- 30/05/2025

- Posted by: flore.demaigret

- Categories: Articles, Household Appliances, SagaBrand, South Africa

The market for small appliance brands in South Africa is rapidly growing. Products like kettles, toasters, and blenders are becoming indispensable kitchen essentials for households seeking convenience. This growth is driven by rising interest in home cooking and personal care. It is also supported by greater accessibility through new malls and booming e-commerce, boosted further by the recent launch of Amazon in the country.

As electricity costs and load shedding shape consumer priorities, demand for energy-efficient and technologically advanced appliances is at an all-time high.

In this context, a recent study from the Brand Health Tracker SagaBrand ranks the top small appliance brands in South Africa based on consumer feedback. It offers valuable insights into which brands are winning over shoppers with their perceived quality.

What are the top appliance brands in South Africa?

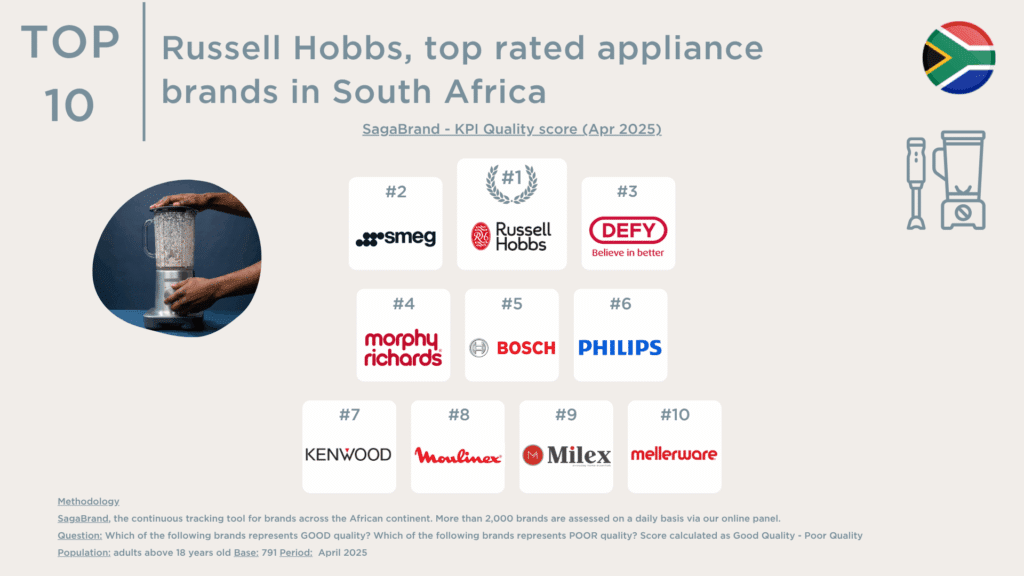

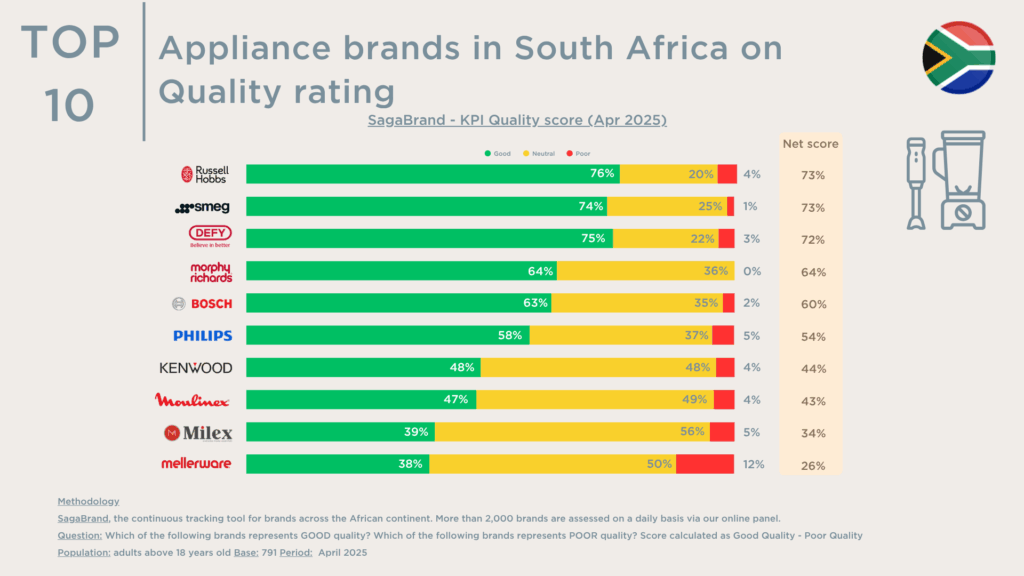

This recent survey, conducted in April 2025 among 791 members of our South Africa online panel, ranks brands based on their Quality Score. It is a metric calculated by subtracting the percentage of ‘Poor Quality’ ratings from the percentage of ‘Good Quality’ ratings.

South Africa’s top 3 brands of small appliances

Consumer ratings place three appliance brands in a tight race for quality leadership.

- #1 – The British brand Russell Hobbs, at 73% Quality score, is renowned for pioneering the world’s first automatic electric kettle and delivering innovative, stylish, and reliable small kitchen appliances

- #2 – The Italian brand Smeg, known for its iconic 1950s-inspired retro design, ties at 73%. Its premium image fuels strong quality perceptions even among non-users, as shown by a notably low Poor Quality rating of just 1%. Meanwhile, actual users largely confirm this positive reputation with a solid 73% satisfaction score.

- #3 – Defy closely follows with a 72% Quality Score. As one of South Africa’s leading home appliance manufacturers, it offers a budget-friendly alternative to the top-ranked brands. Defy’s strong performance highlights how value and reliability resonate with South African consumers, making it a popular choice for those seeking quality without the premium price tag.

Next-tier consumer-rated kitchen appliance brands in South Africa

