- 20/02/2024

- Posted by: Janick Pettit

- Categories: Articles, Bank, Financial Services, Kenya, Online Panels, SagaBrand

Are you curious to know which are the top banks in Kenya in terms of Customer Satisfaction for 2023? Customer satisfaction is a crucial metric that reflects how well a bank meets the needs and expectations of its customers, ultimately influencing customer loyalty, retention, and advocacy.

SagaBrand, the largest Brand Health Tracker in Africa, tracks on a monthly basis consumers opinions across the continent. Via the online panel SagaPoll, we asked Kenyan members, among the banks they have ever used, for which ones they consider themselves a satisfied or dissatisfied customer. Results from our online panel in Kenya in 2023 reveal which players in the Kenya banking sector are winning the hearts of consumers and which ones still have room for improvement.

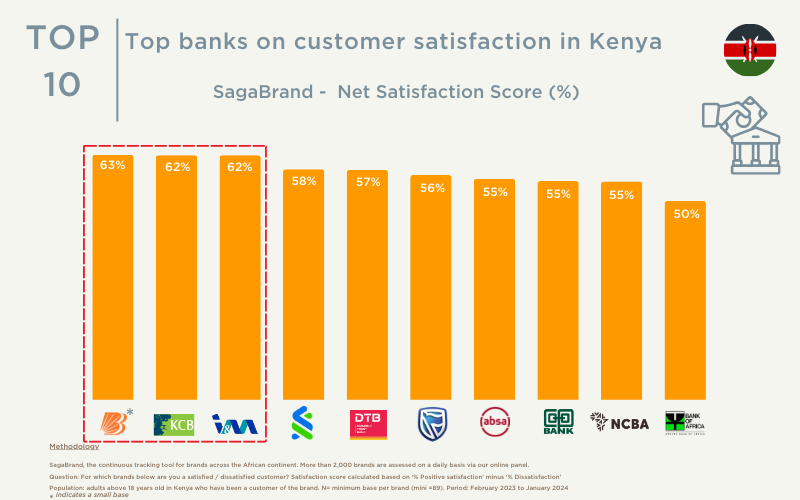

Ranking of the top banks in Kenya

Customer satisfaction represents one of the 25 Key Performance Indicators (KPIs) monitored by SagaBrand, the pan-African brand tracker. In this piece, we delve into the Net Satisfaction score, derived from the balance between satisfaction and dissatisfaction levels.

Below is the Kenya banks ranking based on the Customer Satisfaction score:

- Bank of Baroda

- KCB Bank

- I&M Bank

- Standard Chartered

- DTB – Diamond Trust Bank

- Stanbic Bank

- ABSA

- Co-op Bank

- NCBA

- BAO – Bank of Africa

Which brands stand out among the top-ranked banks in Kenya?

Bigger does not necessarily mean better. Particularly so in this instance.

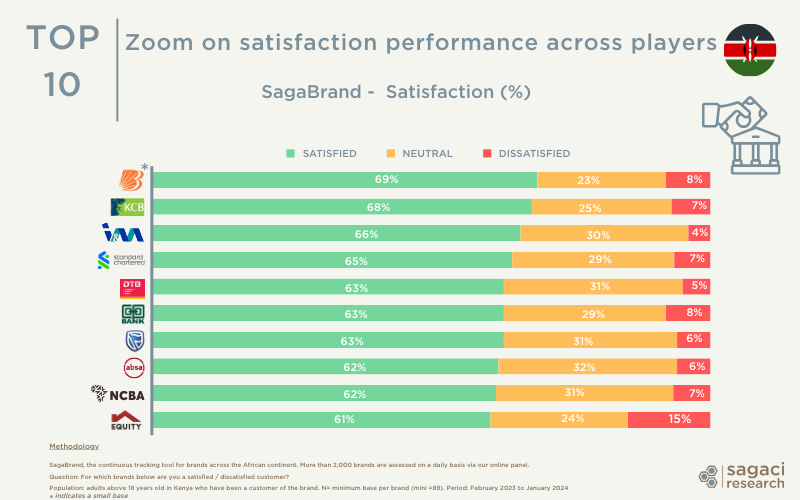

- Bank of Baroda, one of the smaller players in the personal banking space in Kenya, narrowly edges out KCB Bank for the top spot, boasting a Net Satisfaction rate of 63% compared to KCB’s 62%. The Indian Bank of Baroda tends to concentrate more on corporate banking services which is reflected in its significantly lower brand awareness among consumers compared to larger players in the category (57% vs. 92% for KCB, see in full report). Yet, it seems to have found a way to please its customers.

- I&M Bank also performs well boasting the lowest dissatisfaction rate (4%). On the other hand the regional bank has a fairly high proportion of neutral customers which could mean an opportunity to win undecided customers…

- Despite its prominence in the market (highest awareness level registered in 2023 within the category at 93%), Equity Bank appears to face a challenge when it comes to customer satisfaction. Indeed, the brand tracker indicates that it registers the highest percentage of dissatisfied customers (15%) among the top-rated banks in Kenya. The same pattern is found in Customer Recommendation for which Equity ranks among the lowest.

More on financial services in Africa

Finally, financial services is one of dozens of FMCG and non FMCG categories that SagaBrand tracks on a monthly basis across the continent. As such we regularly share insights on the banking sector in Africa. For example last year we looked into Kenyans’ favourite banks, or earlier into the top banks in Zambia, Zimbabwe and Uganda. We also frequently disseminate category insights through webinars, such as this session focusing on Financial Services in Africa.

If you would like further insights on bank ratings in Kenya or another African country based on our online panel in Africa, get in touch with us.

Please send an email to contact@sagaciresearch.com or alternatively click below.

Methodology

SagaBrand, the continuous tracking tool for brands across the African continent. Our online panel assesses around 2,000 brands on a daily basis.

- Brand Awareness: Which of the following brands have you ever heard of? Base: All respondents.

- Customer Satisfaction: For which brands below are you a SATISFIED or DISSATISFIED customer? Base: Respondents who have ever been a customer of the brand.

- Satisfaction score: satisfaction minus dissatisfaction.

Population: adults in Kenya above 18 years old.

Period: February 2023 to January 2024

© Cover Photo by KCB