- 22/07/2024

- Posted by: ilana.czerwinski

- Categories: Articles, Bank, Financial Services, Nigeria, SagaBrand

Discover the top banks in Nigeria for customer satisfaction as of June 2024. With formal financial inclusion in Nigeria rising significantly from 56% in 2020 to 64% in 2023*, monitoring the performance of financial institutions in this key sector is essential. Because customer satisfaction is a crucial indicator of a bank’s performance, let’s explore which banks are leading in this metric, according to the SagaBrand tracker.

Tracking Financial Services in Nigeria

SagaBrand, the largest Brand Health Tracker in Africa, continuously monitors consumer opinion about brands across the continent with a set of 25 Key Performance Indicators (KPIs), including brand awareness and customer satisfaction. We leveraged the SagaPoll online panel to ask Nigerian consumers about the banks they are familiar with and their satisfaction levels with the financial institutions they have been customers of. Our online panel in Nigeria reveals the most recognized banking brands, but also the most appreciated by customers, while also identifying those with significant room for improvement.

Which are the top banks in Nigeria?

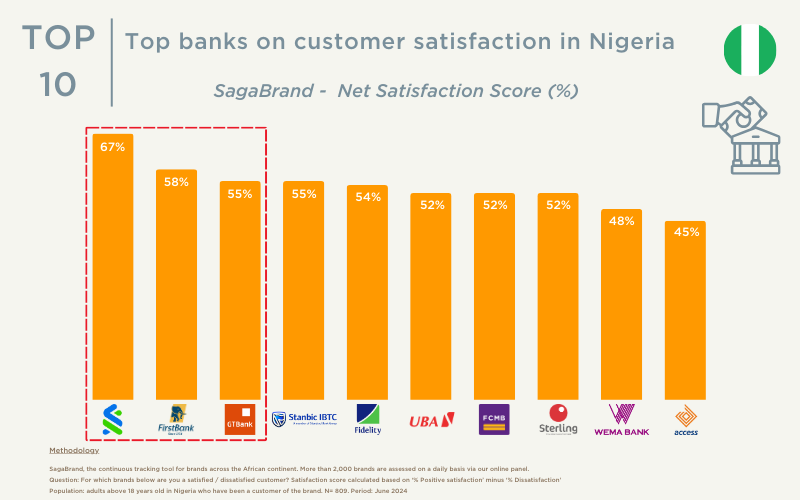

In Nigeria, awareness of banking institutions is notably high. With a 90% awareness rate, Access Bank leads the field, closely followed by UBA and GTBank, both at 89%. Despite this high level of recognition, customer satisfaction tells a different story. Indeed, rankings based on net satisfaction scores differ considerably from those based on awareness, confirming that recognition does not necessarily correlate with satisfaction. In this article, we specifically examine the Net Satisfaction score, calculated by subtracting Dissatisfaction from Satisfaction.

Here is the top-rated banks in Nigeria based on the Net Customer Satisfaction score:

- Standard Chartered (subsidiary of British Standard Chartered Bank)

- FBN – First Bank of Nigeria (Nigeria)

- GTBank – Guaranty Trust Bank (Nigeria)

- Stanbic IBTC Bank (subsidiary of Standard Bank Group from South Africa)

- Fidelity Bank (Nigeria)

- UBA – United Bank for Africa (Nigeria)

- FCMB – First City Monument Bank (Nigeria)

- Sterling Bank (Nigeria)

- Wema Bank (Nigeria)

- Access Bank (Nigeria)

Interestingly, all banks, except for Standard Chartered and Stanbic Bank, originate from Nigeria, which highlights the strength of the Nigerian banking sector.

Which institutions stand out among the top-ranked banks in Nigeria?

