- 29/09/2021

- Posted by: Caitlin Beck

- Categories: Articles, Benin, Cameroon, Cote d'Ivoire, Egypt, Financial Services, Kenya, Nigeria, Online Panels, SagaBrand, Sagaci Insights, Senegal, South Africa, Uganda, Webinars

Event summary

On Thursday 23rd September 2021, we hosted our Financial Services in Africa webinar. Our product and research teams took an in-depth look at how consumer habits and attitudes are shaping the industry across the continent.

Please note that our sample only takes into account respondents with access to a mobile phone with internet. For more information about the methodology, please contact us.

Key themes and topics – Financial Services in Africa

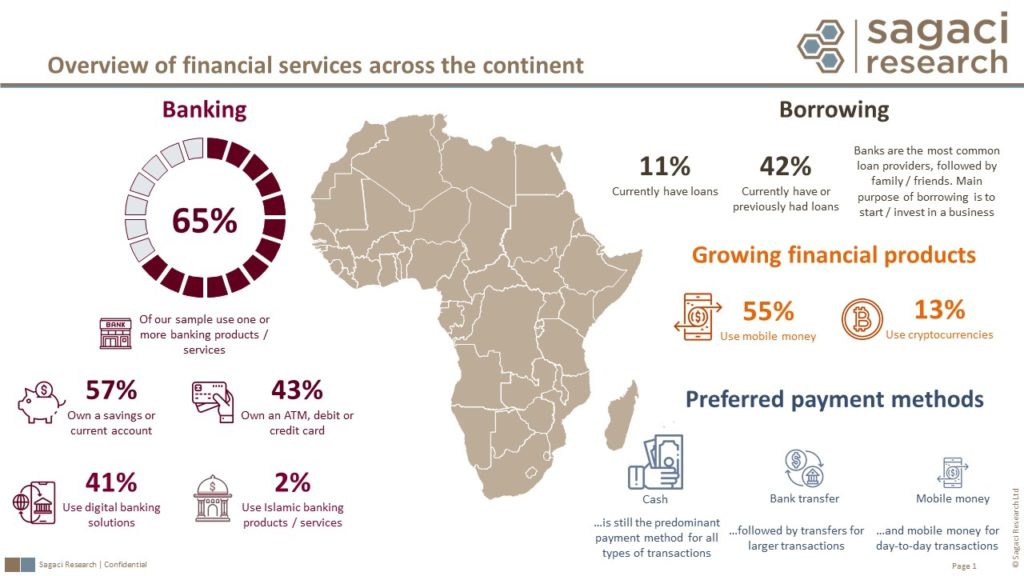

Overview of financial products and services

- Sagaci Research methodology

- Bankarization levels across Africa

- Penetration of credit cards and savings / current accounts

- Online banking usage

- Digital solutions in Kenya

- Financial institution choice drivers

- Islamic banking

- Borrowing habits – including differences between the penetration, purpose and source of borrowing

- Mobile money

- Cryptocurrency

- Payment methods

Overview of leading financial service brands in Kenya, Nigeria and South Africa

- Sagaci Methodology – SagaBrand

- Brand Awareness

- Brand Satisfaction

Interested to know more?

Contact us at sales@sagaciresearch.com for more information about how our data can help your business.

Related topics

Satisfaction across Financial Services in South Africa: Find previous SagaBrand rankings, showing how Capitec has maintained it’s reputation over time

Our syndicated brand-health tracker also provides data to show which brands consumers would recommend or avoid. Check out below how brands are performing in Nigeria and Côte d’Ivoire:

Recommended financial services brands in Nigeria

Financial Services in Ivory Coast

Show me the money: Sagaci Research survey finds high level of financial literacy in nine African countries: In a late 2020 study, we found that 75% of respondents demonstrated basic financial literacy