- 17/03/2025

- Posted by: flore.demaigret

- Categories: Articles, Egypt, Energy drinks, Ivory Coast, Kenya, SagaCube, South Africa

Curious about the growth of the energy drinks market in Africa? Wondering which brands are winning over consumers? We’ve got you covered.

In this article, we dive into the African countries experiencing significant growth, backed by data from the SagaCube consumption tracker. Plus, we tap into our extensive Product Insights platform—with over 4,600 SKUs captured—to reveal the top energy drink brands across the continent.

The foundation of these insights? Africa’s largest online panel.

Read on to discover the latest trends shaping the energy drinks category in Africa.

Energy drinks market in Africa: growing countries

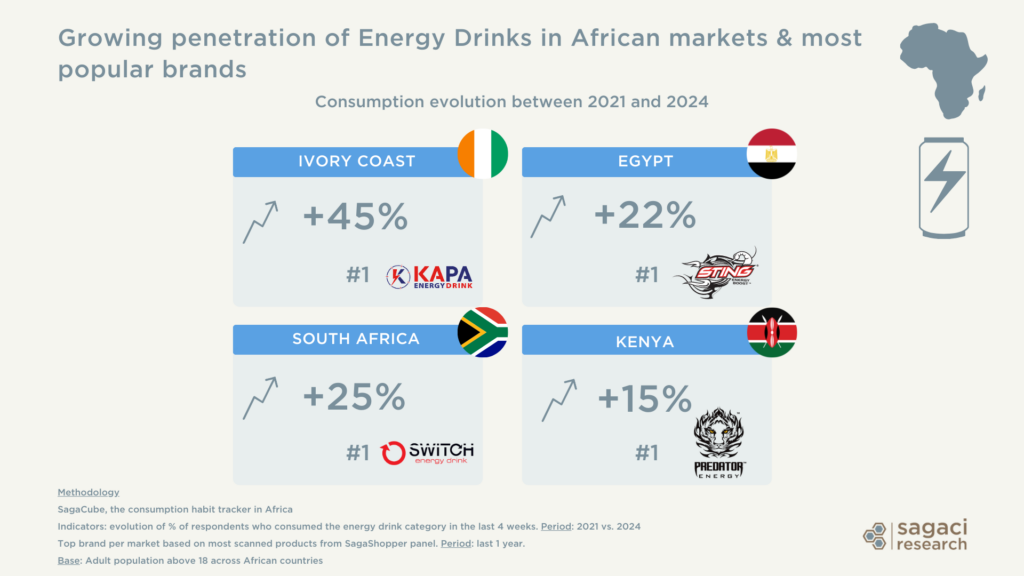

Data from our African consumption platform (SagaCube) shows that countries like Côte d’Ivoire, Kenya, South Africa, and Egypt have experienced double-digit growth rates between 2021 and 2024.

Energy drinks in Côte d’Ivoire

Energy drinks consumption in the last four weeks surged by 45%, with Kapa leading the market.

Produced locally by La Société Moderne de Limonaderie de Côte d’Ivoire (SMLCI), Kapa is the most widely available energy drinks brand in Côte d’Ivoire. In an increasingly competitive market, it goes head-to-head with the German brand Cody’s, which previously ranked as the 6th most preferred brand in Africa, according to brand tracking data.

Energy drinks in South Africa

The penetration of energy drinks in South Africa grew by 25% between 2021 and 2024. Owned by South African Switch Beverage Company, SWITCH emerges as the most popular brand according to the Product Insights data capture.

Energy drinks in Egypt

The consumption of energy drinks in Egypy surged by 22%, with Sting Energy leading the market. Owned by PepsiCo, Sting Energy dominates the category, thanks in part to its affordability compared to its key competitor, Red Bull. This aligns with our previous analysis of Egypt’s energy drinks market and the Red Bull vs. Sting rivalry. By the end of 2023, Sting was on the verge of surpassing Red Bull across several brand performance KPIs (based on SagaBrand).

