- 04/04/2024

- Posted by: Janick Pettit

- Categories: Angola, Articles, Botswana, Burkina Faso, Cameroon, Congo, Consumer Goods / FMCG, Cote d'Ivoire, Dairy, DR Congo, Egypt, Ethiopia, Gabon, Ghana, Ivory Coast, Kenya, Mali, Morocco, Mozambique, Nigeria, SagaBrand, SagaCube, Senegal, South Africa, Tanzania, Zambia, Zimbabwe

In this article we explore the top yogurt brands in Africa as well as the various levels of yogurt consumption across the continent. Where do Africans consume the most yogurt and which brands are their favourites?

Yogurt consumption penetration in Africa

Yogurt and fermented dairy products are deeply ingrained in the dietary traditions of various African cultures, with products like ergo, kefir, and nono being staples in their respective regions. While rural and lower-income populations often favor affordable traditional and homemade yogurt varieties, the demand for commercial yogurt is surging in urban areas and among middle to high-income groups.

Despite logistical challenges like cold chain distribution impacting availability and quality, the yogurt market in Africa is on a growth path. This is partially due to factors such as increasing urbanization, growing awareness of yogurt’s health benefits and evolving consumer preferences (eg. lactose-free or plant-based yogurts).

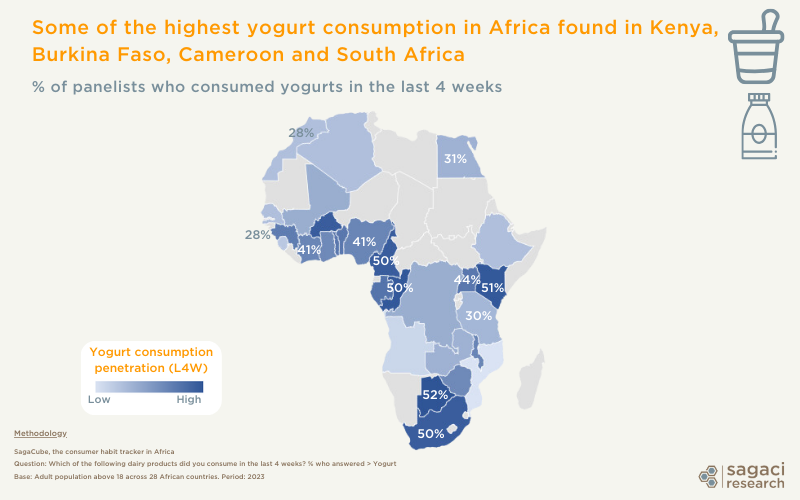

So how much are yogurts part of African consumers’ diet at the country level? The consumption tracker SagaCube reveals the proportion of the general population who have consumed yogurt in the last 4 weeks (including both drinkable and spoonable yogurt types).

Here are the African countries with the highest yogurt consumption:

- Kenya (51% of respondents have consumed yogurt in the last 4 weeks)

- Burkina Faso (50%)

- Cameroon (50%)

- South Africa (50%)

Conversely, consumption is the lowest in countries such as Senegal (28%), Angola (23%) and Mozambique (20%).

Top yogurt brands in Africa

We also asked members of our online panel in Africa which of the yogurt brands they had purchased was their favourite. Below are the most popular yogurts in Africa based on the brand health tracker survey SagaBrand.

The survey results show that local dairy groups are holding up well against their international competitors across the continent. In fact, in 7 of the 12 countries surveyed, local brands outperform international brands. For example, in West Africa, Dolait (by Soti Group) is leading in Cameroon, Dolima in Senegal, Hollandia (by Chi Limited) in Nigeria. In Egypt, the yogurt from Cairo based ‘healthy lifestyle’ brand Lychee is the favourite of surveyed consumers. In East Africa, the Kenyan yogurt market is clearly dominated by Delamere (owned by Brookside Dairy) while Jesa leads in Uganda and Asas in Tanzania.

Alongside these local players, international brands that are top performers all originate from French dairy groups. We find Danone in Morocco and Mozambique (with NutriDay), Yoplait in Côte d’Ivoire (produced by Eurolait and owned by French cooperative Sodiaal) and Parmalat (owned by Lactalis) in South Africa.

Explore the dairy market across Africa

The SagaPoll online community and self-serviced data platforms SagaBrand and SagaCube allow deep exploration of African brands and consumers across hundreds of categories, brands, attitudinal and behavioral topics. Here is an example in the dairy sector with the profile of the yogurt consumers in Nigeria in which we bring out what uniquely defines them.

To conclude, if you would like further insights on the performance of the best yogurts in Africa (with the full ranking by country for example) or more generally how to conduct online market research, get in touch with us!

Please send an email to contact@sagaciresearch.com or click below.

Methodology

- SagaBrand, the continuous tracking tool for brands across the African continent. Our online panel assesses around 2,000 brands on a daily basis.

Brand Preference: From the following yogurt brands (ever purchased), which one is your preferred brand?

Base: adults above 18 years old, across 11 countries.

Period: various waves between 2023 and 2024 depending on country

- SagaCube, the African consumer habit tracking tool

Question: Which of the following dairy products did you consume in the last 4 weeks? % who answered ‘Yogurt’

Base: Adults above 18 years old across 28 African countries.

Period: 2023