- 15/12/2025

- Posted by: Janick Pettit

- Categories: Articles, Household Care, SagaBrand, SagaCube, Zambia

Understanding laundry detergents in Zambia is essential for brands navigating a category shaped by strong habits, demographic differences and intense competition. SagaCube’s continuous consumption tracking provides granular consumer insights in Zambia on how households wash their clothes. Building on this, the SagaBrand brand health tracker uses data collected daily from our online panel in Zambia to show how detergent brands perform on KPIs such as awareness, usage and preference.

This article provides a quick snapshot of the insights these tools generate. For a full market assessment, get in touch with our team!

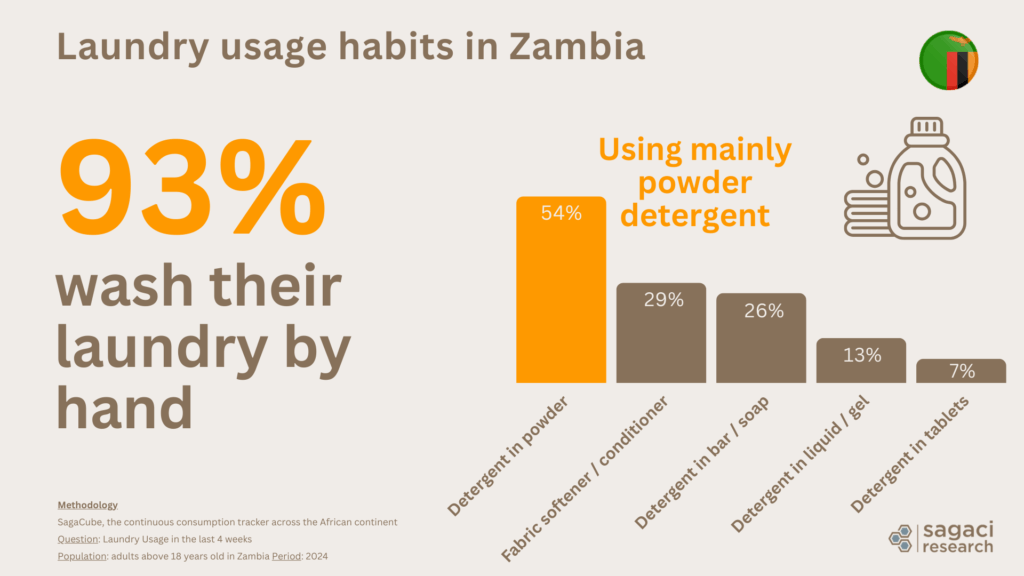

Laundry usage in Zambia: how consumers wash and which formats they prefer

SagaCube data shows that 93% of adults wash their laundry by hand, a central behaviour shaping the laundry market in Zambia and reinforcing the need for detergents that perform well without machine support.

Powder detergent leads the category (54%), ahead of fabric softeners (29%) and bar soap (26%). Usage rises with age and income, and women remain the primary users, being over-represented (72%) compared to men (49%).

For manufacturers, these patterns signal that product positioning must align with real-world washing contexts, where value, lathering performance and ease of rinsing influence adoption far more than convenience alone.

