- 30/07/2024

- Posted by: ilana.czerwinski

- Categories: Articles, Consumer Goods / FMCG, e-commerce, Online Panels, SagaCube, Social media and communication

In recent years, social commerce in Africa has been emerging as a significant driver in the digital economy on the continent. Social commerce involves using social media platforms to promote and sell products directly within the apps. To expand their services and revenue, platforms have integrated native shopping solutions like Facebook Shops and Instagram Shops, which act as online stores, and peer-to-peer sales such as Facebook Marketplace.

African social media users have embraced this new shopping channel, but to what extent? Which platforms are most popular, and which product categories dominate these channels? A recent SagaCube report, leveraging the SagaPoll online panel in Africa, explores African consumers’ usage of social media platforms for commerce.

Social commerce penetration in Africa

Most African survey respondents use social media weekly, with WhatsApp and Facebook leading at 90% and 84% respectively.

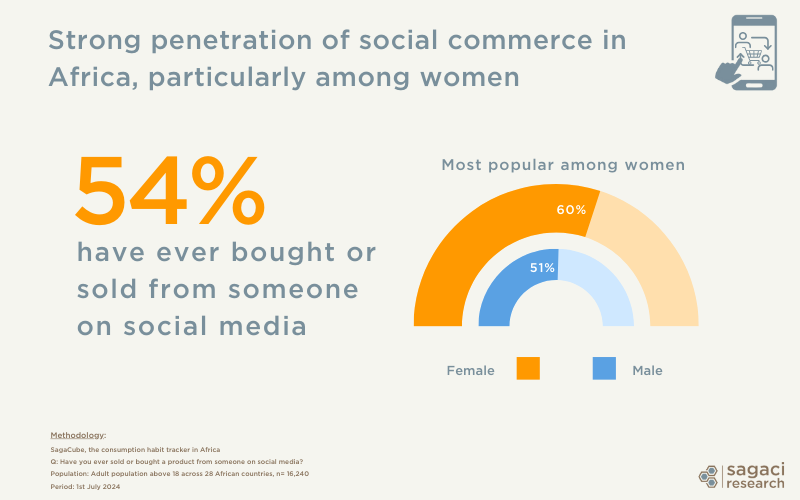

Social commerce penetration is also significant, as 54% of social media users have bought or sold products at least once.

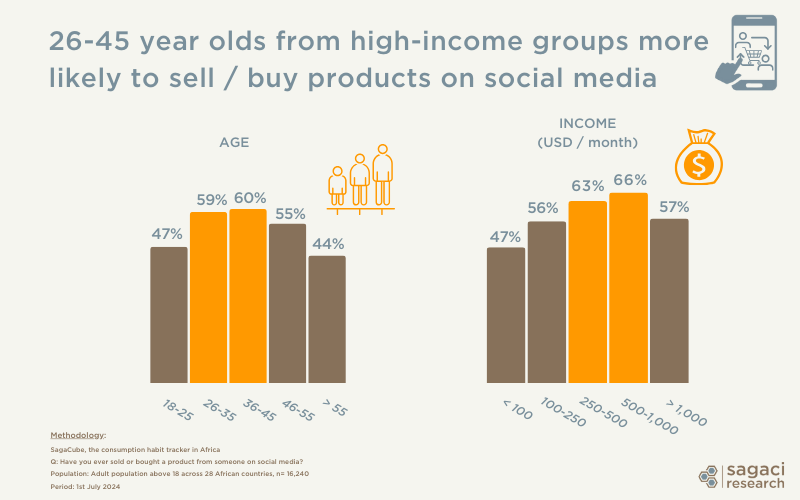

Usage of social commerce is notably higher among women, individuals aged 26 to 45, and higher earners.

Social commerce penetration varies across Africa, with Anglophone countries leading. The highest rates are observed in Nigeria (69%), Zimbabwe (66%), Kenya (65%), and Zambia (62%).

Top social media apps for social shopping in Africa

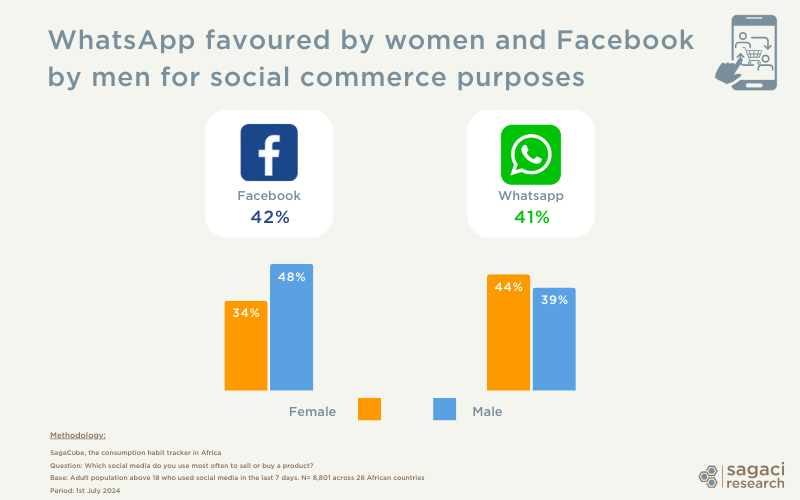

The survey reveals that WhatsApp and Facebook are not only the top social media platforms in Africa but also the most popular for social commerce.

