- 17/09/2024

- Posted by: Janick Pettit

- Categories: Algeria, Articles, Consumer Goods / FMCG, Non-alcoholic beverages, SagaBrand

Curious about the top soda brands in Algeria for 2024? Understanding consumer preferences is crucial for success in the competitive soda market. This is facilitated by SagaBrand, Africa’s largest Brand Health Tracker, which provides monthly insights based on consumer feedback from across the continent.

Through our online panel in Algeria, we survey consumers to gather insights on their preferred soda brands based on their consumption habits. These insights reveal which soda brands in Algeria resonate most with consumers. Read on for a detailed analysis of the top soft drinks in Algeria.

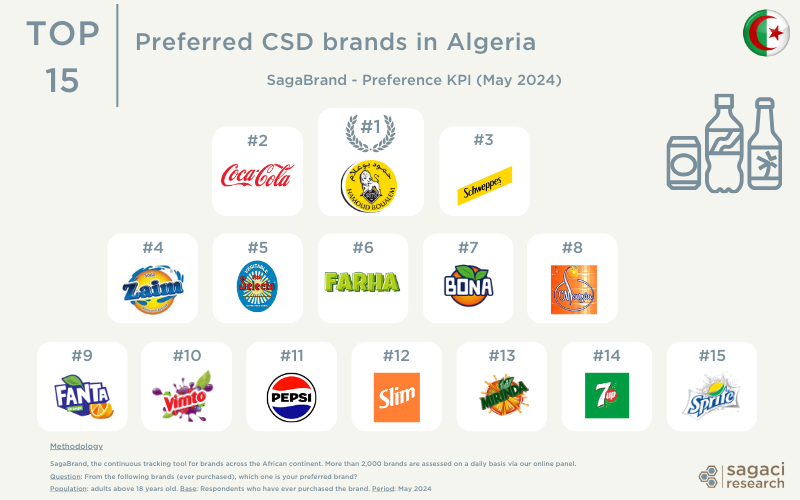

Ranking of the top soda brands in Algeria

In this article, we explore the best soda brands in Algeria, specifically Consumer Preference, one of the 25 Key Performance Indicators (KPIs) tracked by SagaBrand, the leading pan-African brand tracker.

Below is the Algeria soda ranking based on the Preference rate:

- Hamoud (by Hamoud Boualem, Algeria) – 37% preference rate

- Coca-Cola (USA) – 30%

- Schweppes (by The Coca-Cola Company) – 25%

- Zaim (Algeria ) – 24%

- Selecto (by Hamoud Boualem, Algeria) – 23%

- Farha (by Setifis Bottling Company, Algeria)

- Bona (by International Drink Company, Algeria)

- Mouzaia (by Groupe SIM, Algeria)

- Fanta (by The Coca Cola Company)

- Vimto (UK)

- Pepsi (by Atlas Bottling Corporation / Pepsi)

- Slim (by Hamoud Boualem, Algeria)

- Mirinda (by Atlas Bottling Corporation / Pepsi)

- 7up (by Atlas Bottling Corporation / Pepsi)

- Sprite (by The Coca-Cola Company)

Interestingly, nearly half of the brands in the ranking are of Algerian origin indicating a strong Carbonated Soft Drink (CSD) industry in the country. Hamoud Boualem, a long-established local soft drink company, leads the way with three brands (Hamoud, Selecto and Slim), outpacing in some cases international competitors like Coca-Cola and Pepsi.

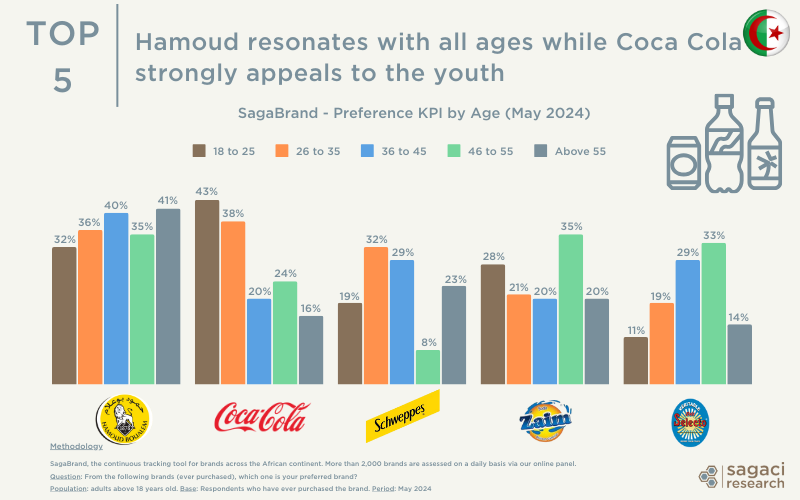

Demographic differences among Algeria’s leading Soft Drink brands

In Algeria’s soft drinks market, the top five brands demonstrate varying strengths across different demographics.

Hamoud stands out for its broad appeal, performing strongly across all age groups, unlike other brands that tend to excel in specific age brackets (eg. Coca-Cola is particularly strong among the youngest age group 18-25). Hamoud’s strong performance across all age groups can be attributed to its deep-rooted history in Algeria, dating back to 1878, and its cultural significance, which is frequently emphasised in its marketing. The brand is often referenced in Algerian music and pop culture, therefore reinforcing its connection to national identity and enhancing its appeal across generations.

The leading brand in the Algerian carbonated soft drink market also dominates among higher socio-economic classes (SECs), whereas its closest competitors are more popular among lower-income consumers.

In terms of gender, Hamoud and Coca-Cola show greater popularity with men, whereas other top brands perform better with women.

More on the non-alcoholic beverage market

To sum up, the non-alcoholic beverages category is just one of many FMCG sectors that SagaBrand monitors on an on-going basis across the continent. In fact, we regularly deliver insights into this sector, including recent analysis of Africa’s favourite soft drinks and in-depth looks at specific markets such as Cameroon.For more insights on consumer preferences in Algeria or the beverage market trends in Africa for 2024, feel free to get in touch with us. Please send an email to contact@sagaciresearch.com or click below.

Methodology

SagaBrand, the continuous brand health tracking tool across the African continent. More than 2,000 brands are assessed on a daily basis via our online panel in Africa.

Question: From the following brands (ever purchased), which one is your preferred brand?

Population: adults above 18 years old.

Base: Respondents who have ever purchased the brand.

Period: May 2024

- Note: The full report is available for download and includes an in-depth analysis by key demographics such as age, gender, and socio-economic class (SEC), along with detailed performance percentages for the complete ranking.