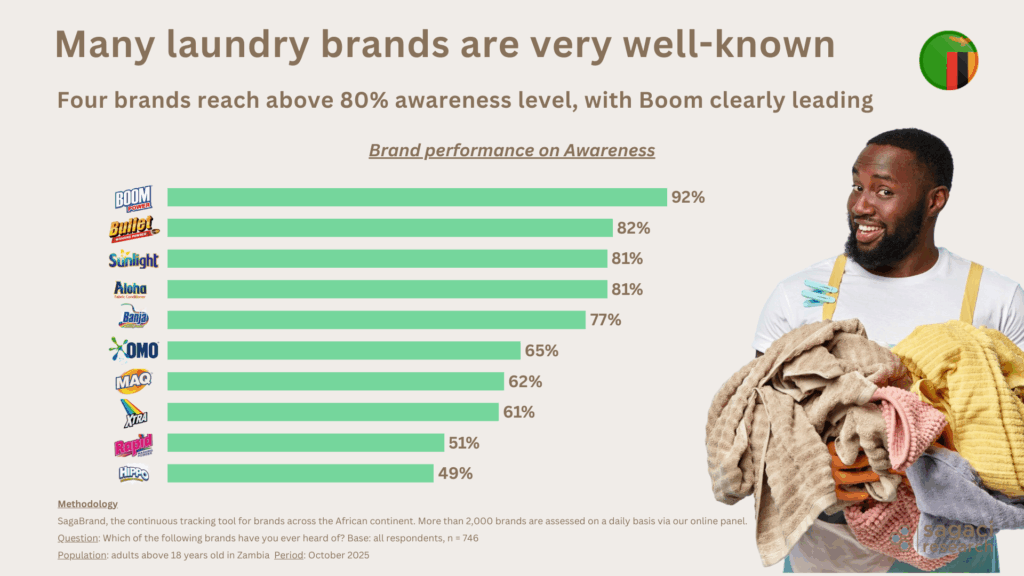

Detergent brands in Zambia: strong awareness

SagaBrand confirms that laundry detergents in Zambia enjoy high visibility across the country. Four brands exceed 80% awareness, led by Boom at 92%, followed by Bullet, Sunlight and Aloha.

Here is the full Awareness ranking of laundry brands in Zambia where local manufacturer Trade Kings clearly dominates:

- Boom (by Trade Kings)

- Bullet (by Trade Kings)

- Sunlight (by Unilever)

- Aloha (by Trade Kings)

- Banja (by Trade Kings)

- Omo (by Unilever)

- Maq (by (by BlissBrands)

- Xtra (by Trade Kings)

- Rapid (by Innova Manufacturing)

- Hippo (by Trade Kings)

Low loyalty among users of laundry detergents in Zambia

Yet, despite strong visibility across many brands, loyalty remains low. Consumers report trying an average of 5.5 brands and still switching between 2.5 brands in recent purchases. This behaviour demonstrates how actively Zambians reassess performance and price at each buying occasion, a key element of consumer insights in Zambia.

For marketers, the takeaway is that high awareness alone does not shield brands from churn. Consistent product performance and improved value perception are essential to reduce leakage across the customer journey.

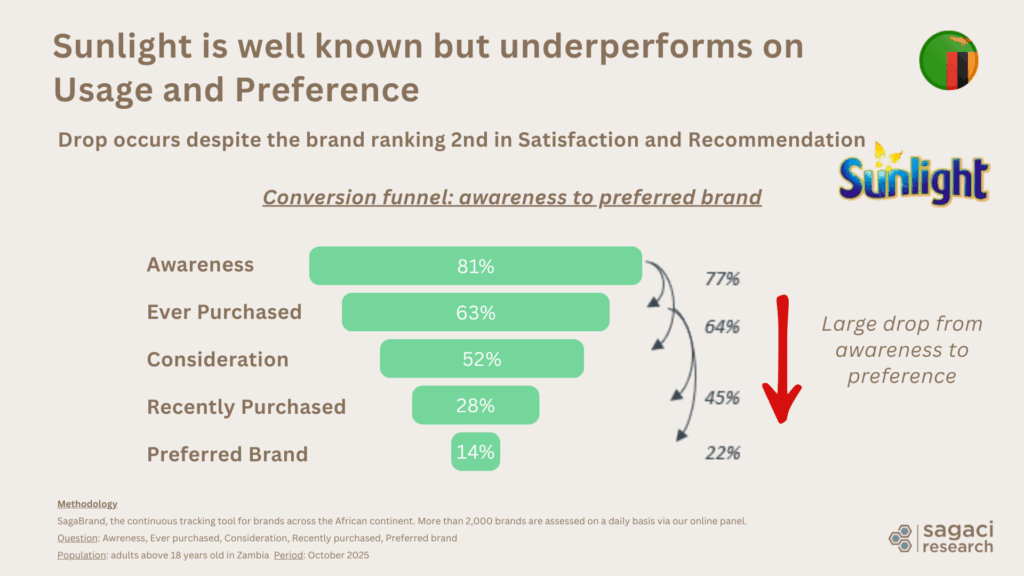

Sunlight and Rapid: diverging paths in the laundry market in Zambia

Sunlight illustrates the challenge of converting awareness into long-term preference. Despite 81% awareness, the brand falls to 14% preference, with notable drop-offs across the funnel, from 63% ever purchased to 28% recently purchased.

