- 05/11/2024

- Posted by: Janick Pettit

- Categories: Articles, Beauty & Personal Care, Consumer Goods / FMCG, DR Congo, SagaBrand

Deodorants in DR Congo (Democratic Republic of Congo) have seen a 33% surge in usage over the past three years according to consumption tracker SagaCube. This reflects the growing consumer demand for personal care products in the country. Deodorants are becoming an essential part of daily routines, especially among women, driving fierce competition between local and global brands to capture this expanding market.

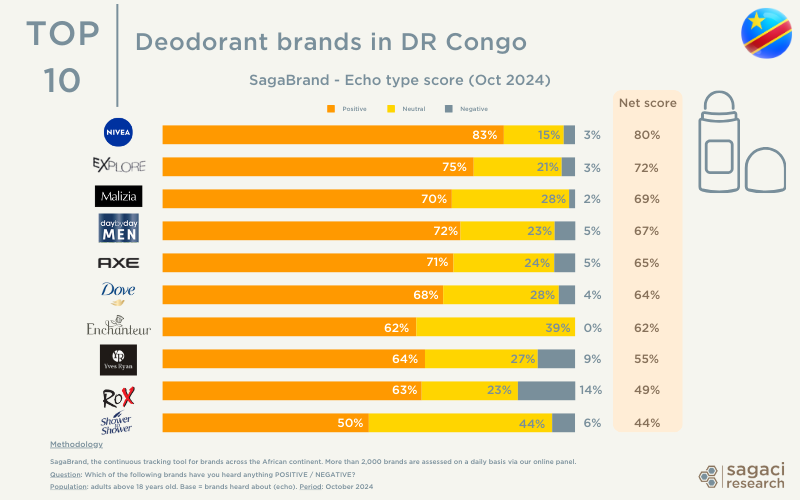

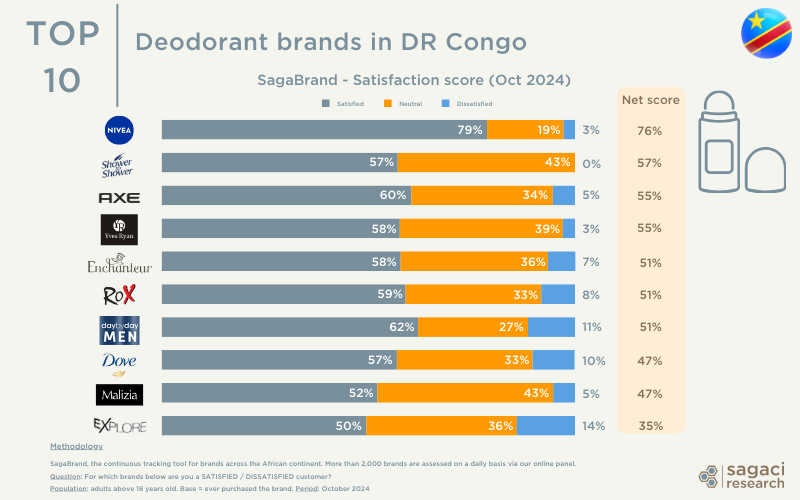

Using the SagaBrand Brand Health Tracker we assess the top deodorant brands in DR Congo, including Nivea, Axe, and Dove, across key performance indicators like brand awareness, quality perception, and consumer satisfaction, among the 25 metrics we track. This analysis provides a detailed look at each brand’s unique standing in the DRC deodorant market, uncovering strengths and areas for improvement that reveal how these brands resonate—or miss the mark—among local consumers.

The top deodorant brands in DR Congo on Perceived Quality

Below is a list of the top deodorant brands in the Democratic Republic of the Congo, ranked according to their quality score. This score is derived by subtracting the percentage of respondents who rated a brand as poor quality from those who rated it as good quality, based on their awareness of the brand. This metric effectively captures the public’s perception of each brand, regardless of whether they have personally used the product.

