- 26/02/2024

- Posted by: mohamed.boucetta

- Categories: Algeria, Angola, Articles, Benin, Burkina Faso, Cameroon, Cote d'Ivoire, DR Congo, Egypt, Eswatini, Gabon, Ghana, Guinea, Kenya, Mali, Morocco, Nigeria, Non-alcoholic beverages, Online Panels, SagaBrand, Senegal, South Africa, Tanzania, Togo, Uganda, Zambia, Zimbabwe

Introducing the latest insights on the best soda brands in Africa in 2023 from SagaBrand, the continuous Brand Health Tracking Survey.

On a daily basis members of our online panel in Africa answer surveys related to FMCG (as well as non FMCG) consumer brands from their market. The Sagabrand tracker covers dozens of categories including non-alcoholic beverages such as Carbonated Soft Drinks.

Among the 25 KPIs tracked on a monthly basis let’s look at the African soda market from a consumer Preference perspective. Namely, among all the main CSD tracked across 23 African countries, which were the favourite soda brands in Africa last year in the eyes of consumers?

The best soda brands in Africa in 2023

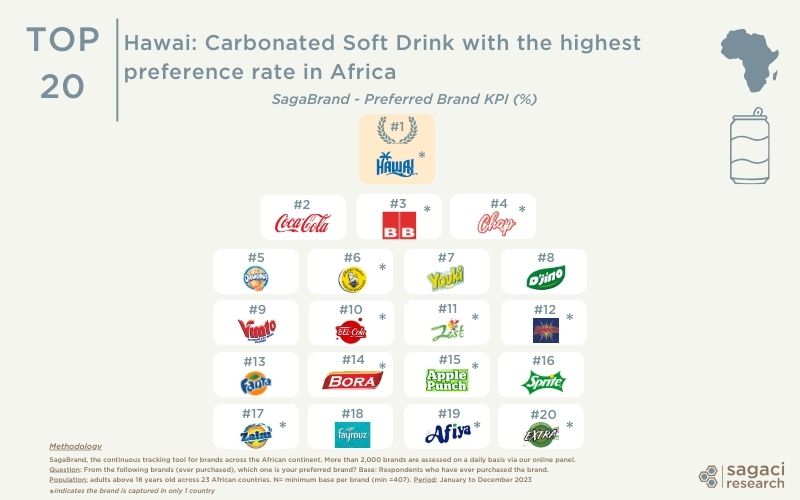

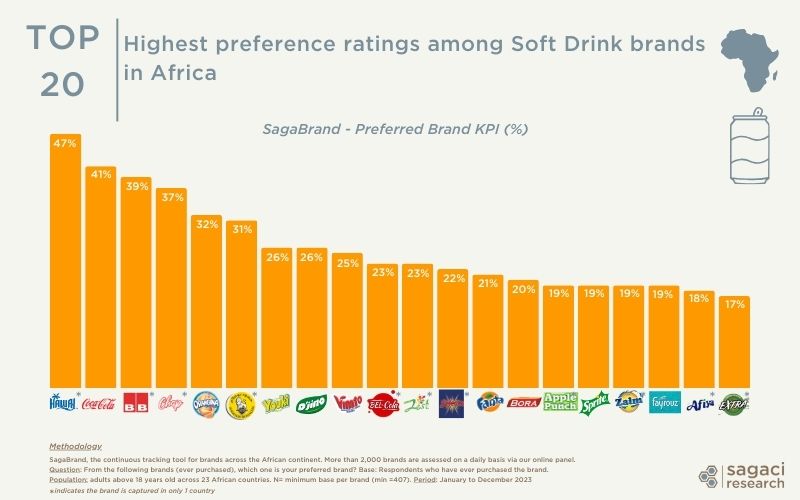

Here is the soda brand ranking in 2023 based on the Preference rate (share of consumers of that brand mentioning it as their preferred brand).