Energy drinks in Kenya

Energy drinks penetration in Kenya increased by 15% over the same time period (2021/24). According to our Product Insights data, Predator, Monster Energy’s affordable brand under Coca-Cola, stands out as the most popular energy drink in the country. Its competitive pricing likely contributes to its strong performance, with a 400ml PET bottle costing as little as 59 KES, compared to premium options like Red Bull, which sells for 222 KES for a 250ml can (Carrefour Kenya).

Want to access more energy drinks data in Africa?

What are the most popular energy drinks in Africa?

Africa’s energy drinks market is a dynamic mix of global giants, regional leaders, and local challengers, each catering to different consumer segments. Red Bull and Monster Energy lead the premium category, while Sting (by PepsiCo) and Predator (by Coca-Cola) compete in the more affordable segment, making energy drinks accessible to a wider audience. Regional and local brands also play a major role. In West Africa, Fearless (Nigeria), Cody’s (Côte d’Ivoire), and XXL Energy (Congo) are notable contenders, while in East Africa Azam (Tanzania) and Rock Boom (Uganda) stand out. In South Africa, brands like SWITCH and Power Play continue to attract consumers.

Meanwhile, brands such as Dragon, Storm, Vandam, and Mojo Energy have built strong followings in various local markets.

Hybrid brands like Lucozade and Powerade also compete in the energy and sports drink space, appealing to fitness-conscious consumers. With a diverse range of offerings, affordability, accessibility, and brand loyalty remain key drivers in shaping Africa’s energy drinks landscape.

Want to access more energy drinks data in Africa?

Why is energy drink consumption increasing in Africa?

We’ve seen that energy drink consumption in Africa is on the rise. But what are the factors fueling this growth?

- Youthful demographics: Africa’s young population, especially male students and professionals, is a major driver of demand.

- Marketing & brand positioning: Aggressive advertising, celebrity endorsements, and sports sponsorships boost brand appeal. For example, Monster Energy drinks has partnered with SA Rugby in South Africa or Kapa Energy Drink in Côte d’Ivoire with football player Geoffroy Serey Die.

- Expanding distribution channels: Energy drinks are now more accessible in supermarkets, convenience stores, and street vendors catering to on-the-go consumers.

- Growing sports & fitness culture: Increased interest in fitness drives demand for performance-enhancing drinks. Power Play, a brand from Coca-Cola, has established a connection with Kenya’s fitness culture. It is also linked to active sports like boxing and basketball in Uganda.

- Energy drinks used as alcohol mixers, particularly in nightlife and social settings. For example, the brand Vody (by Cody’s) which is a Vodka energy mix is quite popular in Côte d’Ivoire and neighboring countries (Benin, Togo, Ghana and Burkina Faso).

- Affordable options: Local brands as well as some global brands offer lower-cost alternatives, making energy drinks more accessible (eg. Predator, Sting, Cody’s, Switch…).

More on the non-alcoholic beverages in Africa

In conclusion, Africa’s energy drinks market is seeing significant growth, fueled by youthful demographics, aggressive marketing, and a growing sport culture. Data from Product Insights highlight top brands like Red Bull, Sting, Kapa, Rush, and Fearless, capturing various consumer segments across the continent.

For deeper insights into the energy drinks market and broader soft drink trends in Africa, explore our platforms. Contact us to access detailed data and stay ahead of evolving consumer preferences and brand performance in the region.

Methodology

- SagaShopper / Product Insights: Sagaci Research’s proprietary shopper panel in Africa, captures detailed insights into the products consumers purchase. Brands most scanned by online panel (including barcode, image, rating, etc).

Population: Adults above 18 years old across 54 African countries

Period: ongoing since 2024

- SagaCube, the consumer habit tracker in Africa based on our online panel in Africa. It monitors over 150 consumer categories as well as 800+ usage and attitude segmentation variables.

Question: Energy drink consumption in last 4 weeks

Population: adults above 18 years old in Kenya, Côte d’Ivoire, Egypt and South Africa

Period: captured on an ongoing basis since 2021. Comparison of 2021 vs. 2024