- 11/08/2023

- Posted by: Baptiste Pioch

- Categories: Algeria, Articles, Botswana, Burkina Faso, Consumer Goods / FMCG, Egypt, Ghana, Guinea, Mali, Morocco, Nigeria, Online Panels, Retail, SagaBrand, SagaCube, South Africa, Supermarkets, Zimbabwe

How developed is the breakfast cereal market in Africa? Findings from SagaCube, the consumer habit tracker in Africa, show that breakfast cereal consumption in Africa differs a lot between countries. Read on for more insights on the overall category penetration as well as a profile of the Breakfast cereal consumer in Nigeria.

Breakfast cereal market in Africa | category penetration

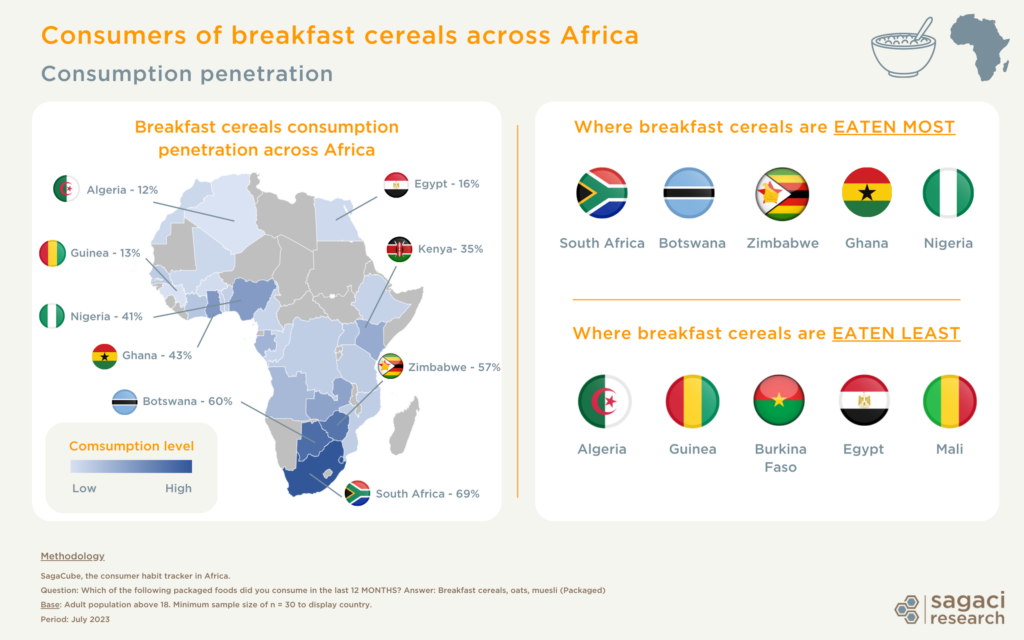

The 5 countries with the highest breakfast cereal penetration in Africa happen to be all anglophone: South Africa (69%), Botswana (60%), Zimbabwe (57%), Ghana (43%), and Nigeria (41%). On the other hand, the countries with some of the lowest breakfast cereal consumption tend to be francophone: Algeria (12%), Guinea (13%), Burkina Faso (15%), and Mali (17%).

From a quick glance at the map, the penetration rate of breakfast cereals is generally higher in Southern Africa. Conversely it tends to be lower in North Africa in countries like Algeria, Egypt and Morocco, countries all under 20% penetration and where traditional breakfast food is still very popular.

Breakfast cereal market in Africa | zoom on the Nigerian consumer

Leveraging our online panel in Nigeria, we are able to profile the Nigerian breakfast cereal consumer and thus better understand the breakfast cereal market in Africa.

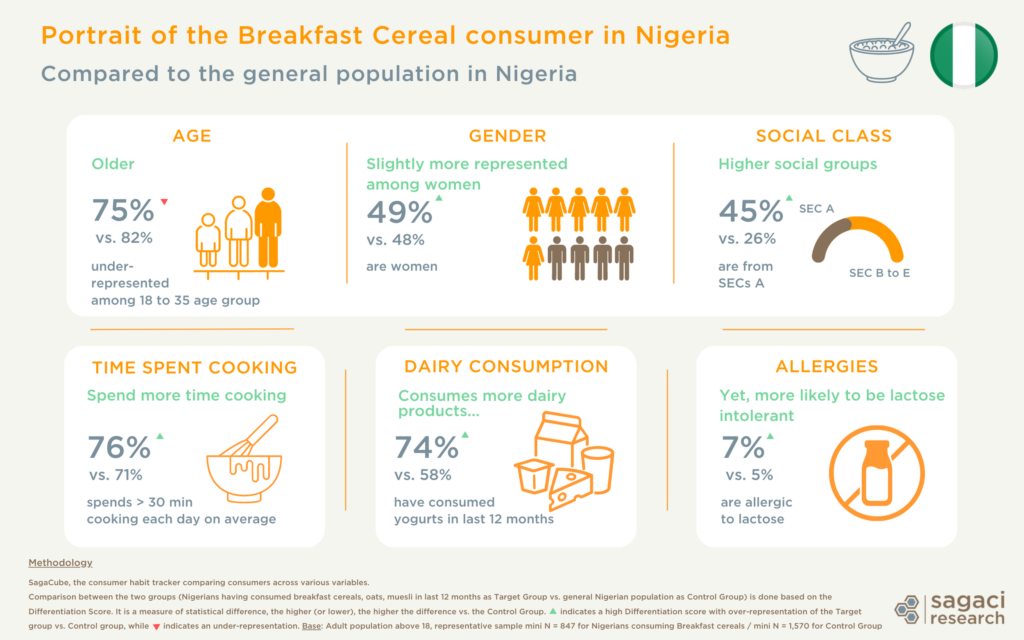

In order to draw the detailed portrait of consumers, we compare two groups: Nigerians who consumed breakfast cereals, oats, and muesli in the last 12 months VS. the general Nigerian population.

