- 03/08/2023

- Posted by: Baptiste Pioch

- Categories: Articles, e-commerce, Nigeria, SagaBrand, SagaCube, South Africa

The sector of e-commerce in Africa is experiencing significant growth driven by increasing internet penetration and mobile phone usage. While it is a household name in most of Europe and the USA, Amazon is yet to break through on the world’s second biggest continent. So when is Amazon coming to Africa? What are the obstacles it will likely encounter when launching in the African e-commerce market? In this article, we take a look at some of the challenges the brand faces from a consumer perspective. In the same time, we’ll also get a glimpse into where the brand has potential to do well.

Amazon’s entry into Africa: expected launch in Nigeria and South Africa

In 2022, Amazon announced the upcoming launch into Nigeria and South Africa. But, in both countries, the launches have been somewhat delayed due to various challenges. However, once the global online shopping leader actually starts operations the e-commerce competitive landscape in both countries could be changing, shaking things up for existing players.

One of them is the African e-commerce start-up Jumia, often referred as the “Amazon of Africa”. In the last decade it has managed to position itself as one of the leading e-commerce platforms in Africa. It currently serves 10 countries including Nigeria, where a majority of its visits come from.

E-commerce platforms in Nigeria

Using data from Sagaci Research’s syndicated brand health tracker – SagaBrand – we are able to assess consumer opinions. The graph below shows how they have evolved over the past two years in the West African country.

Jumia is leading in Customer Satisfaction in Nigeria, ahead of AliExpress. However we can assume that things could change once Amazon actually launches in the country.

E-commerce platforms in South Africa

Similarly, the next example shows the evolution of customer satisfaction of the top e-commerce brands in South Africa.

Takealot takes the clear lead in South Africa with a very steady performance over the past two years consistently above 80%. Uber Eats and Mr D Food are close rivals for the 2nd and 3rd place around the 70% satisfaction mark.

Challenges of e-commerce in Africa

Despite the potential growth of the e-commerce sector in Africa, there are several challenges. They are specific to the continent and Amazon will need to consider them. For example:

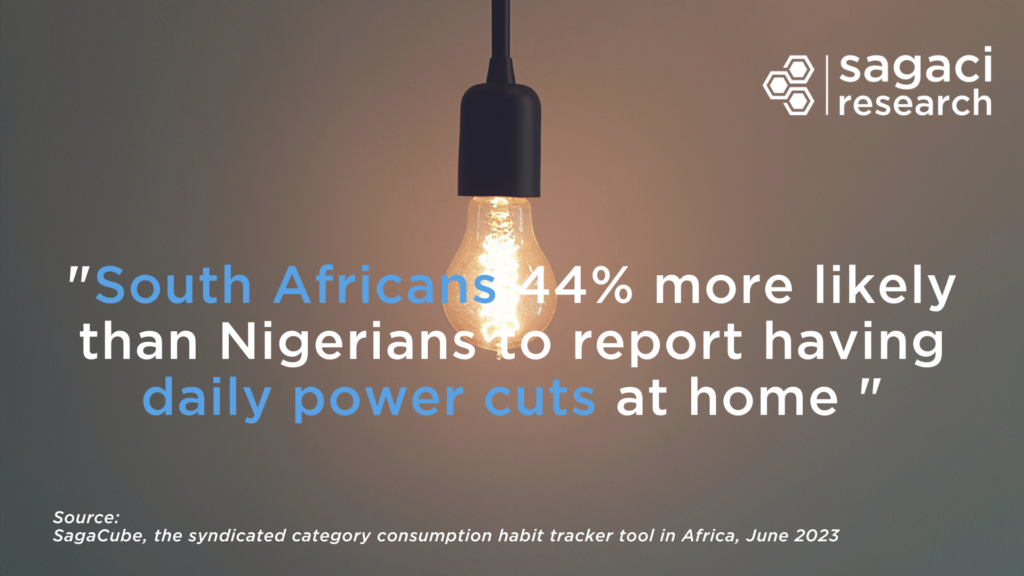

- Power: factories and distribution centres require a stable power source. This is particularly a problem in countries like South Africa, where increasing ‘load shedding’ has been causing disruption across the country

- Delivery: in order to deliver products in the timely manner achieved elsewhere in the world, infrastructure improvements to roads are required in many parts of Africa. The lack of formal address systems in many regions also remains a challenge. Luckily efforts are being made to improve accessibility through innovative solutions. For example, digital mapping, geolocation technologies, and community-based addressing systems.

- Consumer trust: in order to win the trust of consumers, online sites should offer easy-to-use, secure payment methods, building consumer confidence that their personal data will be protected from fraud.

In addition, consumers’ pre-conceptions about other similar e-commerce brands could influence their willingness to try out alternatives. If people aren’t happy with the experience from using existing brands on offer, Amazon must prove themselves to be better (not the same) than these brands causing dissatisfaction.

- Consumer education: A significant portion of the population in Africa may have limited digital literacy skills, particularly in rural or underserved areas. For African consumer online behaviour to evolve, education about basic online shopping processes, website navigation, and digital payment methods would certainly help. For example, according to SagaCube, only 65% of Nigerians and 67% of South Africans surveyed reported having made an online purchase within the last 6 months. This highlights a large gap to reach in the online shopping market. To address this and grow their market share beyond urban centres, Jumia has put in place an offline community of commission based sales people (JForce agents), spread throughout the country, whose role is to educate and help their peers place orders. In parallel Jumia has also set up partnerships with a network of kiosks. They are acting as local relay in some of the countries where it operates to increase the depth of their reach.

“Delivering to rural areas is definitely a better way of achieving growth than opening up new countries”.

— Julien Garcier, MD of Sagaci Research quoted in a recent Jeune Afrique / Africa Report article about Jumia’s expansion to rural areas

Finally, beyond these challenges, the main issue may remain the limited purchasing power of the population in some countries, with most customers unable to place frequent and substantial orders, making the target market potentially small for e-commerce players. This encourages online stores to focus primarily on affordable, high-demand categories (such as electronics, beauty, fashion), making scalability and large-scale investment difficult.

Want to know more?

One of the best ways to do market research and specifically to get fast and reliable data on E-commerce trends in Africa, is by leveraging SagaBrand, the continuous Brand Health Tracker tool. The monthly tracker monitors 25 essential KPIs for over 2,000 brands across dozens of countries in Africa.

Beyond those essential KPIs, our online panel can also be useful in different ways. It can dig in deeper and explore specific reasons behind some SagaBrand results.

To learn more about consumer preferences for e-commerce in Africa, please send an email to contact@sagaciresearch.com or click below.

Methodology

Insights taken from SagaBrand, the continuous tracking tool for brands across the African continent, and SagaCube, the syndicated category consumption habit tracker tool in Africa.

SagaBrand question: For which brand below are you a satisfied customer? Base: Respondents who have ever purchased / used the brand. Period: 2021 to 2023

SagaCube questions: Did you buy something online within the last 6 months? / How often do you experience power cuts in your house? Period: June 2023

Population: Adults above 18 years old