- 22/09/2025

- Posted by: Janick Pettit

- Categories: Articles, Non-alcoholic beverages, SagaCube

Juice consumption in Africa deserves close attention, as it ranks among the top beverages on the continent according to a recent Sagaci Research survey.

The survey draws on responses from more than 53,000 consumers across all 54 African countries through our proprietary pan-african online panel and the consumption tracker SagaCube. It explores everyday drinking patterns, what, when, where, and with whom people consumed beverages yesterday. It then goes further to uncover the underlying motivations, the ‘why’ behind those choices.

These need states are key to understanding consumer behaviour and unlocking growth opportunities in the African beverage market. In this report today, we focus specifically on juice consumption and the insights that matter most for juice brands in Africa.

Juice, among the most consumed beverages in Africa

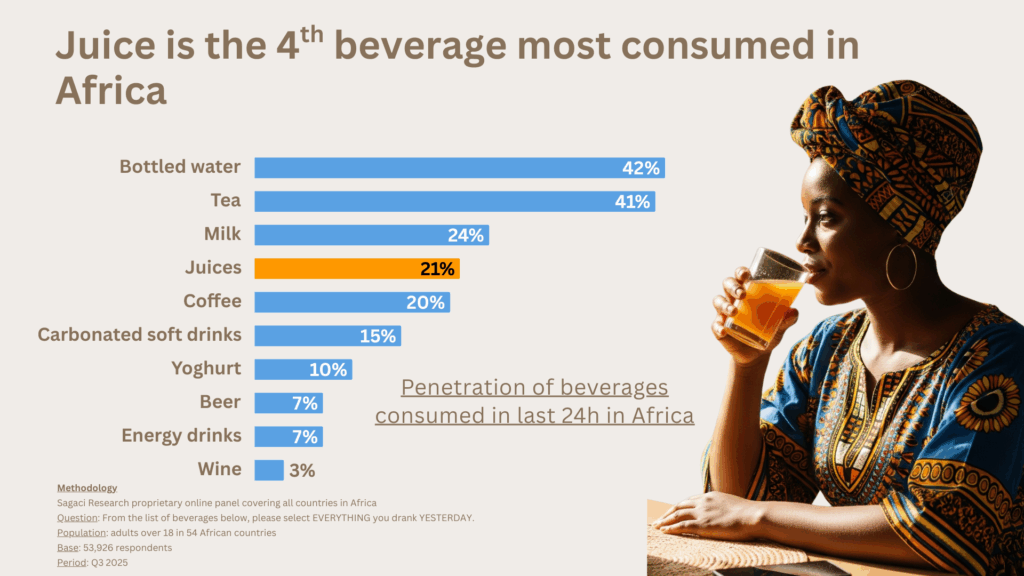

Across alcoholic and non alcoholic drinks, juice places fourth in Africa with 21% of reported occasions. It sits behind bottled water 42%, tea 41%, and milk 24%, and ahead of coffee 20%, carbonated soft drinks 15%, yoghurt 10%, beer 7%, energy drinks 7%, and wine 3%.

Where is juice consumed the most across Africa?

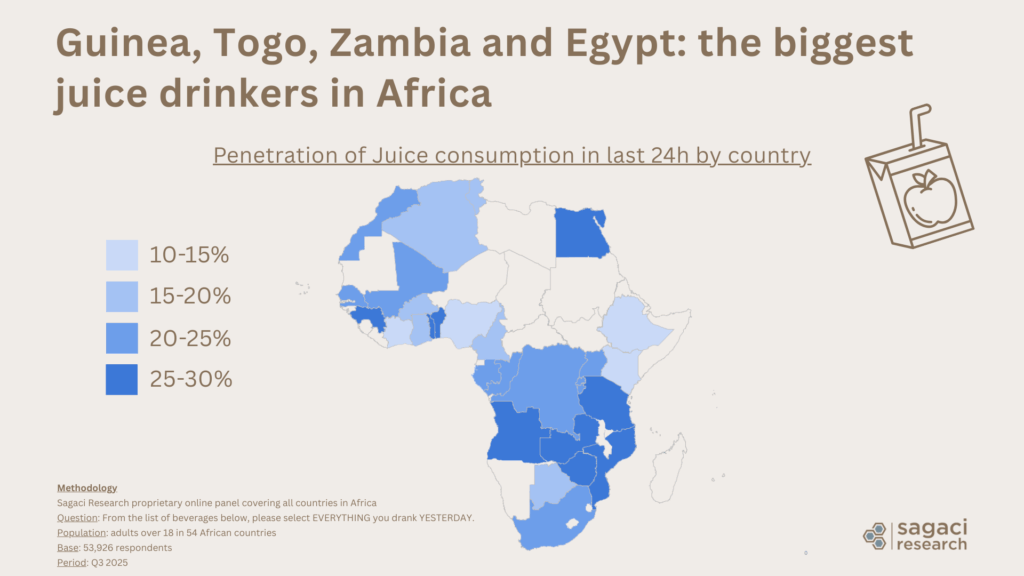

While one in five respondents across the continent reported drinking juice the previous day (21%), the study highlights significant differences in penetration by region and country.