Here are some interesting demographic and habits insights about the breakfast cereal consumer in Nigeria:

- Under-represented among the 18-25 years old (75% vs. 82%)

- Slightly more represented among women (49% vs. 48%)

- Belongs to a higher social group (45% vs. 26% belong to SEC A)

- Consumes more dairy products, including yogurts (74% vs. 58%)

- Prefers organic products (61% vs. 55%)

- Spends more time cooking thus tends to eat more home-cooked food

- Drinks more juice during breakfast …

- … but is more likely to skip breakfast

Favourite cereal and supermarket brands in Nigeria

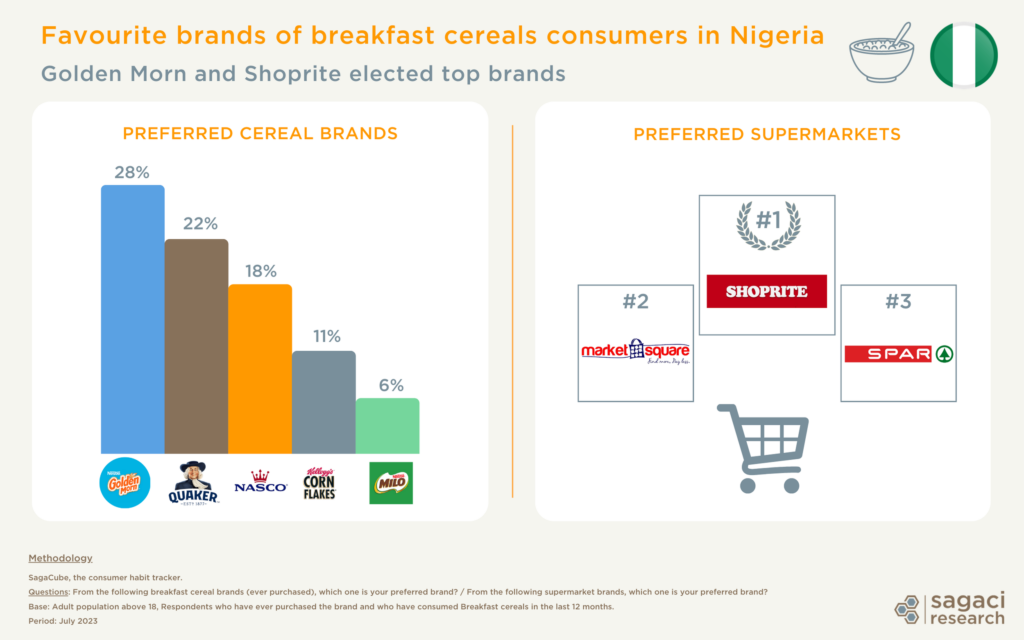

Digging a bit deeper, this time leveraging SagaBrand, the Brand Tracker tool in Africa, we asked breakfast cereal consumers in Nigeria, among the cereal brands they have ever purchased, which one they prefer.

Here is the ranking of the best cereal brands in Nigeria based on consumer preferences:

- Golden Morn (owned by Nestlé)

- Quaker (owned by PepsiCo)

- Nasco cereals (owned by Nasco Group)

- Kellogg’s CornFlakes (owned by Kellogg’s)

- Milo (owned by Nestlé)

Considering packaged cereals are often bought in supermarkets in Nigeria, we also explored the preference of breakfast food consumers in terms of supermarket brands. Where are they likely to buy their morning cereals? When asked, our panellists elected Shoprite as their top favourite supermarket brand, with Market Square and Spar coming respectively 2nd and 3rd.

Breakfast cereal is a category we already explored in Nigeria a few months ago. If the KPI used was different at the time (we looked at Quality previously vs. Brand Preference now), it is interesting to note that Golden Morn remains the top brand on both KPIs and almost a year later.

Leveraging online market research in Africa

This data was generated using two of Sagaci Research online research tools.

We are able to generate powerful and very granular insights combining SagaCube, the syndicated profiling and category consumption habit tracker tool in Africa, and SagaBrand, the Brand Health Tracker tool. Both leverage our representative African online panels and in particular here the online panel in Nigeria. As for all countries, it is mobile based to ensure deep reach and fast turnaround times.

To conclude, if you would like to know more about how to do market research online please send an email to contact@sagaciresearch.com or click below.

Methodology

SagaCube, the consumer habit tracker in Africa comparing Nigerians who have consumed breakfast cereals, oats, muesli in the last 12 months (Target Group) vs. the general Nigerian population (Control group). Comparison between the two groups is done based on the Differentiation Score. It is a measure of statistical difference, the higher (or lower), the higher the difference vs. the Control Group.

Base: Adult population above 18, representative sample mini N = 847 for Nigerians consuming Breakfast cereals / mini N = 1,570 for Control Group

Survey Questions:

Which of the following packaged foods did you consume in the last 12 MONTHS? Answer: Breakfast cereals, oats, muesli (Packaged)

Base: Adult population above 18. Minimum sample of n = 30 to display country.

Period: July 2023

SagaBrand, the brand health tracker tool in Africa

Survey questions: From the following breakfast cereal brands (ever purchased), which one is your preferred brand? / From the following supermarket brands, which one is your preferred brand?

Base: Adult population above 18, Respondents who have ever purchased the brand and who have consumed Breakfast cereals in the last 12 months.

Period: July 2023