- 25/09/2023

- Posted by: Caitlin Beck

- Categories: Articles, Consumer Goods / FMCG, Household Care, Nigeria, SagaBrand

In this article, we look at how Nigeria’s top laundry detergent Viva Plus collaborates with Planet 3R to recycle plastic packaging. Planet 3R is a social enterprise dedicated to converting textile and plastic wastes into eco-friendly products. They use the 3R ( Reduce, Reuse, Recycle) to save our planet Earth by weaving them into innovative items. Regarding their recent collaboration with Viva Plus detergent, founder and creative director of Planet 3R, Adejoke Lasisi, claims that “each bag has saved up to 180 Viva detergent (400g) sachets from ending up on the landfill”.

Brand collaborations in Nigeria

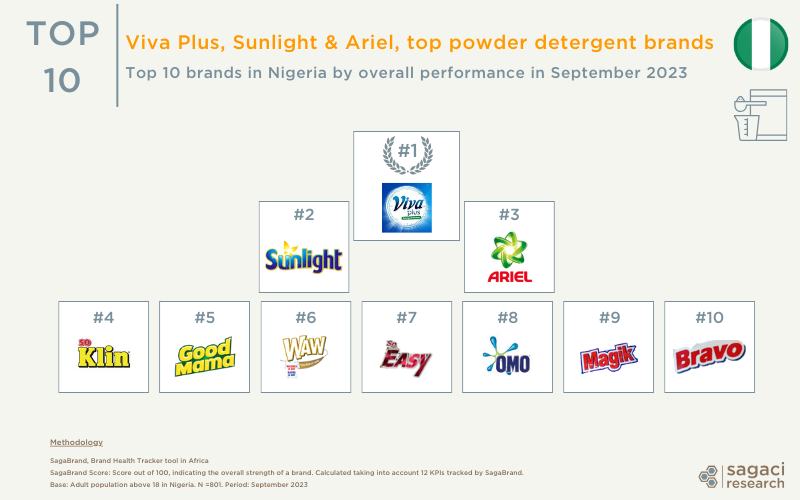

From a data standpoint, Viva Plus seems a great choice for the social enterprise to collaborate with, since the brand ranks #1 overall in Sagaci Research’s Laundry Powder Detergent brand health tracker in Nigeria.

With a 5-point lead over Sunlight (recently discontinued by Unilever in Nigeria) in the SagaBrand score, and 76% of our online panel in Nigeria having ever purchased the detergent, the brand proves a popular choice amongst Nigerians. As such, there is plenty of plastic waste generated by the brand to be considered as part of their corporate social responsibility (CSR) efforts.

In addition to laundry detergent sachets, the Planet 3R project also incorporates used water sachets, and other plastics into their works – providing local jobs and reducing plastic on the streets of Nigeria.

Viva Plus is owned by Aspira Nigeria Limited – one of the largest manufacturers and distributors of personal health care and laundry products in Nigeria. Other brands by Aspira include Fizz, Sabil, Baby & Me, and Oracare+ toothpaste.

Nigeria’s Top 10 laundry detergent in September 2023

SagaBrand scores of Nigeria’s top laundry detergent brands

Below the SagaBrand scores out of 100, indicating the overall strength of a brand. They are calculated taking into account 12 KPIs tracked by SagaBrand.

- Viva Plus – 76

- Sunlight – 71

- Ariel – 68

- So Klin – 63

- Good Mama – 63

- Waw – 59

- So Easy – 50

- Omo – 49

- Magik – 47

- Bravo – 43

If this category is interesting to you, you might also want to check the Brand Health Tracker results from 2021 when we explored the preferred laundry detergent brands in Nigeria.

Should more brands commit to the circular economy?

With the penetration of carbonated soft drinks / sodas at 71% in Nigeria, and 50% of Nigerians stating that they are “taking actions to reduce the amount of plastic purchased or used”, there could be plenty more opportunities for similar collaborations.

Based on Sagaci Research’s continuous brand health tracker, Viva Plus experienced a 21% increase in the total buzz around their brand between January and September 2023. Perhaps as a result of positive noise generated by their collaboration with Planet 3R. Cleverly incorporating their logo into the recycled school bags certainly provides further opportunities to raise awareness of the brand. Also building on its recent innovative Viva Bubbles of Joy Mobile Laundry activation campaign Viva Plus is clearly making waves in the Nigeria laundry detergent market.

So which other brands do you think should be next to get involved in the circular economy?

Methodology

SagaCube, the consumer habit tracker in Africa

Survey Questions: Which of the following beverages did you consume in the last 12 MONTHS? Selected: Carbonated soft drinks / sodas

Survey Questions: Which of the following household care products did you use in the last 12 MONTHS? Selected: Laundry products

Survey Questions: To what extent, if at all, do you agree or disagree with the following statement: “I am taking actions to reduce the amount of plastic I purchase or use”? Selected Strongly agree / Agree

Base: Adult population in Nigeria above 18. N = 3,457 – 12,176

SagaBrand, the brand health tracker tool in Africa

SagaBrand score: Score out of 100, indicating the overall strength of a brand. Calculated taking into account 12 KPIs tracked by SagaBrand.

Base: Adult population in Nigeria above 18. N = 801

Survey questions: Ever purchased – Which of the following brands have you ever purchased?

Base: Adult population in Nigeria above 18, respondents who have ever heard of the brand

Survey questions: Buzz / echo – Which of the following brands have you heard anything about in the last four weeks, through advertising, promotions, news, social media or word-of-mouth?

Base: Adult population in Nigeria above 18, respondents who have ever heard of the brand

Period: January & September 2023

Cover image source: Ibadangirl