- 28/11/2023

- Posted by: Issa Sawadogo

- Categories: Articles, Consumer Goods / FMCG, Morocco, Pasta, SagaCube

In this article, we explore the pasta consumers in Morocco. With the consumption tracking tool SagaCube we can compare the profile and behaviour of consumers of Dari and Alitkane, the leading pasta brands in Morocco (according to SagaBrand, the Brand Health Tracker in Africa). Read on to find out how they might differ

Who are the pasta consumers in Morocco?

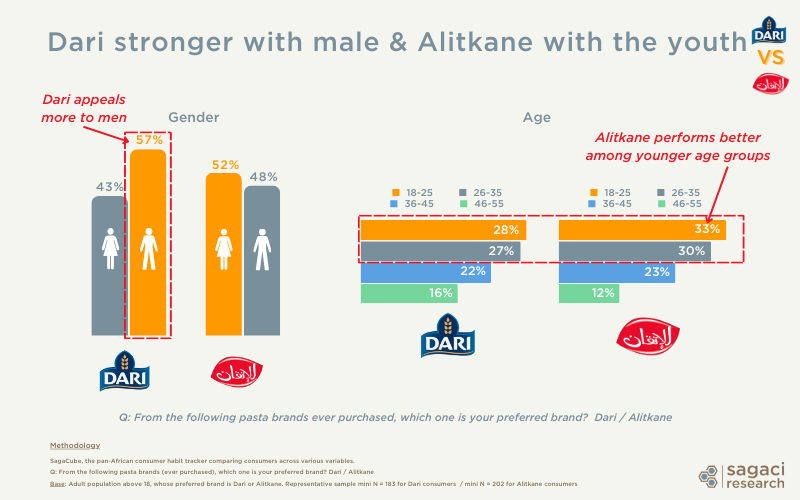

Looking at Dari and Alitkane consumers, we find some interesting differences:

- Gender: Dari appeals significantly more to men (57% vs. 43%) while Alitkane performs slightly better with women

- Age: Alitkane consumers tend to be younger than Dari’s (63% vs. 55% are between 18 and 35)

- Finances: Dari consumers are wealthier (more represented among SEC AB, 51% vs. 38%) and more financially literate than Alitkane’s, yet they are more careful with prices when shopping (89% vs 81%)

- Environment: Dari consumers are more active when it comes to reducing plastic in their daily lives (70% vs 63%). They also purchase organic products more often (33% vs. 25%)

- Consumption: Dari consumers tend to consume more tomato paste and purée than those who prefer Alitkane brand (43% vs 33%). Combining these two products in marketing campaigns could therefore have a greater impact on Dari consumers.

Want to find out more?

This data was generated via the Sagaci Research online panel in Morocco. Indeed, Sagaci Research has a robust, mobile based and representative online panel of respondents in 34 African countries, including Morocco. The information gathered by our online panel gives us in-depth knowledge of the continent’s consumers across hundreds of variables: demographic, psychographic, attitudinal, etc). Consequently, we can provide within a few days detailed answers to your questions on the African consumer market to help your business grow.

Finally, for more information on the pasta market in Morocco , or more generally on how to research market trends online, please send an email to contact@sagaciresearch.com. You can also contact us using the form below.

Methodology

SagaBrand, the continuous tracking tool for brands across the African continent. Our online panel assesses around 2,000 brands on a daily basis, including the pasta category.

SagaCube, the consumption database in Africa

Questions: From the following pasta brands ever purchased, which one is your preferred brand? Dari / Alitkane

To what extent do you agree with the following statement : “When shopping, I always look at the price first.”? Net Agree (Agree + Strongly Agree)

To what extent, if at all, do you agree or disagree with the following statement: “I am taking actions to reduce the amount of plastic I purchase or use.”? Net Agree (Agree + Strongly Agree)

How often did you, or someone in your household, buy organic food within the past 4 weeks? Several times

Which of the following packaged foods did you consume in the last 4 weeks? Tomato paste & purée

Base: Moroccan consumers whose preferred pasta brand is Dari or Alitkane

Minimum sample per brand: n = 77

Population: Adults above 18 years old living in Morocco

Period: October 2023