- 16/07/2024

- Posted by: ilana.czerwinski

- Categories: Articles, e-commerce, Egypt, Ethiopia, Ghana, Ivory Coast, Kenya, Nigeria, Online Panels, SagaCube, Senegal, South Africa, Tanzania, Travel & Tourism, Uganda, Zambia

Ride-hailing services in Africa are revolutionising urban transportation, fueled by growing connectivity and the rising demand for convenience. They seek to tackle the inefficiencies of public transport and often chaotic private transportation systems, providing a structured, technology-driven alternative.

Leading players like Uber, Bolt, and Yango are at the forefront, driving the African ride-hailing market forward with diverse offerings, from simple ride-sharing to last-mile delivery. A recent SagaCube report, leveraging SagaPoll online panel in Africa, explores African consumers’ usage of ride-hailing apps.

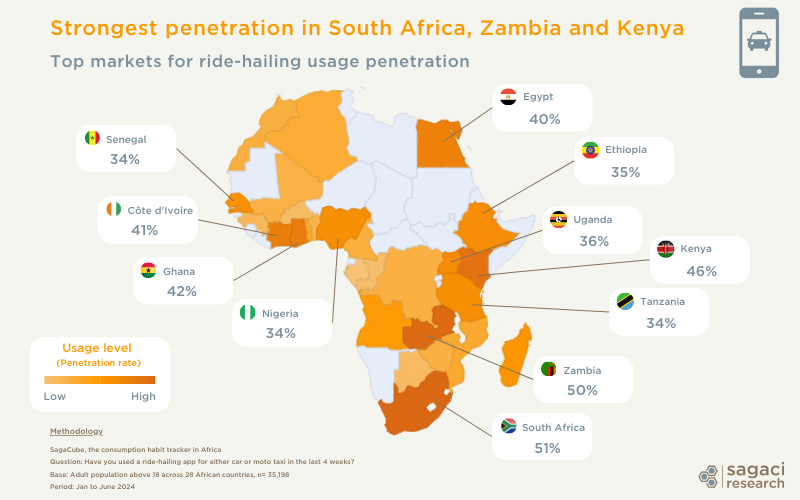

Ride-hailing Market Penetration in Africa

Based on a consumer survey conducted online from January to June 2024, involving over 35,000 respondents across 28 African countries, approximately one-third of Africa’s population (30%) has recently used a ride-hailing app (within the last 4 weeks). The highest adoption rates were observed in South Africa (51%), Zambia (50%), Kenya (46%) and Ghana (42%).

Who are the leading ride-hailing services in Africa?

With the influx of players into the online transport sector, ranging from international giants to local startups, competition is intensifying across the continent. Who stands out as the key contenders in this rapidly evolving landscape?

