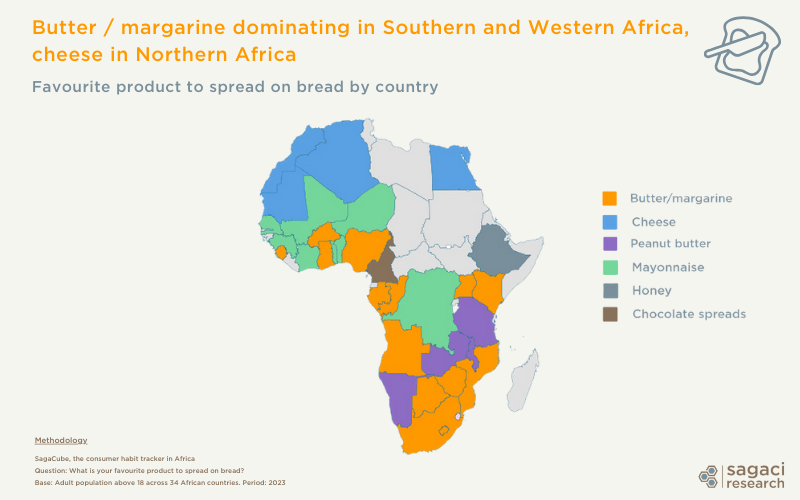

If butter / margarine wins the most consumers overall, consumer preferences for bread spreads can vary significantly across different regions and cultural contexts within Africa.

For example, butter / margarine is popular especially in Sub-Saharan Africa, peanut butter is a beloved staple in East Africa and Angola, while cheese is enjoyed more in Northern Africa.

The main bread spread brands in Africa

When it comes to the main brands of bread spread most commonly found in African consumers shopping baskets, here are some highlights for some of the top categories based on Shoppers Scans.

For deeper insights into shoppers baskets, did you know that our SagaPoll panel members not only answer survey questions on a daily basis but also scan the products they purchase and consume?

Zoom on main brands in key spread categories

- Butter / margarine: among all spread types, this is the favourite category in Nigeria and Mozambique. Nigerian consumers favour the most Golden Penny margarine (by Flour Mills of Nigeria). The FMN brand is indeed a key staple in the country as confirmed by recent insights into Nigerian consumer trends. In Mozambique, Rama (by South African Siqalo Foods) emerges as the leading margarine brand.

- Cheese: Egyptian consumers have a strong preference for cheese when it comes to spreadable products with leading brand Domty. Morocco, with a strong dairy culture, is the second biggest cheese market according to our recent data. Spreadable cheese brands La Vache qui Rit (by Bel Fromageries), Kiri (also by Bel) and Milkana (by Savencia) are among consumers’ favourites.

- Mayonnaise: The biggest mayonnaise consumers are found in Benin with leading brand Mevia and in Guinea with brand Bama by GB Foods.

- Peanut butter: Malawi, Zambia, Botswana, Tanzania and Kenya are among the largest consumers of peanut butter on the continent. With 27% preference rate among respondents, South Africa comes next. This is a category to watch in the rainbow nation as the competitive landscape could be shaken up in the coming months. Indeed, leading brand Yum Yum could face even stiffer competition by Tiger Brands‘ Black Cat brand, with the South African group recently announcing the inauguration of a cutting-edge peanut butter production facility in the country.

- Chocolate spread: Cameroon and Ghana appear as the biggest markets for chocolate spreads. Tartina by Chococam (owned by Tiger Brands) is the top brand in Cameroon while Top Choco is the most commonly found chocolate spread brand in Ghana.

Explore consumer preferences in Africa

As shown in this example, combining different research tools brings a holistic view of a market, category or even brand. Typically, a qualitative approach could complement the understanding of a category by exploring deeper into consumer beliefs and motivations.

To conclude, if you would like further insights on food spreads or popular condiments in Africa or consult with us on the best approach to address your specific business objectives, get in touch!

Please send an email to contact@sagaciresearch.com or click below.

Methodology

- SagaCube, the African consumption tracker including thousands of behavioural and attitudinal variables to deepen the understanding of African consumers. It tracks on an on-going basis 26 countries including Benin, Cameroon, Egypt, Ghana and Mozambique.

Question: What is your favourite product to spread on bread?

Base: Adult population above 18 across 34 African countries. Period: 2023

- Product scans: scan of the daily shopping basket by SagaPoll panel members showing the typical daily FMCG assortment such as sandwich spreads or snacking products

Base: Adult population above 18 in selected countries. Period: March / April 2024