Ranking of the most popular social commerce platforms

- Facebook: As one of the oldest and most popular social media platforms, it is used by 42% of social media users for social commerce. Combining social networking with a robust marketplace, it connects communities and supports buying and selling. Men show a higher preference, with 48% using it for social commerce compared to 34% of women.

“I’ve been buying a lot of items online in Facebook even spare parts of my car”

SagaPoll member, July 2024

- WhatsApp: This popular Meta-owned app is now used by 41% of users for buying and selling products. Recently, it introduced a Channels feature that allows businesses and individuals to broadcast updates—text, photos, videos, and polls—to an unlimited audience, boosting its social commerce capabilities. Notably, 44% of women prefer WhatsApp for social commerce compared to 39% of men.

Aside from the leading platforms, Instagram (photo and video sharing), TikTok (short videos), and Telegram (messaging) lag significantly in social shopping, with usage rates of just 7%, 5%, and 2%, respectively.

The African e-commerce trends

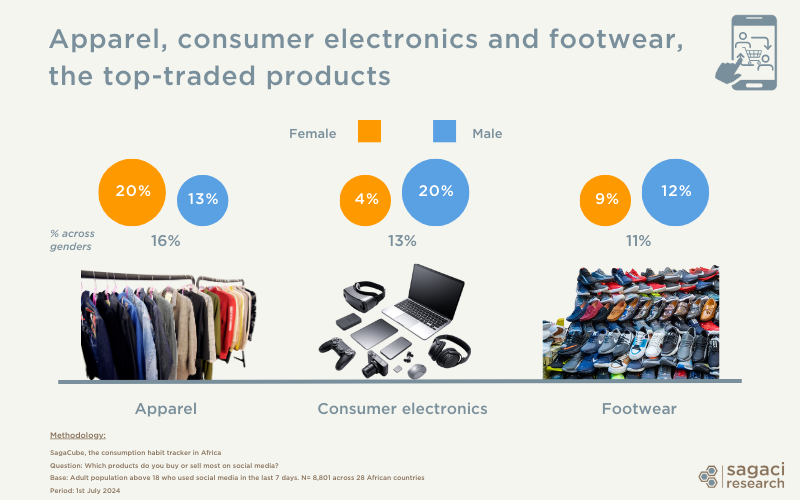

Social commerce products often reflect consumer preferences and market trends. Clothing leads as the most popular category, with 20% of women and 13% of men engaging in buying and selling these items. Consumer electronics follow, accounting for 13% of transactions, with a notable gender divide: 20% of men versus 4% of women. Footwear also shows a gender disparity, with 12% of men and 9% of women participating in buying and selling.

Why do Africans like social commerce?

The primary appeal of social media shopping in Africa is its convenience (32%). One-third of Africans value it for providing access to items not available locally. Additionally, 26% appreciate the ease and simplicity of social media shopping, while the same percentage enjoy the flexibility of shopping from anywhere. Moreover, 21% prefer direct home delivery, enhancing the shopping experience by eliminating the need to visit physical stores.

Leveraging Online Market Research in Africa

Online research tools like SagaCube provide extensive data on consumer habits across Africa. SagaCube covers 144 categories across 26 countries, combining 400+ usage and attitude variables with thousands of brand usage data points. Comprehensive data and insights are available for deeper analysis of social commerce in Africa. If you would like further insights on social selling in Africa based on our online research services, get in touch with us. Please send an email to contact@sagaciresearch.com or click below.

Methodology

SagaCube, the online pan-African consumption tracker.

Questions

Q1: Which of the following social media did you use in the last 7 days?

Q2: Have you ever sold or bought a product from someone on social media?

Base Population: Adult population above 18 across 28 African countries.

N= 16,327

Q3: How often do you use social media to sell or buy products?

Q4: Which products do you buy or sell most on social media?

Q5: Which social media do you use most often to sell or buy a product?

Q6: Why do you buy on social media?

Base Population: Adult population above 18 who used social media in the last 7 days across 28 African countries.

N= 8,801

Survey Period: 1st July 2024