Juice consumption is strongest in parts of East and Southern Africa (e.g., Zambia with 30%, Tanzania 29%, Uganda 27%) and in markets like Togo (30%), Guinea (30%) or Egypt (29%). By contrast, it is noticeably lower in Nigeria (14%), Kenya (13%), and several North and West African markets.

What does this mean for juice brands? In higher consumption markets, brands should deepen their portfolios with wider pack variety and bold flavour innovations to keep juice top of mind and increase frequency. In lower consumption markets, the priority would be to win share from other non alcoholic beverages by positioning juice as an accessible, refreshing, and versatile alternative through the right price points, stronger distribution, and clear communication of its benefits.

Favourite juice flavours and packaging in Africa

Across Africa, the leading juice flavours are orange (18%), mango (14%), and pineapple (13%). These are followed by multifruit / tropical blends, then apple and passion fruit. Hibiscus, also known as bissap, ranks only 12th at the continental level, yet it holds a stronger position in parts of West Africa, rising to 6th place in Côte d’Ivoire and 7th in Senegal.

When it comes to packaging, consumer preferences are clear. Plastic bottles dominate with 35% of consumers choosing this format, followed by cartons such as Tetra Pak or box (19%), glass bottles (16%), and cans (15%). These results underline the importance of practical and widely available packaging, with plastic bottles and cartons setting the standard for the African juice market.

Understanding juice consumption occasions in Africa

To grow in the African juice market, brands need to know where, when, and with whom consumers drink juice. These insights highlight the key occasions that shape demand and guide strategies on packaging, pricing, and marketing.

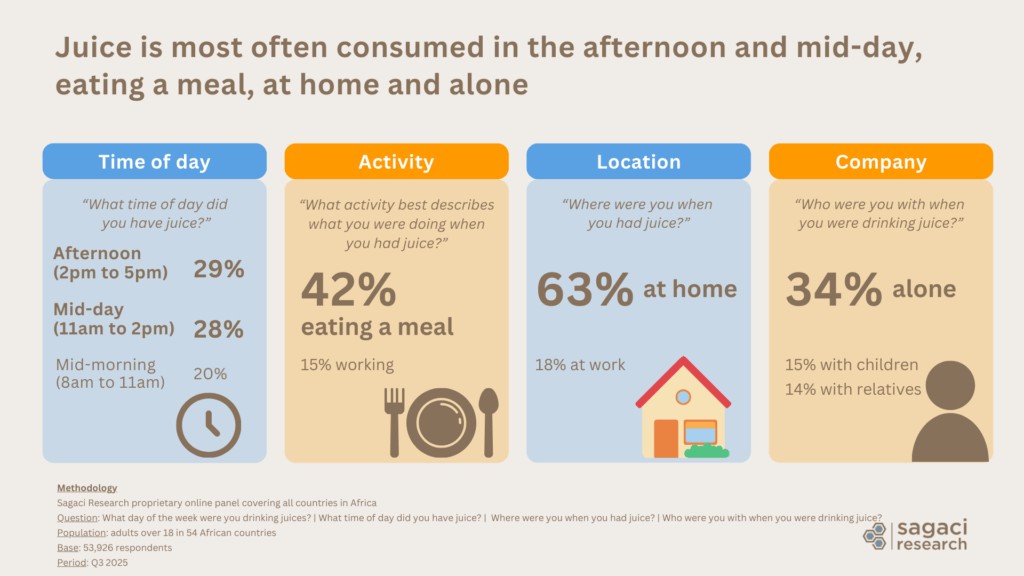

Where do African consumers drink juice?

Juice consumption in Africa takes place mainly at home, representing nearly two thirds of all occasions (63%). The workplace follows as the most important secondary setting (18%), which highlights opportunities for convenient formats and single serve packs that fit into busy work routines. Out of home occasions are also meaningful, with juice consumed in eating and drinking establishments in 8% of cases, while on the go 8%, or at leisure destinations 6%.

This shows that juice in Africa plays a dual role: mostly a household staple for family meals but also an accessible refreshment outside the home. For juice brands, the implication is clear: strengthen in home consumption with larger family packs while also targeting workplace and leisure moments with affordable single serve options and impulse purchase availability in retail and convenience channels.

When do African consumers choose juice?

Juice is primarily a daytime beverage, most often consumed in the afternoon (29%) and at midday (28%). This timing aligns with lunch, which is the leading mealtime for juice occasions, followed by dinner and breakfast. Beyond mealtimes, juice also fits into leisure moments (17%), work breaks (15%), and everyday routines or socializing (11% each).