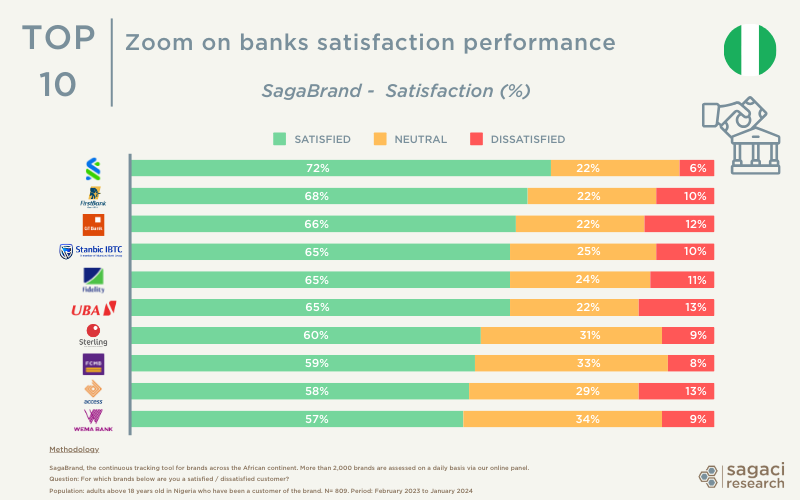

The satisfaction score provides a good overview into how well these financial institutions are meeting customer’s expectations. Digging a bit deeper, here is a detailed performance considering both Satisfaction and Dissatisfaction.

Here is the detailed satisfaction rating for the top 10 banks in Nigeria:

Zoom on the Top 3 banks in Nigeria:

- Standard Chartered: The British multinational bank tops the satisfaction ranking with a score of 72%. Additionally, it has one of the lowest neutral scores (22%) and dissatisfaction scores (6%), demonstrating an ability to successfully meet client expectations. While the group has withdrawn from numerous African markets and closed off most of its physical branches in Nigeria, Standard Chartered’s strategy to prioritise digital banking almost exclusively in Nigeria seems to be paying off.

- First Bank of Nigeria: As the oldest bank in Nigeria (and the first bank in West Africa), FBN comes second with a satisfaction rate of 68%. While also developing a strong digital presence, FBN continues to rely on an extensive branch network to serve its customers.

- GTBank: Rounding out the top three, GTBank achieves a 66% satisfaction score, closely following FBN. As an early pioneer of 24/7 digital banking solutions in West Africa, GTBank launched its “GT Connect” platform in 2006. However, with a dissatisfaction score double that of Standard Chartered, there are clear areas for improvement for the bank.

- In contrast, Access Bank and UBA, while being the top performers in terms of awareness, have the highest dissatisfaction rates at 13%. They also have high neutral scores, with Access Bank at 29% and UBA at 22%. These figures suggest that a significant portion of their customers are either dissatisfied or indifferent to their banking experience. This underscores the need for these banks to enhance client satisfaction by improving customer service strategies and addressing key areas of concern.

- Conversely, Wema Bank has the lowest satisfaction score at 57% and the highest neutral score at 34%. With a third of its clients expressing indifference toward their banking experience, the bank should focus on improving customer satisfaction to better engage its clientele.

More on financial services in Africa

SagaBrand tracks dozens of non-FMCG industries monthly throughout the continent, including financial services. Consequently, we frequently provide insights about the banking sector in Africa. For example, we surveyed last month the Top banks in Côte d’Ivoire, and previously the top banks in Kenya, Zambia, and Zimbabwe. We also share category insights via webinars, such as this one on Financial Services in Africa.

If you would like further insights on financial services in Nigeria or another African country based on our online panel in Africa, get in touch with us.Please send an email to contact@sagaciresearch.com or click below.

Methodology

SagaBrand, the continuous tracking tool for brands across the African continent. Our online panel assesses around 2,000 brands on a daily basis.

- Brand Awareness: Which of the following brands have you ever heard of? Base: All respondents.

- Customer Satisfaction: For which brands below are you a SATISFIED or DISSATISFIED customer? Base: Respondents who have ever been a customer of the brand. Minimum base per brand.

- Satisfaction score: satisfaction minus dissatisfaction.

Population: adults in Nigeria above 18 years old.

Period: June 2024

*According to the EFInA Access to Finance (A2F) Survey