Track your brand performance in Africa. Continuously.

Use our SagaBrand product to track your brand performance and brand health across 25 African countries and visualize insights and data, all in one place.

Categories

Consumer Goods / FMCG

Yoghurt, Milk, Cheese, Wine, Beer, RTDs, Cider, Whisky, Vodka, Gin, Rum, Brandy & Cognac, CSD, Juice, Bottled Water, Energy & Malt Drinks, Sugar Confectionery, Gum, Chocolate, Salty snacks, Rice, Pasta & Noodles, Sauces Dressings & Condiments

Non FMCG and Retail

Restaurants & Cafés, Supermarkets, Sportswear & Fashion, Make Up, Skin Care, Hair Care, OTC Drugs, Home Care, Household Appliances, E-Commerce, Social Media, Electronics, Car Manufacturers

Services

Transportation & Delivery, Airlines, Telecom, Insurance, Banks & Financial Services

Countries

| North Africa Algeria Egypt Morocco |

East Africa Kenya Tanzania Uganda Rwanda |

| West and Central Africa Benin Burkina Faso Cameroon DR Congo Congo Côte d’Ivoire Gabon Ghana Guinea Mali Nigeria Senegal Togo |

Southern Africa Angola Mozambique South Africa Zambia Zimbabwe |

Frequency

Monthly, Quarterly, Bi-annual

Pick your category and country, and start getting data on your brand performance in Africa!

A simple way to start getting data on your brand performance but also on your competitors. We use a standard questionnaire and approach across all countries and categories, so you don’t need to worry about it.

Pick your category

Pick your countries of interest

Select your frequency

Track 40 indicators for your brand and competitors

Gives you immediate insights on your brand health and your competitors in the local market

Brand awareness and visibility

Brand purchase

Brand image, satisfaction and recommendation

What does SagaBrand track?

Awareness

Echo

Positive Echo / Negative Echo

Reach

Good Quality / Poor Quality

Ever Purchased

Recently Purchased

Preferred

Satisfaction / Dissatisfaction

Recommendation / Avoid

Future Consideration

Purchase Intent

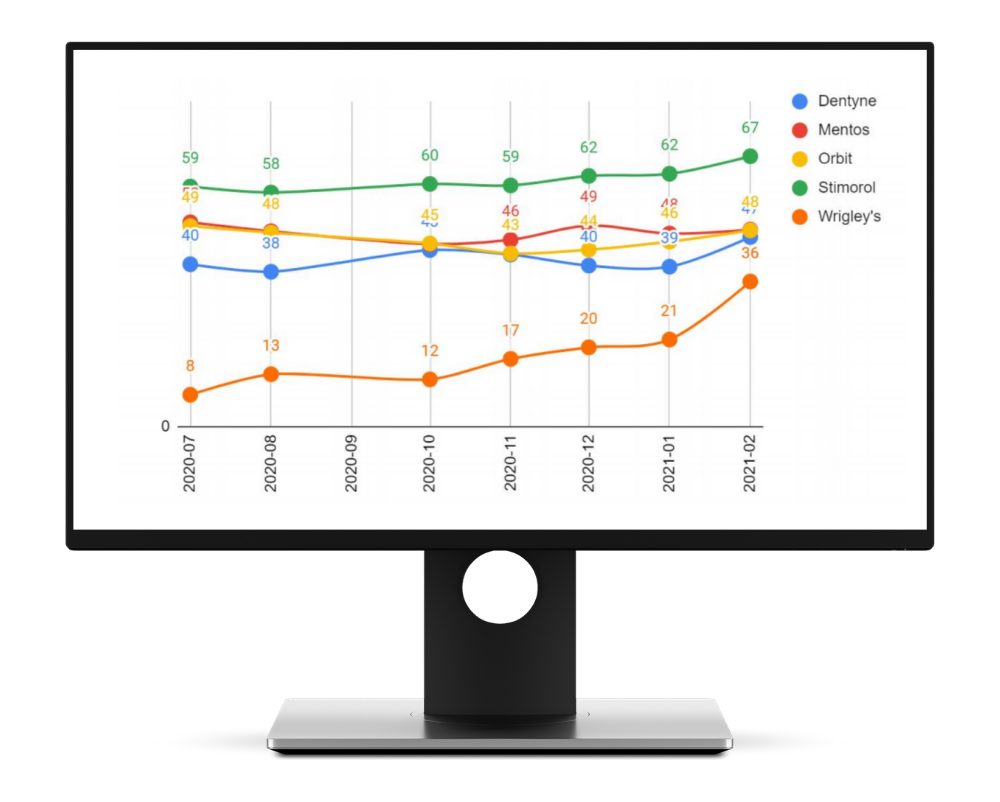

Continuously collect data and insights related to your brand health

Track brand performance

Monitor your brand health on an ongoing basis.

Benchmark yourself against your peers

Assess how your brand is doing against competitors

Monitor competitive threats

Track new up and coming brands in your market

Assess your brand image

Track your brand image KPIs and see how perceptions evolve

Measure the impact of your marketing activities

Assess how your marketing activities are impacting your brand metrics

Assess the buzz around brands

Keep an eye on word-of-mouth and other buzz metrics

A brand tracking tool can be your best ally

Download our white paper on how to measure your brand health performance in Africa.

Immediate online access to collected data on your brand performance and brand health

No need to wait for a report, immediate access to the data, pre-analyzed and pre-charted. Our platform transforms raw data into structured analysis for your business

Online dashboard with all historical data

Downloadable reports

Downloadable datasets in XLS or CSV format

Get started

We are here to help you! Ask us anything or schedule a meeting!

Our insights from SagaBrand, our brand performance and brand health tool

-

Top banks in South Africa: Customer satisfaction and brand performance

Top banks in South Africa remain closely watched as customer expectations evolve and competition between established players and challengers intensifies. The latest wave of our ongoing SagaBrand tracker provides an updated view of how leading institutions perform today, highlighting shifts in customer satisfaction, brand strength and perception across the market. While this article focuses on

05/02/2026 -

Laundry detergents in Zambia: key insights on usage and brands

Understanding laundry detergents in Zambia is essential for brands navigating a category shaped by strong habits, demographic differences and intense competition. SagaCube’s continuous consumption tracking provides granular consumer insights in Zambia on how households wash their clothes. Building on this, the SagaBrand brand health tracker uses data collected daily from our online panel in Zambia

15/12/2025 -

Ranking of the top supermarkets in Côte d’Ivoire according to consumers

A recent SagaBrand study (our continuous brand health tracking tool across Africa) reveals the ranking of the best supermarkets in Côte d’Ivoire based on consumer satisfaction. We asked members of our online panel in Côte d’Ivoire to rate the supermarkets they have shopped at, identifying which ones they are satisfied or dissatisfied with. Read on

08/09/2025 -

Ranking of the top banks in Cameroon according to consumers

Ready to discover the top banks in Cameroon in 2025? A recent SagaBrand study (the continuous brand health tracker in Africa) reveals the best banks in Cameroon based on consumer perception of quality. We asked members of our online panel in Cameroon to tell us which banks they know, and among those, which they consider

15/07/2025