- 06/12/2023

- Posted by: Issa Sawadogo

- Categories: Algeria, Angola, Articles, DR Congo, Ethiopia, Guinea, Insurance, Kenya

The penetration of private health insurance in Africa is generally lower compared to other regions of the world. With coverage often concentrated among higher income individuals or through corporate schemes let’s assess what the situation really is on the continent. Recent data from SagaCube indicate that 21% of respondents from the highest Social Economic Classes (SEC AB) of Sagaci Research online panel in Africa currently have private medical insurance.

Read on for details on why this rate is low and on the different penetration rates by country.

Why is the penetration of health insurance in Africa so low?

Several factors can explain the generally low healthcare coverage in Africa. For one, low income levels make healthcare affordability an issue. Furthermore, the predominance of the informal sector in Africa’s economy implies a lack of access to employment benefits such as healthcare. Limited or inadequate healthcare infrastructure can also impact the perceived value and accessibility of health insurance. Finally, the lack of awareness and understanding about the benefits of health insurance among the population can also hinder its penetration.

Heterogeneous levels of private medical insurance penetration across Africa

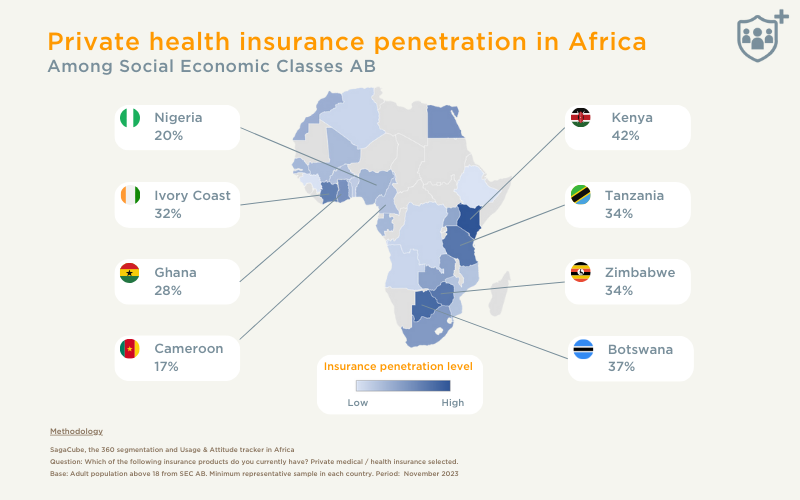

Results from the online survey conducted in 2023 reveal some significant disparity between countries.

Generally East and Southern African countries tend to have higher penetration rates compared to Northern and Western Africa. Countries with the lowest rate include Guinea, Ethiopia (both at 9%) and the Democratic Republic of Congo (11%). Algeria and Angola follow at both 12%.

Conversely, Kenya boasts the highest private health insurance penetration rate at 42%. We can largely attribute this to a notably competitive insurance market within the East African region. The result is greater availability of affordable insurance products. Additionally, Kenya, the birthplace of the renowned mobile money platform Mpesa by Safaricom, has witnessed the emergence of pioneering technologies, including in the digital health platform sector. The introduction of mobile-based insurance solutions like M-Tiba, also under Safaricom’s umbrella, alongside innovations like mTek-Services, has significantly simplified the process for individuals to access and procure insurance coverage.

Finally, despite being a public institution, the National Health Insurance Fund (NHIF) of Kenya is often perceived as resembling private health insurance providers by many Kenyans. This perception arises from similarities in certain operational aspects, such as membership structures and the scope of coverage. This blurred distinction may also contribute to a high penetration rate of private medical insurance membership in Kenya.

To find out more on the Insurance sector in Africa

The insights presented are drawn from Sagaci Research’s expansive online panel covering 34 African countries. This robust platform serves as a rich source of comprehensive information about African consumers. Our panel encompasses a diverse array of variables, including demographics, psychographics, and attitudinal data, among others. Leveraging our mobile-centric consumption database, we’re adept at swiftly and thoroughly addressing a wide spectrum of inquiries related to African consumer behavior, delivering detailed insights within days.

Finally, for more information on the Health Insurance market in Africa, or more generally on how to leverage our online consumer panel, please send an email to contact@sagaciresearch.com or click below.

Methodology

SagaCube, the consumption database in Africa

Questions: Which of the following insurance products do you currently have? Private medical / health insurance selected.

Population: Adult population above 18 years old from SEC AB. Minimum representative sample in each country.

Period: November 2023