A couple things to keep in mind when reading these insights:

- The ranking is based on the average performance across the markets where the brands are present

- Some of the brands are only present in one or a handful of countries, while others (eg. most Coca Cola brands) are found in all 23 countries

- Hawai

- Coca-Cola

- BB Cocktail de Fruits

- Chap

- Orangina

- Hamoud

- Youki

- D’jino

- Vimto

- Bel Cola

- Zest

- Selecto

- Fanta

- Bora

- Apple Punch

- Sprite

- Zaim

- Fayrouz

- Afyia

- Extra

In the realm of carbonated soft drinks across Africa, Hawai (present in Morocco and owned by Coca-Cola), emerges as the undisputed frontrunner with a 47% preference rate, ahead of Coca-Cola, BB and Chap (both from Togo). Following closely behind is Orangina, a fruit-flavored carbonated beverage recognized for its citrus taste and strong presence in both European and French-speaking African markets.

Ranking of the best soda brands in Africa in 2023 in terms of Preference rate

Zoom on Orangina and a contrasted performance

The rankings provided are determined by averaging the performance metrics across various markets where each brand operates. So readings might differ according to the country. For example, Orangina by Japanese group Suntory demonstrates a 32% overall preference rate across the six markets under observation. However, its performance varies significantly across these regions, with preferences ranging from 17% in Morocco to a robust 50% in Côte d’Ivoire, where it enjoys a notably stronger market position.

Coca-Cola, home of some of the most loved sodas in Africa

These findings from SagaBrand underscore the dominant position of one of the most established brands in the African soft drink industry. Coca-Cola, present in all 23 markets tracked by SagaBrand, holds a strong position in most of them. The American brand typically boasts a preference rate exceeding 30%, soaring as high as 56% in Angola. Nonetheless, there are a few exceptions to this trend.

Notably, in Egypt, traditionally dominated by Pepsi, Coca-Cola maintains a preference rate of 21%. Likewise, in Cameroon, the brand has encountered significant challenges amid fierce competition from local competitors over recent months, resulting in a distinctly low preference rate of 17%.

Nevertheless, leveraging a diverse portfolio that includes brands like Hawai in Morocco, Fanta, and Sprite, the group consistently demonstrates commendable performances across the rankings.

Ranking of the best soda brands in Africa in 2023 in terms of Preference rate

Popular soda brands and regional dynamics

Alongside globally recognized brands, the market landscape also features several regional favorites that have garnered significant popularity within their respective countries and regions. These include:

- Chap and BB Cocktail de Fruits from Togo

- Fayrouz from Egypt

- Hamoud, Selecto and Zaim from Algeria

- Bora from the Democratic Republic of Congo (DRC)

- Extra from Mali

As Sagaci Research continues to uncover actionable insights through SagaBrand, businesses can leverage this information to make informed decisions and drive success in the ever-evolving African beverage landscape. We also conduct in-depth analyses of non-alcoholic beverages in individual countries, as shown in a recent study in Cameroon. So stay tuned for further updates and analyses as we delve deeper into the dynamics of the carbonated soft drink market and beyond.

More on soft drink industry insights in Africa

In conclusion, SagaBrand tracks carbonated soft drinks and other non-alcoholic beverages on a monthly basis across the continent. If you would like further insights on beverage ratings in Africa or how to leverage our robust African consumer insights, get in touch with us. Please send an email to contact@sagaciresearch.com or click below.

Methodology

SagaBrand, the continuous tracking tool for brands across the African continent. Our online panel is based on the online panel SagaPoll. It assesses around 2,000 brands on a daily basis.

This survey was conducted in the following countries: Algeria, Angola, Benin, Burkina Faso, Cameroon, Congo DRC, Côte d’Ivoire, Egypt, Eswatini, Gabon, Ghana, Guinea, Kenya, Mali, Morocco, Nigeria, Senegal, South Africa, Tanzania, Togo, Uganda, Zambia, Zimbabwe.

- Brand preference: From the following brands (ever purchased), which one is your preferred brand?

Population: adults above 18 years old in 23 African markets.

Period: January to December 2023

© Cover Photo by Sagaci Research in Morocco