- 13/08/2024

- Posted by: ilana.czerwinski

- Categories: Alcoholic beverages, Articles, Beauty & Personal Care, Beer, Consumer Goods / FMCG, e-commerce, Nigeria, Non-alcoholic beverages, Online Panels, SagaCube, Social media and communication, Supermarkets

Uncover the key influences and consumption trends of Gen Z in Nigeria with SagaCube, Africa’s leading consumer habit tracker. Thanks to our online panel in Nigeria, we examine specifically the preferences of Nigerian male consumers aged 18 to 25 from the highest social classes (SEC AB). This analysis, which compares their behaviours with those of men aged 26 and above, reveals unique trends that highlight these young men shopping habits, social media use and their lifestyle choices.

Trends among the Gen Z in Nigeria: more likely to go to physical shops and use cash

Male Nigerian consumers aged 18-25 exhibit different shopping behaviours compared to older ones. A significant 58% of them would rather go to a shop than buying products online versus 47% of the older group. This result stems from young people’s preference for a physical experience; they want to visit stores, see the product firsthand, and make their choice in person. Additionally, 26% of these younger consumers prefer using cash, a higher percentage than the 16% observed in the 26+ demographic.

In contrast, older consumers are more inclined to use debit cards, with 41% opting for this payment method compared to 29% of the younger age group. Following recent banking issues in Nigeria, younger people now prefer to keep physical cash on hand for added security and to avoid potential problems.

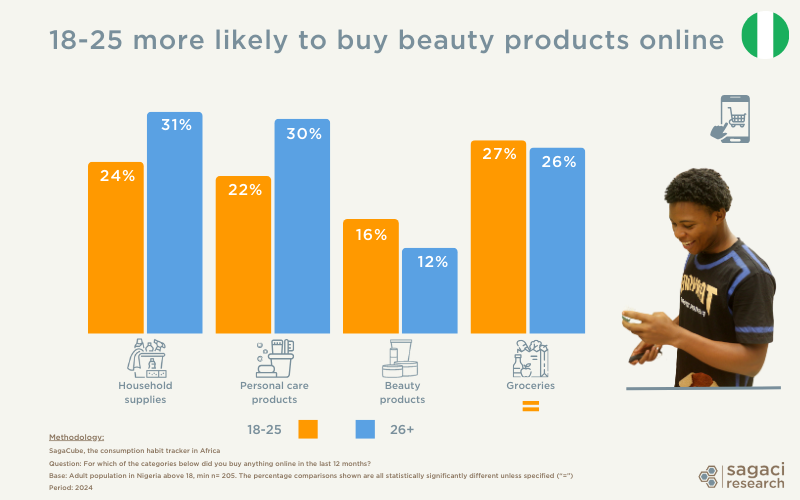

Nigeria Gen Z online purchasing behaviour

While younger consumers generally favour shopping in-store, they are more inclined to purchase certain items online, such as beauty products, with 16% of the 18-25 age group buying them online compared to 12% of the older group.

On the other hand, those aged 26 and above are more likely to use the internet for buying household supplies (31% vs. 24%) and personal care products (30% vs. 22%).

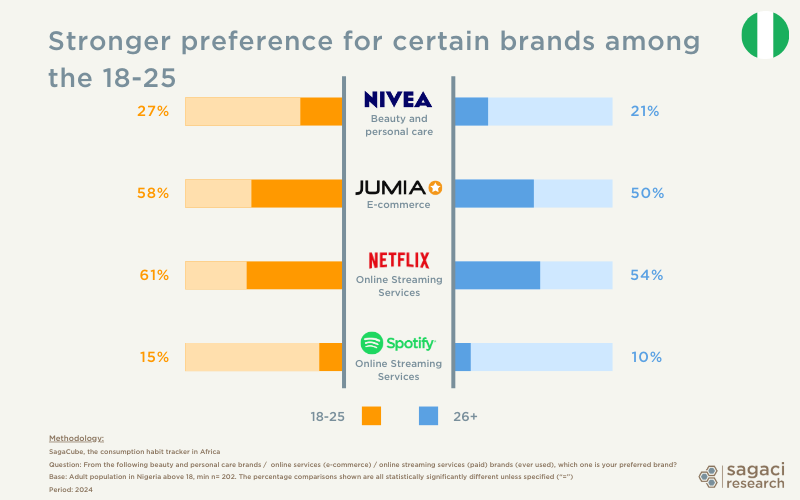

Nigeria Gen Z’s favourite brands

While beauty products are most often purchased online by the male Gen Z, the brand Nivea is among the top choices within this age group. While it was recently ranked as the leading beauty brand in Africa, it is also particularly favoured by younger Nigerian males, with 27% preferring it compared to 21% of older consumers.

When it comes to online services, the following brands stand out among young Nigeria consumers.

- Jumia: More popular among the 18-25 age group (58%) compared to those 26+ (50%)

- Netflix: The most popular online streaming platform widely used by both age groups, but it is more prevalent among the younger group, with 61% usage compared to 54% among the older group.

- Spotify: Preferred by 15% of Nigerians aged 18-25 as their music platform of choice (compared to 10% in older groups).

The impact of advertising and celebrity partnerships

For brands, advertising presents a valuable opportunity to attract more customers and particularly younger ones. Among Nigerian male youth, 73% report that advertising influences their purchasing decisions, compared to 68% of those aged 26 and above.

In response, some brands in Nigeria have leveraged this influence by collaborating with popular celebrities like Burna Boy and Davido, who have strong appeal among young audiences. For example, Burna Boy has partnered with carbonated soft drink Pepsi and Star Beer (by Nigeria Breweries). Similarly, Davido has teamed up with snack brand Munch It (by a JV between Kellogg’s and Tolaram) and laundry care brand Viva, further enhancing their brands’ visibility and connection with this key demographic.

