- 09/01/2024

- Posted by: Issa Sawadogo

- Categories: Articles, Consumer Goods / FMCG, Egypt, Energy drinks, Non-alcoholic beverages

Consumption of energy drinks in Egypt is lower than the average across the African continent (11% vs. 22%) according to SagaCube, the pan-african consumption tracker. A recent survey from SagaBrand showed that carbonated soft drinks are also among essential items that have suffered the biggest consumption cuts in recent months due to widespread inflation. Yet, energy drinks remain a rapidly growing category in Egypt, reflecting an emerging trend in Egyptian consumer preferences toward functional beverages, catering to the need for energy-boosting products in a fast-paced society.

In this article we explore the energy drinks market in Egypt particularly from a brand perspective. Who are the key players and what are some of the dynamics at play in this market?

Leading energy drinks in Egypt: David vs. Goliath?

- Meet Goliath: Red Bull. Often considered one of the most valuable soft drinks brands in the world, the Austrian multinational company benefits from a strong reputation worldwide based on a premium positioning. According to SagaBrand brand tracker, it is also the energy drink market leader in Egypt across most KPIs. It has been distributed in Egypt since 2008 by the Mansour Group (also distributor for L’Oreal and Nivea). In line with its strong association with extreme sports, adventure and pushing the limits, Red Bull local marketing campaigns include the sponsorship of a kitesurfing event a couple months ago.

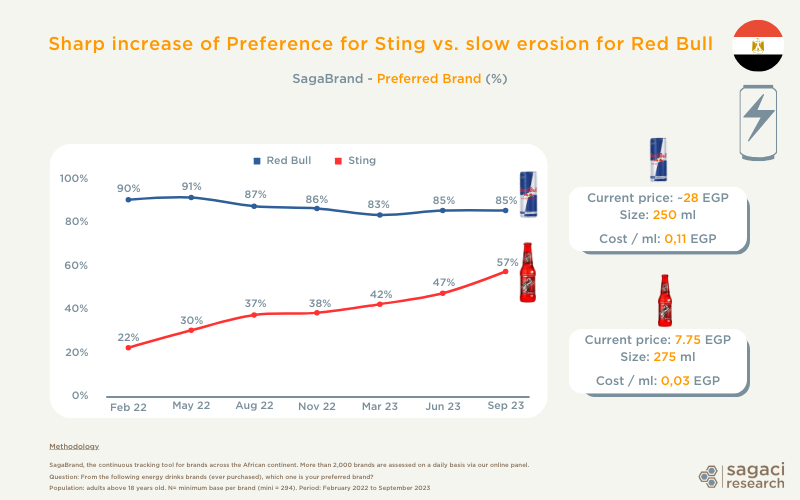

- Meet David: On the other hand, you have Sting, introduced in Egypt by PepsiCo in 2014. Aimed at disrupting the market, it immediately differentiated itself from existing competition. How? First, its price point made it a much more affordable alternative in the energy drink market in Egypt (it is almost 4 times cheaper than Red Bull). Secondly, it is targeting young adults associating itself with the extreme sport of ‘Everyday Egyptian Life’ (rather than actual extreme sport). It launched with the claim that “Sting is everyday energy for the everyday champion.” In this spirit, the brand collaborates with local influencers such as their brand ambassador Mohamed Ramadan, an Egyptian actor and rap singer highly popular in Egypt and throughout the Arab world.

Sting might not exactly be a small player / ‘David’ but it certainly came to challenge the incumbent…

Who has the winning recipe?

Results from the online brand tracking survey SagaBrand conducted over 18 months between 2022 and 2023 gives us a clear picture of how the two brands have performed against each other. Feedback from our online panel indicates that Red Bull seems to feel the heat while Sting is going from strength to strength…