Friday stands out as the peak day for juice consumption (17%), making it a useful cue for retail promotions and activation calendars. Overall, juice remains versatile across contexts but is most strongly anchored to food occasions, especially lunch.

Who African consumers drink juice with?

Juice is most often consumed alone (34%), making it a personal refreshment choice. Still, shared moments matter, with family and partner occasions each representing around 15% of consumption. For juice brands, this underscores the need to position juice as both a trusted mealtime companion at home and a convenient option for individual, everyday routines.

Main drivers of juice consumption in Africa

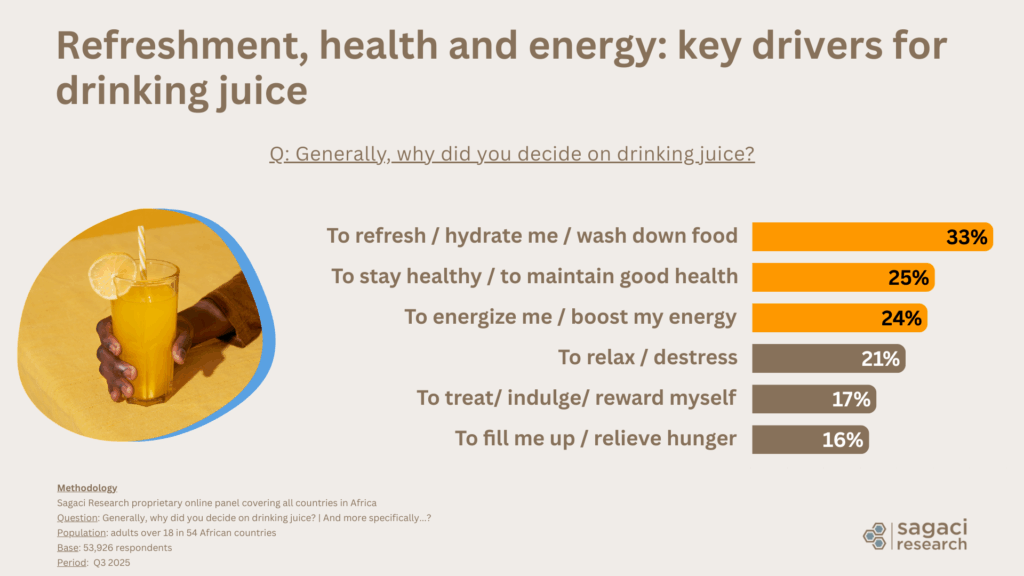

Juice consumption in Africa is driven by three core needs states. The top reason is refreshment and hydration, followed by health and energy.

Within each driver, consumers cite more specific motivations that guide choice.

- To refresh or hydrate me or wash down food (33%)

- To help relieve thirst or quench my thirst (33%)

- To make me feel refreshed physically or mentally (31%)

- To cool me down with a refreshing effect (30%)

- To stay healthy and maintain good health (25%)

- It helps me stay healthy overall (47%)

- To provide essential vitamins, minerals, and nutrients (39%)

- To aid in digestion (25%)

- To energize me and boost my energy (24%)

- To give me an energy boost / a ‘pick me up’ (52%)

- To provide me with sustained long lasting energy (35%)

- To get me going for the day (27%)

In the African juice market, these need states translate into clear positioning territories. By emphasizing hydration and refreshment, showcasing vitamin and nutrient benefits, and communicating natural energy cues, juice brands can attract consumers and capture share from other non alcoholic beverages.

Unlocking growth in the African beverage market with Consumer Insights

Juice in Africa is above all a mealtime companion, most often consumed alone, at lunch and chosen primarily for refreshment, hydration, and energy.

To fully understand the African beverage market, explore our complementary tools, each providing a different layer of insight. The Beverages Need States survey captures consumption occasions, needs states across countries. SagaBrand tracks how juice and competing beverages perform in terms of brand health and equity, and can, for example, identify the top juice brands in Africa. SagaProduct delivers SKU level data on pack formats, pricing, and availability, while SagaCube can profile juice consumers through detailed consumption tracking.

Together, these tools give brands a complete view of the category and the levers needed to drive growth.

Contact us to explore the full data and uncover opportunities for your beverage portfolio.

Methodology

Beverage needs states survey leveraging Sagaci Research proprietary online panel covering all countries in Africa + SagaCube consumption tracker.

Questions:

- From the list of beverages below, please select EVERYTHING you drank YESTERDAY.

- From the list below, which one is your preferred juice flavour?

- What day of the week were you drinking juices?

- What time of day did you have juice?

- Where were you when you had juice?

- Who were you with when you were drinking juice?

- Generally, why did you decide on drinking juice? And more specifically…?

- From the list below, which one is your preferred juice flavour?

- What is your preferred packaging type when buying juices?

Population: adults over 18 in 54 African countries

Bases: 53,926 respondents (except Flavour question n = 27,179 and Packaging question n = 61,636)

Period: Q3 2025

Feature image: © wayhomestudio