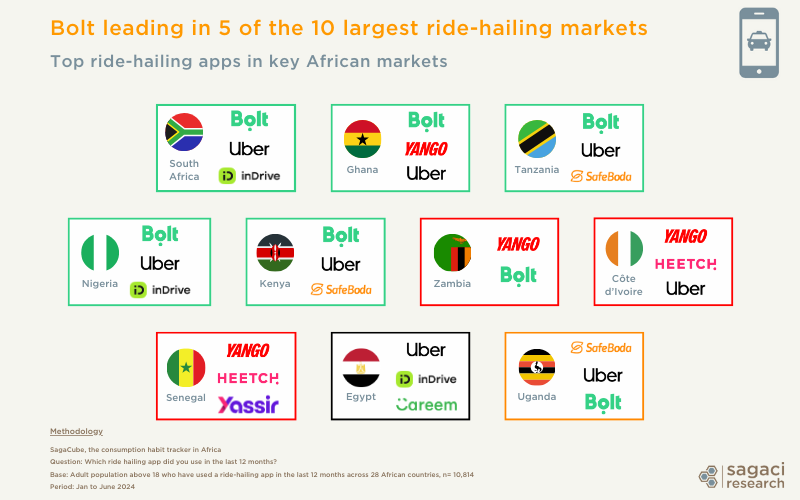

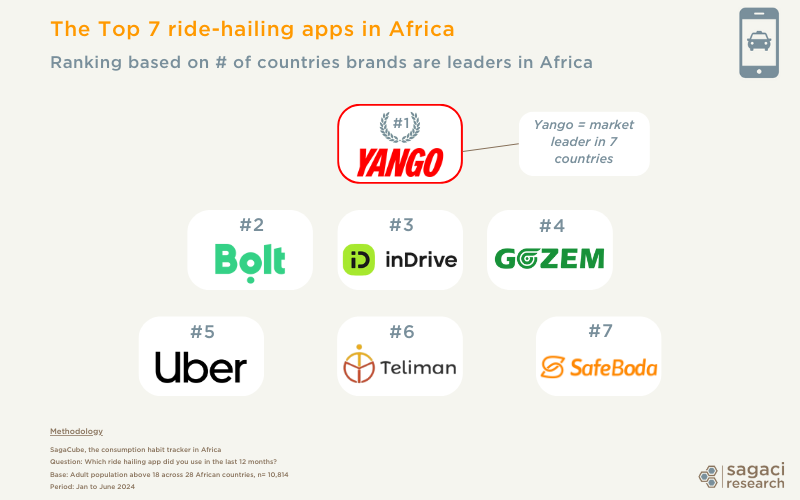

Using the number of countries where each brand leads as a key performance indicator (KPI), here is the ranking of ride-hailing services in Africa:

- Yango: Initially launched in Côte d’Ivoire and Ghana in 2018, the Dutch/Russian company, which focuses primarily on Francophone West Africa has become a market leader in Senegal, Côte d’Ivoire, and Zambia. It differentiates itself by collaborating with local registered taxi firms, empowering these businesses rather than competing directly against them.

- Bolt: The Estonian-based company entered Nigeria and South Africa in 2016. It has become the market leader in five major markets (South Africa, Ghana, Tanzania, Nigeria, and Kenya). Expanding its footprint, it started operations in Q1 2024 in Egypt, Zimbabwe, DRC, Botswana, and Namibia, solidifying its continental presence.

- inDrive: Currently headquartered in the USA, inDrive made its debut in Côte d’Ivoire in 2018 and has since expanded across multiple African countries, pioneering a zero commission policy. This ensures that drivers retain 100% of their earnings from the outset, fostering a robust community of drivers and customers.

- Gozem: Started in Togo in 2018, it has since expanded to Francophone West and Central Africa, providing various on-demand services including transportation, delivery, and cashless payment solutions in one app. Gozem offers diverse transportation options, including motorcycle-taxis, car-taxis, and tricycle-taxis, as well as grocery delivery, food delivery, and other services. It leads in Togo, Benin and Gabon.

- Uber: As a well-known global brand and one of the first major ride-hailing companies to enter Africa in 2013 (South Africa), it has since expanded to numerous countries including Nigeria, Kenya and Ghana. It currently maintains a top-three ranking in eight countries but only dominates in Egypt. The recent launch of Uber Comfort, Uber XL, and Uber Teen Accounts highlights its focus on innovation in certain markets. It is also engaging in sustainability initiatives with electric vehicles (EVs) to drive future business growth, particularly in South Africa.

6. Teliman: Launched in 2018 in Bamako by the Malian diaspora, this small player offers an on-demand motorcycle-taxi service in Mali, where it has quickly become the market leader.

7. SafeBoda: Launched in 2014 in Uganda and partially funded by Google, this company has become the market leader ahead of Uber and Bolt with its SafeCar and SafeBoda (motorcycle) services. It also has a significant presence in Kenya, ranking behind Bolt and Uber.

Competitive Dynamics: Bolt vs. Uber

Bolt and Uber are two of the main players in the ride-hailing apps market in Africa. Bolt leads in five out of ten major markets, while Uber holds a top-three position in eight countries and leads in Egypt.

While Bolt and Uber compete for market share, they each appeal to distinct demographics across all their operating markets.