Let’s explore how South African consumers rate the next tier of kitchen appliance brands in terms of quality and reliability.

- #4 – Morphy Richards, a UK mid-range brand less known in South Africa, leads the next brands with a 64% quality score, making it the most trusted in its price segment.

- #5 – Bosch, a German premium brand, follows with a 60% quality score and a low 2% poor quality rating. It reflects strong reliability expectations at a higher price point.

- #6 – Philips, from the Netherlands and positioned in the mid- to upper-range, achieves a 54% quality score. A 5% poor quality rating indicates more mixed consumer experiences for its price.

Kenwood (UK) and Moulinex (France), both mid-range international appliance brands, receive similar quality scores (44% and 43%) with nearly half of South African consumers remaining neutral. In contrast, local budget brands Milex and Mellerware lag behind with much lower quality scores (34% and 26%). Mellerware has the highest poor quality perception of all brands (12%), indicating some concerns about its reliability.

Note: Samsung and LG, while highly recognized when it comes to large home appliances, are excluded from this ranking focused on small kitchen appliances. These segments differ significantly in consumer needs, pricing, usage and as such quality expectations.

More key findings on the home appliance market in Africa

Leveraging our online panel in Africa, we continuously monitor consumer behaviour across categories including consumer appliances and electronics.

We also regularly publish insights on South African consumers. For example, we recently explored the Top laundry brands and the Top banks in South Africa.

With our tool SagaBrand, the largest Brand Health Tracker in South Africa, we can deep dive into brand performance. We explore quality perceptions and consumer trends across a large number of categories.

So if you’re looking for more detailed insights on appliance brands in Africa, reach out at contact@sagaciresearch.com or click below.

Methodology

This analysis is powered by SagaBrand, the continuous tracking tool for brands across the African continent. More than 2,000 brands are assessed on a daily basis via our online panel.

Questions:

- Which of the following brands represents GOOD quality? Which of the following brands represents POOR quality? Score calculated as Good Quality – Poor Quality

- Base: n = 791, respondents aware of the brands

- Population: adults in South Africa above 18 years old

- Period: April 2025