- Nivea (by Beiersdorf) – Quality score 85%

- Axe (by Unilever) – 71%

- Dove (by Unilever) – 70%

- Yves Ryan – 58%

- Explore (by Fragrance World from the UAE) – 53%

- Malizia (by Mirato from Italy) – 52%

- Shower to Shower (by Amka from South Africa) – 49%

- Day by Day (by Dream Cosmetics from Côte d’Ivoire) – 47%

- Rox (by Noble Group from Angola) – 44%

- Enchanteur (by Wipro Unza from Malaysia) – 43%

Nivea: The leading deodorant brand in DR Congo

In the competitive deodorant market of DR Congo, Nivea holds the top position, standing out as the most popular deodorant among consumers. With 56% brand awareness and a high 74% purchase rate, Nivea maintains a solid lead in visibility and loyalty. Additionally, its quality score of 85% (among respondents aware of the brand) and high consumer satisfaction (76% who have purchased the brand rating it as good quality) further reinforce its reputation. Nivea’s strong echo score (80% have heard about the brand in L4W), combined with only 3% negative feedback, underscores why it remains one of the best deodorants in DR Congo.

Axe: A trusted choice but with moderate reach

Axe’s brand awareness stands at 27%, indicating a need for improved visibility in the DRC deodorant market. Despite a 68% purchase rate among consumers aware of the brand, the decline to 45% in recent purchases suggests challenges in customer retention. Its quality score of 71% reflects a generally positive perception, but the high neutral satisfaction score of 34% highlights the potential for improvement. Additionally, while 71% of consumers have a positive echo towards Axe, converting neutral feedback into recommendations is essential for enhancing brand loyalty. Overall, focused marketing efforts are needed to boost awareness, satisfaction, and consumer engagement for Axe in the DRC.

Dove: Moderate awareness with opportunities for improved customer loyalty

A brand awareness of 39% and a purchase rate of 58% indicates moderate visibility and interest for Dove in the DRC deodorant market. Its recent purchase rate of 48% also highlights challenges in retaining customers. However, the quality score of 70% reflects positive perceptions, yet a 32% neutral satisfaction score points to potential dissatisfaction or lack of interest among consumers who have used the brand. With 53% of consumers expressing a positive echo, Dove might have an opportunity to enhance brand loyalty and strengthen its position in the market.

Niche deodorant brands in DR Congo

Among the other popular deodorant brands in DR Congo, Day by Day from Côte d’Ivoire stands out with a notable 43% brand awareness (2nd behind Nivea) and a strong purchase rate of 61%, indicating solid consumer interest. Its recent purchase rate of 65% also suggests effective retention strategies. However, with a quality score of 47% (and a very high 10% in Poor Quality), there is room for improvement in brand perceptions. Other brands like Explore and Malizia show moderate awareness at 25% and 30%, respectively, but face challenges with lower satisfaction levels. Overall, these smaller brands have growth potential by enhancing quality perceptions and increasing consumer engagement in the DRC market.

More on Personal Care in DR Congo

The personal care sector is one of the FMCG categories that we monitor with our Brand Health Tracker in Congo. This is a sector we often explore, either in specific countries like here in Congo or recently in Kenya with Body lotion or across Africa. If you’re interested in tailored insights from our online panel in DR Congo or want to know more about Africa personal care market trends, please reach out to us at contact@sagaciresearch.com.

Methodology

- SagaBrand, the continuous tracking tool for brands across the African continent. Our online panel in Africa assesses around 2,000 brands on a daily basis.

– Awareness: Which of the following brands have you ever heard of? Base = all respondents

– Quality: Which of the following brands represents GOOD / POOR quality? Base = respondents aware of the brand. Quality score is calculated by subtracting Poor quality ratings from Good quality ratings

– Satisfaction: For which brands below are you a SATISFIED / UNSATISFIED customer? Base = ever purchased brand. Satisfaction score is calculated by subtracting Unsatisfied ratings from Satisfied ratings.

– Echo type: Which of the following brands have you heard anything POSITIVE / NEGATIVE about in the last four weeks? Base = brands heard about (echo)

Population: adults above 18 years old in Congo DRC

Period: October 2024

- SagaCube, the consumption habit tracker in Africa

Annual capture of deodorant consumption in the last 4 weeks in Congo DRC from 2021 (31%) and 2024 (41%)