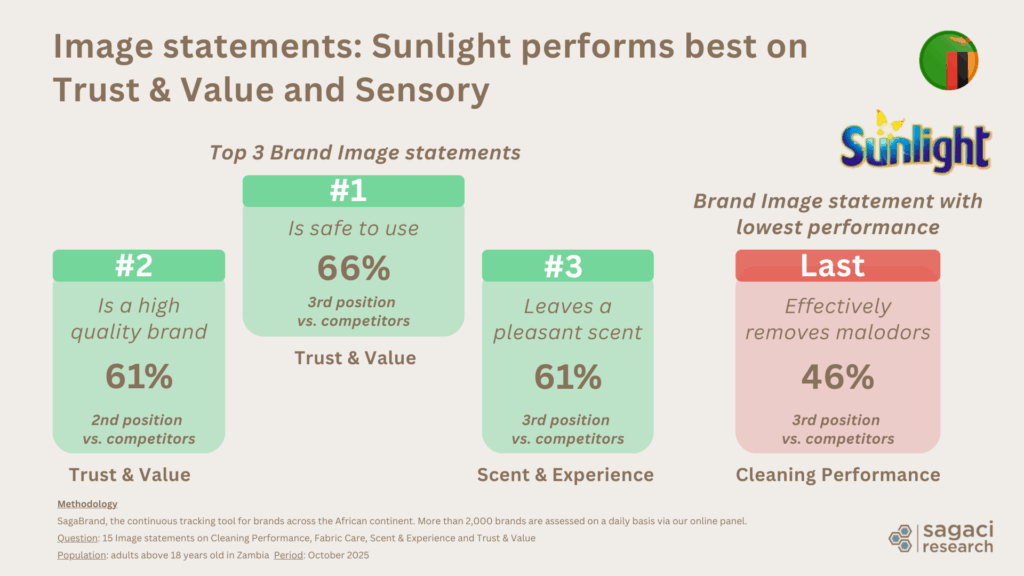

Brand image insights help identify strengths and performance gaps

SagaBrand assesses 15 brand image statements across four key dimensions for the laundry care category: Cleaning Performance, Fabric Care, Scent & Experience and Trust & Value.

These metrics help brands understand which attributes drive consumer perception and where improvements may be needed.

Sunlight’s profile illustrates this well. The brand performs strongly on Trust & Value and Scent & Experience, with high scores on safety, product quality and pleasant scent. However, it underperforms on Cleaning Performance, especially on malodor removal. For marketers, these insights pinpoint which product benefits to reinforce and where innovation efforts may have the most impact.

Key takeaways on the detergent market in Zambia

Laundry detergents in Zambia form a market where habits are strong, but preference is fluid. Hand washing dominates, powder remains the core format, and consumers compare brands regularly.

Sunlight’s conversion challenges highlight the risks of underperforming on core functional attributes, while Rapid’s upward trajectory shows how emerging players can gain ground with the right balance of performance and value.

This article shares only a small glimpse of the insights uncovered through SagaBrand and SagaCube. The full datasets allow a far deeper understanding of laundry usage and consumers in Zambia, brand conversion drivers and competitive dynamics.

So to access further insights, get in touch with our team on contact@sagaciresearch.com.

Methodology

SagaCube, the largest consumption tracker in Africa

SagaBrand, the continuous brand tracking tool across Africa assessing over 2,000 brands via our online panel in Africa powered by SagaPoll.

Our online panel in Zambia captures consumer behaviour across multiple sectors, from FMCG to financial services. This allows us to compare brand performance patterns, such as those seen in laundry detergents and in our study of the top banks in Zambia for customer satisfaction.

Image: by wayhomestudio