- 12/12/2023

- Posted by: Issa Sawadogo

- Categories: Articles, Consumer Goods / FMCG, Dairy, Dry food, Online Panels, Snacks

Amidst the widespread price hikes globally, including within Africa (where inflation is estimated to reach almost 19% in 2023 according to the IMF), we decided to check on members of SagaPoll, our online panel across the continent, to evaluate the effects of high inflation on food consumption patterns.

Between October and November 2023 we asked about 20,000 African consumers across over 50 countries which food products they had reduced their consumption of in recent months. And this is what we found out…

High inflation impact on food consumption in Africa in 2023

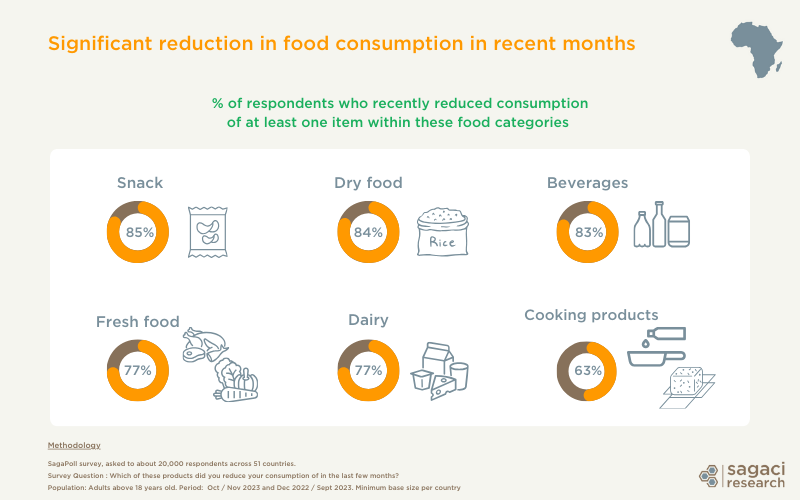

According to our survey findings, a significant portion of African consumers have scaled back their consumption of various food items over the past few months.

When examining specific categories, it is evident that a majority of consumers have cut back on their intake of snacks (85%), dry foods (84%), and beverages (83%). To put it differently, merely 15% of consumers have maintained their previous consumption levels of snacks.

Categories experiencing comparatively lesser impact, though still significantly affected, include fresh food and dairy. Interestingly, cooking ingredients emerge as the category with the least reduction in consumption among consumers in recent months. This trend could be attributed to several potential reasons.

Herbs and seasoning (such as cubes and bouillons) are an important element in African culinary culture and heritage. They are versatile and critical to enhance flavors as well as bring depth to traditional dishes. They are also often sold in small packages which makes it easier for consumers to buy on a need basis. However, our retail audits have unveiled instances of ‘shrinkflation‘ within this category. In a recent article, we highlighted one of the strategies employed by manufacturers tackling the challenge of inflation in Africa. The case of Onga cubes (Promasidor) in Ghana shows that despite the nearly unchanged price, the pack size noticeably shrunk. As this practice becomes increasingly common, one might ponder whether we’ll witness additional shifts in food consumption patterns across Africa.

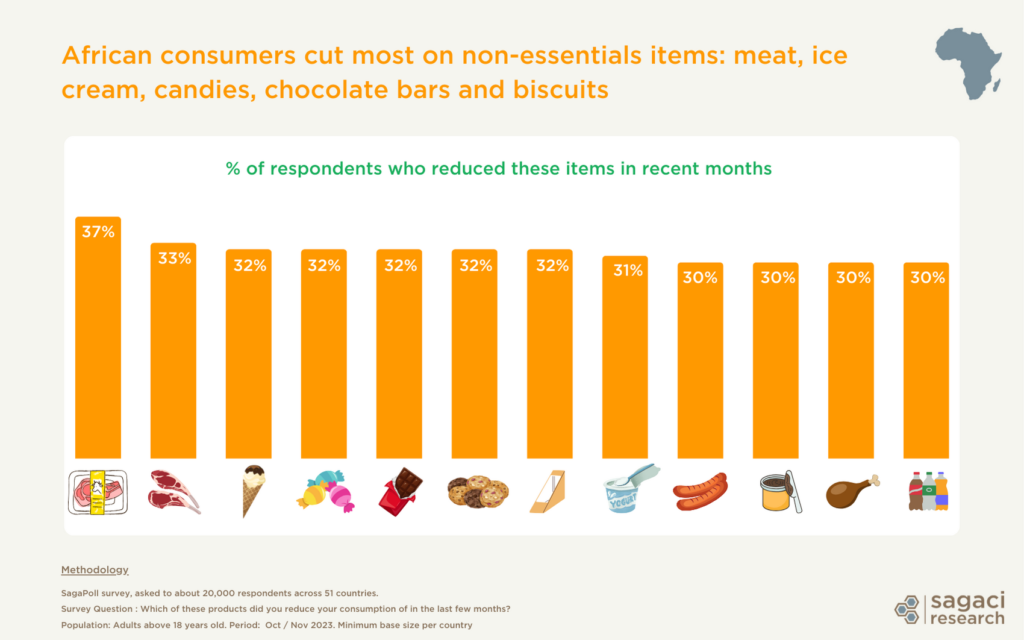

Non essential food items feeling the cut

During periods of high inflation, consumers often prioritize their spending based on essential needs versus non-essential wants. Non-essential food items are typically the first to get cut. And our recent online consumption survey confirms this. For example, it shows that across all categories, meat (beef, lamb, goat…) is the food item most consumers have cut. They may find themselves compelled to substitute their protein intake with more cost-effective options like grains, legumes, or vegetables. Ice cream, candies, chocolate bars or spreads are the next ones to go.

Online research for deeper understanding of consumer behaviour in Africa

Online research is an efficient tool to get quick and reliable insights on food consumption patterns in Africa. This is in fact just one of the several benefits of conducting online surveys in Africa.

Sagaci Research offers robust data collection capabilities and an extensive online panel designed to understand consumers across the African continent. Our innovative mobile-based online panel provides access to respondents in all 54 African countries, ensuring unrivaled depth and fast turnaround times for data collection.

For more information on African consumer preferences in the face of inflation or on how to conduct market research in Africa, reach out to contact@sagaciresearch.com or click below.

Methodology

This article is leveraging SagaPoll, Sagaci Research’s online panel in Africa spanning all 54 countries in Africa.

SagaPoll conducted a series of daily surveys involving over 20,000 respondents from our online panel in Oct and Nov 2023. One survey examining aspects of price sensitivity (also included in the report) spanned across 2022 and 2023.

Questions:

Q: Which of these products did you reduce the consumption of in the last few months? Selection of food categories and items.

Q: When shopping, I look at the price first. NET Agree (Agree + Strongly Agree)

Base: Adult population over 18 years old in 51 African countries