- 03/05/2022

- Posted by: Janick Pettit

- Categories: Articles, Beauty & Personal Care, Cameroon, Egypt, Ghana, Mali, Morocco, Nigeria, SagaCube, Tanzania

SagaCube: category consumption database in Africa

SagaCube provides a unique insight into personal care consumption in Africa. Our syndicated research tool is a category consumption database covering over 130 sub-categories across 35 African countries. Leveraging our online panel in Africa, it can show detailed data on household consumption habits, equipment ownership and purchase habits.

Taking the example of a FMCG product like bar soap, SagaCube allows you to understand critical metrics for the category:

- Penetration of category consumption or usage: What is the share of the population who used bar soap within the last 4 weeks?

- Frequency of consumption or usage: How frequently do the users of bar soap use it?

- Purchase locations: Where do users buy bar soaps?

- Purchase frequency: How frequently do bar soaps users buy it?

These metrics give a good overview of the category, at total level, but even more so when broken down by key demographics:

- Age

- Income

- Gender

- Location: urban/rural

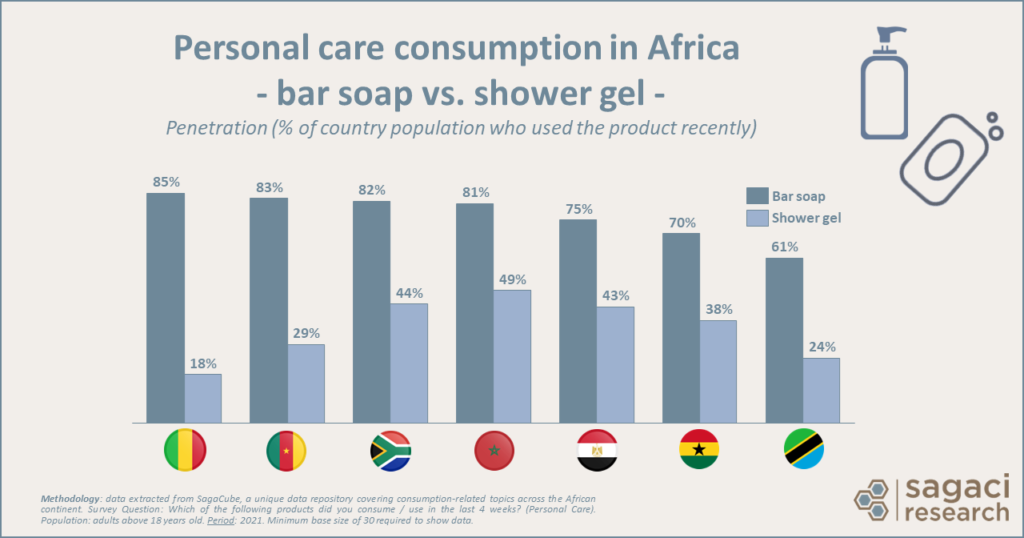

Let’s look into personal care consumption in Africa with the duel bar soap vs. shower gel

First, at the country level with the example of Egypt. The 2021 data from our syndicated research tool SagaCube revealed that Egyptian consumers prefer bar soap over shower gel in the personal care category. Indeed 75% of Egyptians from our online panel in Africa declare having used bar soap in the last 4 weeks. Comparatively, only 43% have used shower gel. When digging deeper into the demographics, some usage profiles start to emerge. For example young Egyptians use less bar soaps than their older counterparts: 67% of the 18-25 age group in Egypt have used bar soaps in the last four weeks compared to 84% of the 46 and above age group. When it comes to shower gel usage, it seems to be clearly more of a thing for female and higher income consumers in Egypt while bar soap usage cuts across all incomes and genders.

What are the trends in personal care consumption in other African countries?

It turns out, bar soap is the clear winner across all surveyed countries and for good reasons. With limited budgets, consumers look for affordable products that can be used for a variety of functions in the home. This is typically the case for bar soap. Depending on the income group, they may use it for a variety of purposes such as cleaning the body, dishes, surfaces and laundry.

Bar soap penetration is particularly high in countries such as Cameroon, Mali, Morocco and South Africa where over 80% of consumers use it. In contrast, shower gel penetration is generally much lower than bar soaps. As low as 18% in Mali and up to 44% in South Africa and 49% in Morocco where we find one of the highest penetration levels.

Generally rural consumers show a higher usage of bar soap than their urban counterparts. Conversely, the share of the population using shower gel is higher in urban settings. In terms of purchase location, shower gel is most often bought in supermarkets while users most often buy bar soaps in kiosks. Some differences occur between countries. For example most consumers in South Africa purchase bar soap primarily in supermarkets and grocery stores.

Read also SagaBrand: Beauty & Personal Care in Senegal

How can our syndicated research tools help you?

Understanding how a particular product category is performing in different countries can help to guide where to invest and how to prioritize your markets. Which country would you like to investigate further among the 35 we track? Read more here on SagaCube. Going one step further, do you want to know how brands are performing in a specific category? This is where SagaBrand, our Brand Health Tracker tool, comes in. Check it out here.

If you have any questions or want to know more about our market research methods in Africa, contact us on contact@sagaciresearch.com or click on the link below.

Methodology

SagaCube, the syndicated category consumption tool across the African continent.

Consumption / usage: Which of the following products did you consume / use in the last 4 weeks? (Personal Care).

Base: All respondents within a country

Population: Adults above 18 years old

Period: 2021