- 12/07/2022

- Posted by: Janick Pettit

- Categories: Articles, Financial Services, Online Panels, SagaBrand, Zambia

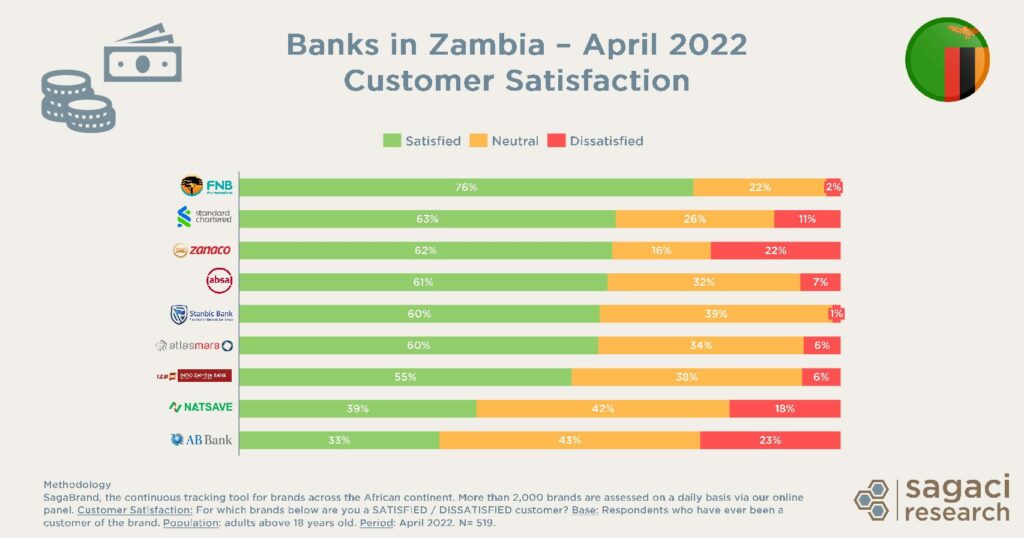

Wondering which banks consumers consider to be the top banks in Zambia in 2022 in terms of satisfaction? Thanks to our monthly Brand Health Tracker SagaBrand survey, we can easily answer that. Read on to discover the feedback from our online panel in Zambia and the ranking of the best banks in Zambia in April 2022.

Ranking of the top banks in Zambia

So we asked our online panel in Zambia, among the banks they have ever used, for which ones they consider themselves a satisfied or dissatisfied customer.

Below is the ranking of the top banks in Zambia considering customer satisfaction:

Read also this related article The best banks in Zimbabwe for customer satisfaction

FNB considered the best bank in Zambia by customers

Respondents of the Brand Health Tracker in Zambia are most satisfied with the bank FNB. Not only does the South African bank lead the ranking with a 76% satisfaction rate, it is also one of the banks with the lowest dissatisfaction rate (only 2%). This is an impressive performance in itself. The next five competitors average around 60% satisfaction level: Standard Chartered, Zanaco, Absa, Stanbic Bank and Atlas Mara. Closing the list are Indo Zambia Bank, NatSave and AB Bank with only 33% satisfaction rating from its customers.

Customer dissatisfaction among top banks in Zambia worth exploring

While some banks manage a good net balance between satisfaction and dissatisfaction rates, some of the players have alarmingly high dissatisfaction rates that would require close attention. For example Zanaco has a fairly good satisfaction rate at 62%, yet almost a quarter of its customers expressed dissatisfaction with the brand. The situation is even more concerning for AB Bank with only 33% satisfaction rate and 23% dissatisfaction.

In parallel, some banks are yet to convince a big chunk of their clients. For example, over a third of customers of NatSave, Indo Zambia Bank and Stanbic Bank are on the fence, neither satisfied nor dissatisfied. No set feelings regarding a brand also means there is potentially an opportunity to bring customers on board, which might be easier than regaining the heart of unhappy ones!

Read more on Financial Services related topic:

- Is Ecobank among the Top 3 banks in Africa in perceived Quality?

- Financial Product brands in Egypt – Customer Satisfaction

- Top 10 banks in Uganda for customer satisfaction

- Sagaci Webinar – Financial Services in Africa

Interested in brand health tracking in Africa?

One of the best ways to do market research and specifically to get fast and reliable data on your brand in Africa, is by leveraging SagaBrand, our continuous Brand Health Tracker tool. SagaBrand is a monthly tracker that monitors 16 essential KPIs for over 2,000 brands across dozens of countries in Africa.

Beyond those essential KPIs our online panel can also be useful to dig in deeper and explore specific reasons behind some SagaBrand results. This is where Flash Surveys come in handy to answer your ‘Why’s”. Why some of my customers are not satisfied? What do they mean by poor quality? Give us a few days and with our nationally representative sample we’ll get you what you need. So if you would like to know more about SagaBrand, our Flash surveys or online panel, please send an email to contact@sagaciresearch.com or click below.

Methodology

SagaBrand, the continuous tracking tool for brands across the African continent. Our online panel assesses around 2,000 brands on a daily basis.

Customer Satisfaction: For which brands below are you a SATISFIED or DISSATISFIED customer?

Base: Respondents who have ever been a customer of the brand. N = 519

Population: adults above 18 years old.

Period: April 2022