- Social class: Uber has a stronger presence among upper-class users, with 49% of its users from the SEC AB segment, compared to Bolt’s 38%

- Age Group: Bolt outperforms Uber in the 26-35 age group, capturing 42% of this demographic compared to Uber’s 38%

- Gender: Bolt has a higher percentage of female users (59%) compared to Uber (50%).

To enhance safety and inclusivity, Uber offers financial incentives to increase the number of female drivers, and both companies have introduced “women-only” options for female passengers.

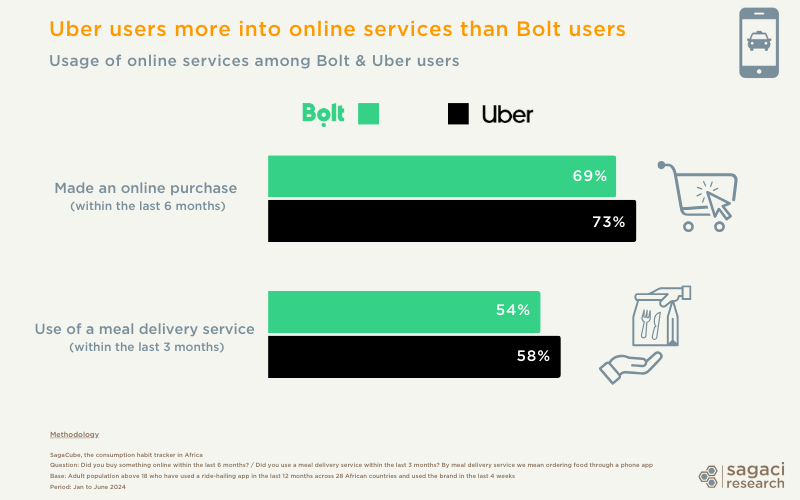

Finally, given that Uber users are more represented among the highest social classes, it’s unsurprising that they also utilise online services more frequently than Bolt’s users (eg. online purchases and meal delivery services).

Ride-Sharing Companies in Africa Expand into Quick Commerce

To solidify their market presence, ride-sharing companies in Africa are diversifying into food delivery and courier services, competing with specialized players like Glovo. Partnerships are also emerging between online transport sector players and brick-and-mortar retailers, acting as last-mile delivery specialists. For instance, Carrefour (partner with CFAO Consumers in West Africa) has teamed up with Gozem in Cameroon to enhance its food delivery services and expand reach to previously inaccessible customers. Similarly, collaborations with Yango are helping to integrate quick commerce solutions into their operations.

To conclude, ride-hailing services in African cities are becoming an integral part of urban mobility. The competition among ride-hailing apps in Africa is fierce, with companies continuously innovating to capture market share. The rise of the online transport sector and the Mobility as a Service (MaaS) market highlights the evolving landscape of urban transportation in Africa. As the market grows, online market research will be key to understanding consumer behavior and preferences in this dynamic environment.

Leveraging Online Market Research in Africa

Online research tools like SagaCube provide extensive data on consumer habits across Africa. SagaCube covers 144 categories across 26 countries, combining 400+ usage and attitude variables with thousands of brand usage data points. Comprehensive data and insights are available for deeper analysis of the African ride-hailing market. Check our previous analysis of the sector from 2023, download this year’s full report or simply contact us at contact@sagaciresearch.com.

Methodology

SagaCube, the online pan-African consumption tracker.

Questions

Q: Did you use a ride-hailing app for either car or moto taxi in the last 4 weeks? By using a ride-hailing app, we mean ordering a ride online via a smartphone application.

Base: Adult population above 18 across 28 African countries. N= 35,198

Q: Which ride-hailing app did you use in the last 12 months?

Base: Adult population above 18 across 28 African countries who have used a ride-hailing app in the last 4 weeks. N= 10,814

Q: Did you buy something online in the last 6 months?

Q: Did you use a meal delivery service within the last 3 months? By meal delivery service we mean ordering food through a phone app.

Base: Adult population above 18 across 28 African countries who have used a ride-hailing app in the last 4 weeks and either Bolt or Uber in the last 12 months. Minimum base: 4,208.

Survey Period: January to June 2024.