- 28/02/2024

- Posted by: Janick Pettit

- Categories: Articles, DR Congo, Household Care, SagaTracker

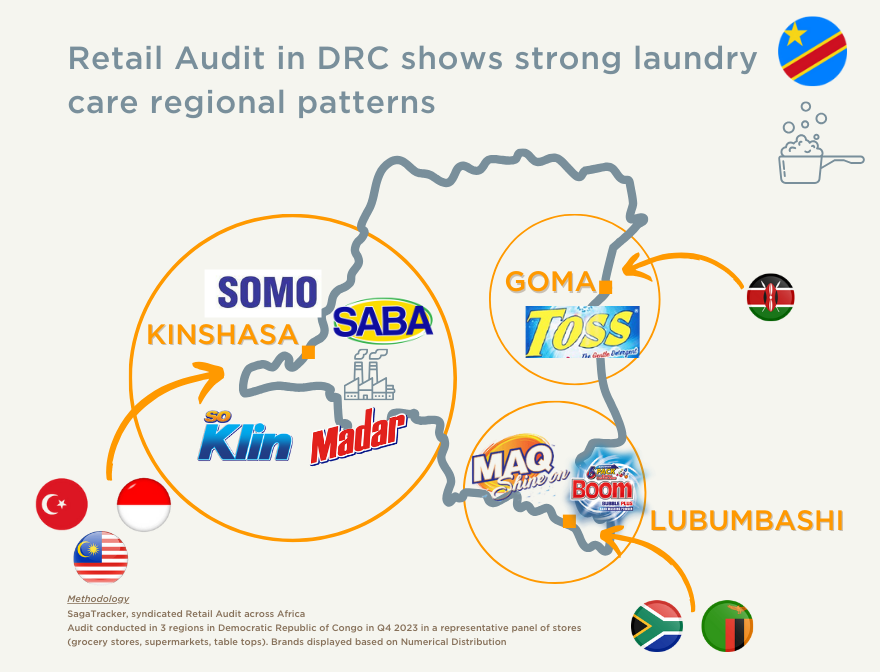

Results from the latest retail audit in DRC / Democratic Republic of Congo, conducted by the Sagaci Research Trade team, shed light on strong regional patterns in supply chain dynamics and sourcing strategies in the country.

Indeed, the vast geography of the country, coupled with deep regional differences hindering cross-regional trade, has led to distinctive retail landscapes in different parts of the country. For instance, in the laundry detergent category, our data show that brands are exclusive to specific regions.

Laundry detergent market leaders in DRC

Although brands Saba and Somo dominate the laundry market in the DRC, collectively commanding nearly half of the market share nationwide, a deeper dive into regional data reveals a more nuanced landscape. While these brands emerge as clear market leaders on a national scale, their dominance varies significantly across different regions within the country.

Regional variations in the laundry market in DRC

When analyzing the numerical distribution of brands within the DRC’s laundry care market, here is what emerges.

- Kinshasa: laundry brands like Somo, Genie, SoKlin, and Madar are only found in the capital city Kinshasa. While some brands are produced locally (eg. Somo, Génie), others come from international groups (eg. Saba, SoKlin both from Indonesia and Madar from Turkey)

- In Lubumbashi the brands most present are Boom and Maq, both imported from Southern markets (respectively Zambia and South Africa)

- In Goma, the brand Toss (from Kenya) is the most prevalent.

These insights highlight how the size and regional differences within the DRC contribute to the emergence of these distinct retail patterns. Understanding localized supply chain dynamics and consumer preferences is crucial for businesses to navigate this diverse market effectively. By adapting sourcing strategies and product offerings to regional nuances, retailers can optimize distribution channels and enhance market positioning. It will ultimately allow them to capitalize on the unique opportunities within each region of the dynamic retail landscape of DRC.

What else can you learn from a retail audit in DRC?

Beyond product checks, our retail tracker in DRC, SagaTracker, captures share of stock, numeric distribution and provides market shares of the key players in the category. Our retail audits in DRC will also include price checks to inform outlet price compliance. All these indicators are critical to assess the true performance of your brands and SKUs at the point of sale. And as we always say, not having retail data is like driving without GPS 😉

SagaTracker to explore the DRC retail landscape

In a nutshell, if you need to monitor your brands in the trade channels in the Democratic Republic of Congo, whether in traditional or modern trade channels, we have the experience, the methodology and the tools to support you.

Finally, if you would like to know more about retail trends in DRC or the laundry market in DRC (or other categories), reach out to us below. Or email us at contact@sagaciresearch.com.

Methodology

SagaTracker, the Retail Tracker in Congo DRC, provides data from on-the-ground measurements in a relevant panel of stores.

Retail audit conducted in Q4 2023 in Kinshasa, Lubumbashi and Goma. Sample: representative panel of stores including grocery stores, table tops and supermarkets.

Along with the Democratic Republic of Congo, our retail tracker is available in minimum 13 markets in Africa. It covers a wide range of FMCG categories from alcoholic and non-alcoholic beverages, cooking ingredients, dairy products, etc.