The social media habits of young Nigerians

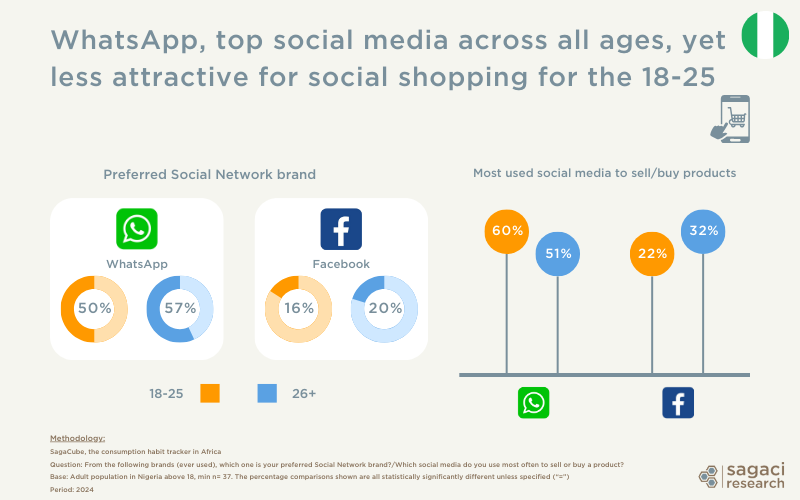

Examining media habits reveals how younger and older Nigerians differ in their use of popular social media platforms.

- WhatsApp: While it remains the favourite social media platform across all ages, including 18-25, it is used more by the older group (57% vs 50%). However, the younger group is more likely to use the platform for social shopping, with 60% engaging in this activity compared to 51% of those aged 26 and older.

- Facebook: It is the second most preferred social media for 16% of the Nigerian Gen Z consumers (vs. 20% for others). Conversely, the platform is used more for social shopping by 32% of the older group (vs. 22% for the younger one).

Explore more about how young Africans engage with Social Commerce in this analysis.

A shift in beverage consumption among Nigeria’s youth?

There is a notable difference in beverage consumption between younger and older consumers in both alcoholic and non-alcoholic categories. However, exceptions exist: both groups show identical preferences for bottled water at 36%, and for champagne and cider, with both age groups reporting 17% and 6% consumption, respectively.

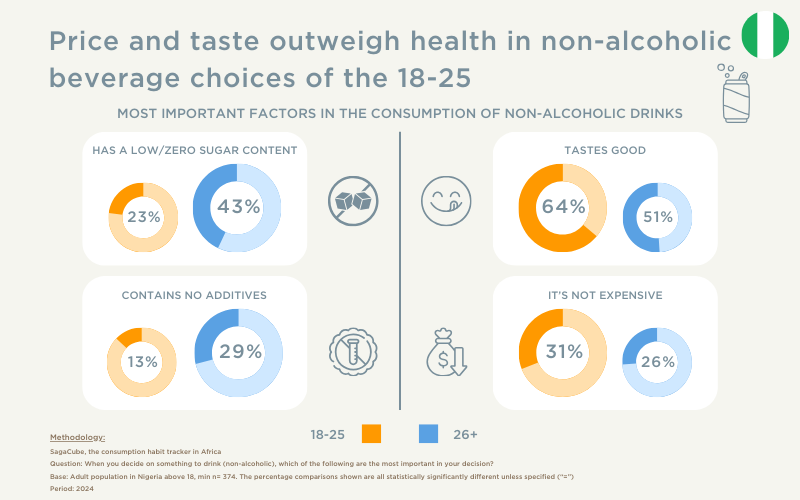

When choosing non-alcoholic drinks, younger and older Nigerian consumers also prioritise different factors.

For the 18-25 age group:

- taste is the top priority for 64% (vs. 51% of the 26+ group),

- 31% consider cost important (compared to 26% of older consumers).

In contrast, older consumers focus more on health, with 43% prioritising low or zero sugar and 29% avoiding additives, while only 23% and 13% of the younger group share these concerns.

These results suggest that while younger consumers are more driven by flavour and price, older consumers are more focused on health-conscious choices.

Environmental impact and life perception among Nigerian Youth

Survey data indicates that Nigerian males aged 18 to 25 are less worried about their environmental impact. Indeed, 75% express concern compared to 82% for older males.

They are also less optimistic about their future, with 25% worried about unemployment versus 14% of those aged 26 and older. This concern likely reflects the current economic challenges in Nigeria, which have recently intensified with protests over the rising cost of living.

Leveraging online market research in Africa

These insights come from SagaCube, the African consumer profiling tool. It spans over 140 categories across 26+ countries, encompassing 400+ usage & attitude variables and thousands of brands.

SagaCube is leveraging our representative online panel in Africa, SagaPoll. Mobile based, it ensures deep reach and fast turnaround times. It enables us to reach thousands of highly engaged respondents across the continent, providing comprehensive insights into consumer attitudes and behaviour across all African countries. This allows us to deliver detailed answers to virtually every consumer related question, with results available within a few days.

To conclude, for more insights on consumer behaviour in Nigeria or conducting online market research in Africa, please send an email to contact@sagaciresearch.com. Or simply click below.

Methodology

SagaCube, the consumer habit tracker in Africa. Here it compares Nigerian male 18 to 25 from SEC AB (target group) with Nigerian male aged 26+ also from SEC AB (control group).

The data comparisons shown in the report indicate significant statistical differences.

Base: Adult population above 18 in Nigeria.

Representative sample with mini N = 37 for 18 to 25 (Target Group) | mini N = 173 for 26+ (Control Group)

Period: 2024