- 06/10/2023

- Posted by: Issa Sawadogo

- Categories: Articles, Consumer Goods / FMCG, Countries, Ghana, Kenya, Retail, SagaTracker

Shrinkflation in Africa (as elsewhere) consists of reducing the volume (in grams, liters or units) of a product while keeping the same price, sometimes along with a packaging change, so that it is barely noticeable. It tends to be more common during periods of inflation such as the one we have been facing in the recent months on the continent and across the globe.

Shrinkflation in Africa: size down, sales up?

Africa is no stranger to this practice, whatever the reason – struggle against price increase, cutting cost, or supply shortages.

This is a phenomenon our Retail team has observed over the last 18 months. For example, in Kenya, the Miksi dairy brand has changed a large number of its products, including a 500g sachet of milk powder which became a 450g sachet of milk powder. This resulted in an 11% increase in the price per gram, while the price of the pack remained unchanged.

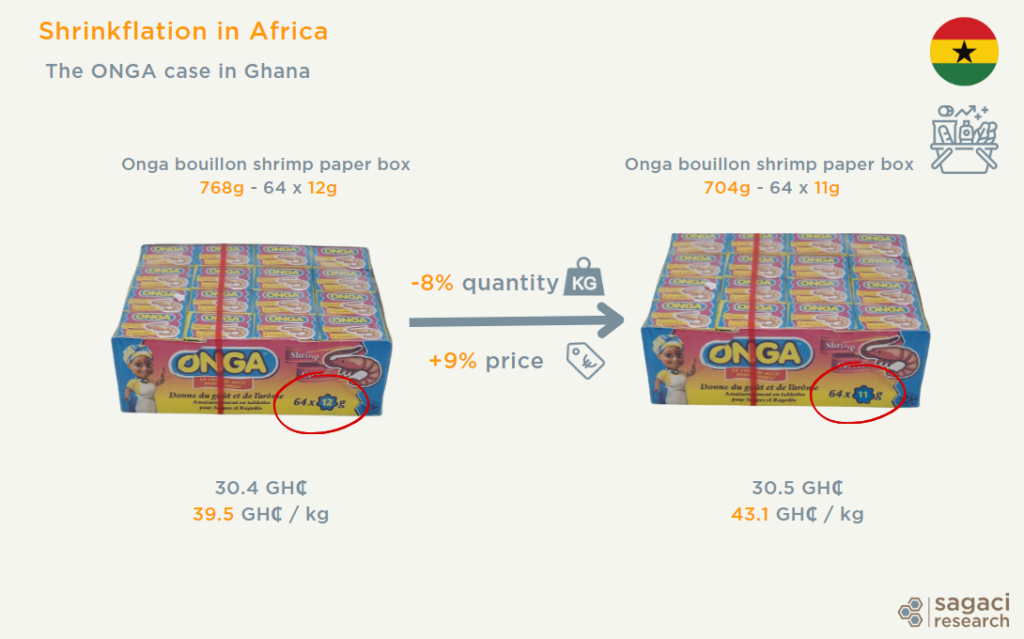

In Ghana this time, as another example of a FMCG product size reduction in the bouillon category, we observed that Onga‘s seasoning cubes had dropped from 12 to 11 grams.

African consumer behaviour in the face of shrinkflation

Africa, which is already a ‘sachet’ market, could become even more so. Bulk purchase with family sizes and multi-serve, steadily gives way to single/small size. To the companies that will be savvy enough to take that turn, the spoils of their market.

Resource scarcity, inflation and so on would then be a blessing in disguise, or a one-off opportunity for companies willing or needing to abide by today’s changing habits.

Mitigation and limits of shrinkflation in Africa

However, as this practice of product downsizing becomes more widespread, one can wonder about its limits. Manufacturers can absorb increasing costs of production up to a point. The shortage of the most essential and common resources (eg. wheat) has to be eventually reflected in prices (or sizes) of consumer goods, leading to trade-offs in favour of maintaining margins.

Going forward fewer resources will be available to manufacture fewer products, or fewer quantities. The challenge will then be to find a way to cope and maintain market share. But how far will FMCG companies be willing to go to remain competitive? To avoid unpopular price increases, some have reduced the size of their packaging. Others might be tempted to cut back on quality or production resources (adding pressure on the supply chain), etc. But how far can this downward spiral go? Until it seriously damages the brand’s equity, driving consumers to cheaper local alternatives. Or going further and ultimately reconsidering the composition of their shopping basket?

One possible outcome could be increased interest from manufacturers in developing local and therefore potentially more affordable supply chains, wherever possible. To the benefit of the local economy and consumers’ purchasing power.

Retail audits to monitor retail trends

Theses examples come from our retail data captured on a monthly basis by our Trade field team. If you would like to know more about retail audits in Africa or the SagaTracker FMCG retail tracker, please send an email to contact@sagaciresearch.com or click below.