- 23/01/2024

- Posted by: Janick Pettit

- Categories: Alcoholic beverages, Articles, Beer, Consumer Goods / FMCG, Cote d'Ivoire, Online Panels, SagaBrand, SagaCube

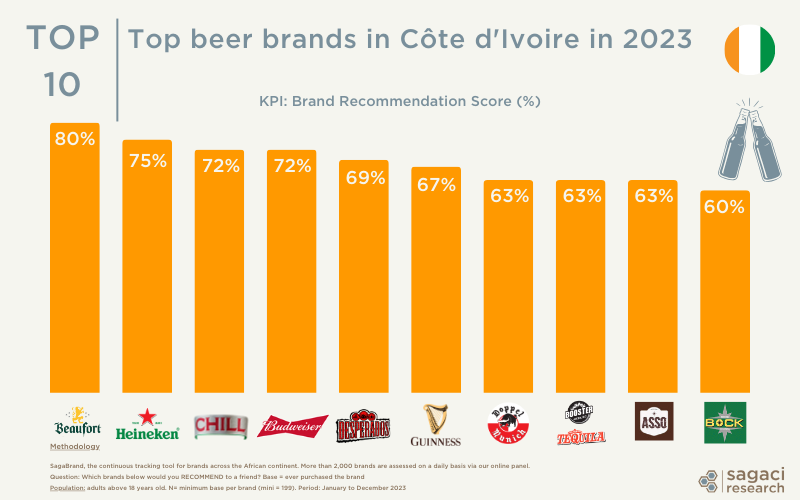

In this article we explore the top beer brands in Côte d’Ivoire in 2023. More specifically, the beer brands consumers recommend the most to their peers.

Interestingly, beer consumption in Côte d’Ivoire is among the highest in Africa (at 45% in the last 4 weeks) according to SagaCube, the Pan-African consumption tracker. Beer also happens to be the alcoholic beverage the most consumed in the West African country. It comes ahead of wine which is at 36% penetration. The Côte d’Ivoire beer market is therefore worth looking into. Especially as it boasts a dynamic local ecosystem with key Ivorian brewers competing to conquer the hearts of beer consumers.

The top 10 beer brands in Côte d’Ivoire

According to SagaPoll panel members in Côte d’Ivoire, and results from the Brand Health Tracking tool SagaBrand, here are the top beer brands in the country based on the consumer Recommendation score:

- Beaufort (Solibra)

- Heineken (Brassivoire)

- Chill Citron (Solibra)

- Budweiser (Solibra)

- Desperados (Brassivoire)

- Guinness (Diageo)

- Doppel Munich (Solibra)

- Booster Tequila (Solibra)

- Asso (Solibra)

- Bock (Solibra)

Behind the most recommended beer brands in Côte d’Ivoire, the duel Solibra vs Brassivoire

This brand ranking highlights the stiff competition going on in the brewing industry in Côte d’Ivoire with two major brewers sharing a big chunk of the market:

- Solibra – The historic market leader has been dominating the market for over 60 years and is part of the Castel Group. The Ivorian brewer manages to place seven of its brands in the Top 10 (Beaufort, Chill Citron,american-style pale lager from AB inBev Budweiser, Doppel Munich, Booster Tequila, Asso and Bock)

- Brassivoire – Set up in 2016 as a joint-venture between Heineken and CFAO, it is striving to shake up Solibra’s strong positioning. For now, only two of its brands feature in the ranking (Desperados and Heineken). Its flagship brands Ivoire and Ivoire Black don’t make the Top 10 at 59% and 57% respectively.

Guinness and Diageo lagging behind

As these data and a previous brand battle conducted by our pan-African online panel confirm, Côte d’Ivoire is not a market where Guinness is strongest.

Coming in 6th position, the Irish Stout Guinness makes Diageo the 3rd player in the Côte d’Ivoire beer market. It should be noted that, unlike the two main market leaders, it is the only player in the beer industry in Côte d’Ivoire not to have local production capacity in the country. Guinness is in fact brewed by Solibra in Côte d’Ivoire. Indeed, Diageo’s current strategy in Africa contrasts with that of its competitors. While Castel and Heineken prioritize acquisitions and the construction of new plants, the British multinational alcoholic beverages company is more focused on reorganizing and consolidating its beverage operations.

However, Guinness performance clearly varies from country to country in West Africa. For example, it holds a significantly more prominent position in the minds of consumers in Nigeria which happens to be the world’s second largest market for the brand.

Want to find out more our online panel in Africa?

Sagaci Research has an established online panel in Côte d’Ivoire and across 34 countries in Africa. Our online panel and data collection capabilities help businesses understand consumers across the continent.

Our Africa-wide online panel is mobile phone based to ensure a wide reach and fast response times. We reach thousands of respondents in a high-engagement online panel, and get detailed answers to your questions with results available in a few days.

Finally, for more information on the beer market in Ivory Coast or generally how to research African markets online, please send an email to contact@sagaciresearch.com. Alternatively, contact us using the form below.

Methodology

SagaBrand, the continuous tracking tool for brands across the African continent. Our online panel in Africa assesses around 2,000 brands on a daily basis, including the beer category.

Recommendation score: Calculated as Recommend less Avoid.

Recommend: Which brands below would you RECOMMEND to a friend?

Avoid: Which brands below would you tell a friend to AVOID?

Base: Respondents who have ever been a customer of the brand. Mini sample per brand n = 199

Population: Adults above 18 years in Côte d’Ivoire

Period: 2023