- 25/04/2025

- Posted by: flore.demaigret

- Categories: Articles, Household Care, SagaBrand, South Africa

Laundry brands in South Africa are a staple in households across the country, with consumers often placing high value on quality, scent, and affordability. In a market where both global and local players compete for attention, understanding which brands resonate most is key for marketers and manufacturers. To understand which laundry brands in South Africa are leading the way, we analyzed results from SagaBrand, our continuous brand health tracker, based on answers from hundreds of SagaPoll panel members. Based on this consumer feedback, the article identifies which laundry brands are rated highest for quality perception.

What are the most popular laundry brands in South Africa?

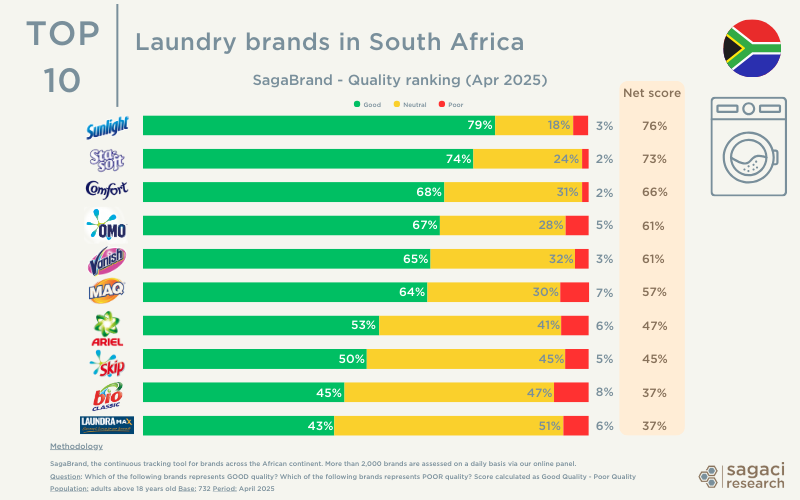

The results of a recent online survey, conducted in early April with over 760 South African consumers, highlight the leading laundry brands in the market based on their Quality Score, a metric calculated by subtracting the percentage of ‘Poor Quality’ ratings from those rated as ‘Good Quality’.

Here is the full ranking of laundry brands based on Quality score, according to South Africans:

- Sunlight (by Unilever)

- Sta-Soft (by Colgate-Palmolive)

- Comfort (by Unilever)

- Omo (by Unilever)

- Vanish ( by Reckitt Benckiser)

- Maq (by BlissBrands)

- Ariel (by Procter & Gamble)

- Skip (by Unilever)

- Bio Classic (by ClassicClean)

- LaundraMax (by KT Wash)

Sunlight: South Africa’s leading laundry brand and FMCG powerhouse

Sunlight leads the pack with an impressive 76% Quality Score. The brand’s 79% ‘Good Quality’ rating and minimal 3% ‘Poor Quality’ rating demonstrate its widespread appeal. Its reputation goes beyond laundry detergent. In South Africa, Sunlight bar soap is a household essential, used not only for clothes but also for dishes and even bathing. Consumers consider it versatile, cost-effective, and highly effective, especially among lower-income households where price sensitivity is high. This multi-purpose use and strong penetration at the bottom end of the market contribute significantly to its top ranking.

Comparing global laundry brands in South Africa: winners and surprises

In the competitive South African laundry market, global brands are making significant strides, with Unilever leading the charge. Four of its brands—Sunlight, Comfort, Omo, and Skip—dominate the top 10 quality rankings, showcasing the company’s stronghold on consumer preferences. While other local and global players contribute to the market landscape, it’s the international giants like Unilever, Procter & Gamble and Reckitt Benckiser that continue to shape the narrative, with brands like Ariel and Vanish also securing strong positions. However, despite their dominance, there are some unexpected insights into their performance, revealing both strengths and surprising gaps in consumer perception.

- Sta-Soft and Comfort, both positioned as fabric softeners, enjoy strong positive perception. While Comfort ranks slightly below Sunlight in terms of negative quality feedback, Sta-Soft actually outperforms Comfort in overall score, thanks to a higher number of “Good” quality ratings. This may be attributed to brand loyalty or price point perceptions, where Sta-Soft is seen as offering good value.

- Omo, Unillever’s targeted stain removal offering, holds a decent position, but its relatively higher percentage of poor quality ratings is surprising. Given its price and heritage, it may typically be expected to perform better.

- Ariel, often seen as a direct competitor to Omo and Skip, shows a more split perception with similar numbers of “Good” and “Neutral” quality responses. This split lowers its net score compared to Omo while on par with Skip, and may indicate a lack of clear positioning in the market.

- Vanish, widely known for bleach and stain-removal effectiveness, delivers a solid quality rating. Consumers likely associate its strong results on tough stains with high perceived efficacy.

Local players are gaining ground

It’s not just multinationals in the race. Local brands like Maq and LaundraMax are steadily carving out space in the consumer’s basket. Maq, a local South African brand with over 20 years in the market, is well-known for its affordable prices and wide availability. Maq has also built a strong reputation with a diverse product range that spans from laundry detergents to other household cleaning products. Impressively, it achieves a higher quality score than Ariel!

What this means for laundry brands in South Africa

The laundry detergent market in South Africa is diverse and highly competitive. From premium international brands like Ariel and Vanish to versatile staples like Sunlight and value-driven local brands, there’s a wide spectrum of quality perceptions and consumer loyalties.

These insights, powered by SagaBrand, offer a detailed view into how consumers in South Africa evaluate laundry products — helping brands understand where they stand and where opportunities lie.

We regularly publish similar insights on other key African markets. For example our analysis of the Top 10 laundry brands in Ivory Coast highlights local consumer preferences and brand performance.

If you would like further insights on the detergent category or more generally on home care brands in South Africa based on our online panel in South Africa, please send an email to contact@sagaciresearch.com or click below.

Methodology

This analysis is powered by SagaBrand, the continuous tracking tool for brands across the African continent. Our online panel assesses around 2,000 brands on a daily basis.

- Question: Which of the following brands represents GOOD quality? Which of the following brands represents POOR quality? Score calculated as Good Quality – Poor Quality.

- Base: 732

- Population: adults in South Africa above 18 years old

- Period: April 2025