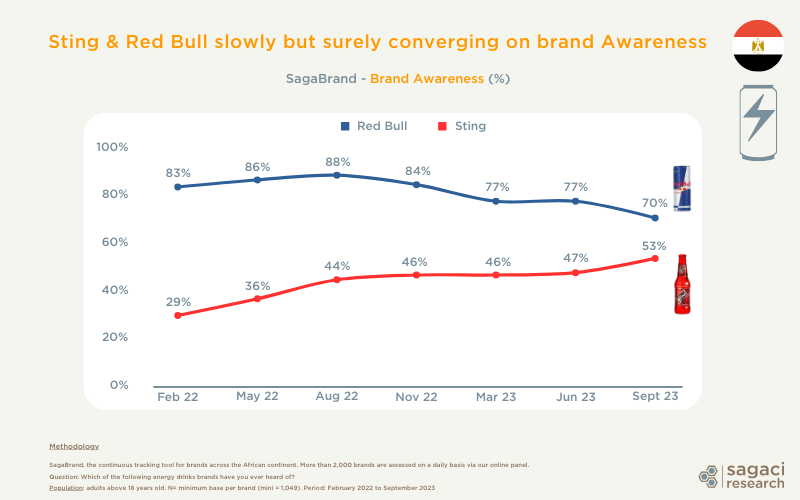

Energy drinks brand awareness

Indeed, Sting has been progressively gaining in Awareness in the first half of 2022. It gained 15 % points in the span of only 6 months (from 29% in Feb 22 to 46% in Nov 22). Around the same time, Red Bull was just starting to lose traction and started decreasing in notoriety going from 88% in Aug 22 down to 70% in Sept 23.

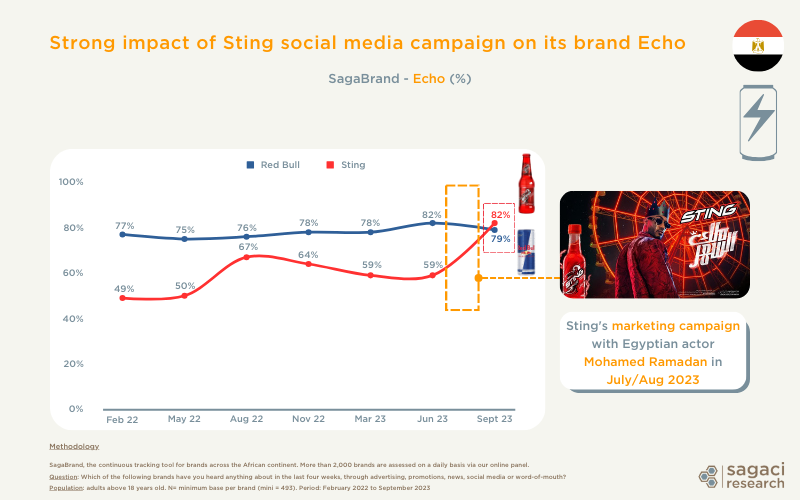

Brand echo: what consumers hear

While Red Bull’s performance has been relatively stable over time in terms of echo, Sting, on the other hand, is making waves. With a big jump in the summer 2022 (from 50% to 67% in 3 months) it has now overtaken Red Bull with an impressive 82% echo rate (vs. 79% for the Austrian brand). This could be likely due to an aggressive marketing campaign in July/August 2023.

Consumer brand preference

With a price well below that of most other energy drink brands in Egypt (Red Bull, Power Horse, Hype Energy) and cleverly targeted communication, Sting seems to have quickly found its way into the hearts (and wallets) of Egyptian energy drink consumers. Indeed, consumers’ preference for Sting jumped from 22% in early 2022 to 57% in Sept 2023. During that period, Red Bull, which started from a very high base (90% in Feb 222) slowly lost a few % points. Price can be a decisive consideration in the choice of a non-alcoholic drink, especially at a time of inflation in Africa and the rest of the world.

Want to find out more on beverages and CSDs in Egypt?

You can start by checking some previous data we shared on the beverage category in Egypt.

Then for updated data, reach out to us! We will show you how easy it is to leverage our consumer panel. It covers 34 countries in Africa and includes an online panel in Egypt.

For several years now our strong data collection capabilities have helped businesses understand consumers across the continent. Our panel across Africa is mobile based to ensure deep reach and fast turnaround times. You will be able to access thousands of respondents in a highly engaged online panel. You will get detailed answers to your questions – with results available in a few days.

Finally, for more information on non-alcoholic beverages in Egypt or generally how to leverage research panels, please send an email to contact@sagaciresearch.com. Alternatively, contact us using the form below.

Methodology

SagaBrand, the continuous tracking tool for brands across the African continent. Our online panel assesses around 2,000 brands on a daily basis, including in the energy drink and soft drink categories in Egypt.

Questions:

Awareness – Which of the following energy drinks brands have you ever heard of?

Echo – Which of the following energy drinks brands have you heard anything about in the last four weeks, through advertising, promotions, news, social media or word-of-mouth?

Preference – From the following energy drinks brands (ever purchased), which one is your preferred brand?

Population: Egyptian adults over 18

Period: February 2022 to September 2023