- 17/06/2025

- Posted by: flore.demaigret

- Categories: Articles, Consumer Goods / FMCG, Food, Pasta, SagaCube

Pasta consumption in Africa, as captured by recent data from SagaCube, the pan-African consumption tracker, reflects consumer habits and preferences that align with the sector’s ongoing expansion and transformation.

The growth of the pasta market in Africa

The African pasta industry is experiencing robust growth, driven by urbanization and changing lifestyles leading consumers to choose more practical and time-saving foods. This, combined with the rising adoption of Western diets (especially among younger populations) is fueling demand for easy and quick meals across the continent. Pasta responds well to this need, offering a versatile, affordable, and easy-to-prepare option that fits perfectly into busy modern lifestyles.

Local production is gaining momentum

International giants like Panzani and Barilla are active in the African pasta market, but much of the recent momentum is coming from local players expanding their presence through new product launches and strategic partnerships. Notable investments include Ghana’s largest pasta facility, developed by Westco Investment Ltd in partnership with Turkish company OBA Markana. West Africa’s largest pasta factory is also being built this year in Burkina Faso.

Local tastes are also shaping product innovation. For example, Crown Flour Mill Ltd in Nigeria (part of Olam Agri) recently introduced Crown Thick Spaghetti, designed to match local preferences for thicker pasta.

Other strong local players include Merec Industries in Mozambique, Africa Food Manufacture in Cameroon, BUA in Nigeria. In terms of brands, some of the biggest names on the continent include Golden Penny Pasta (Flour Mills of Nigeria), Fatti’s and Moni’s in South Africa (Tiger Brands), Moroccan brands such as Dari (by Dari Couspate) and Alitkane, or Maman in Côte d’Ivoire (by Carré d’Or).

This growing local presence has been further reinforced by economic pressures. Wheat costs and inflation in Africa spiked in early 2022 due to global supply chain disruptions and the war in Ukraine, before easing in 2023–24. This prompted many consumers to trade down from imported or premium pasta brands to more affordable local options.

Which country consumes the most pasta in Africa?

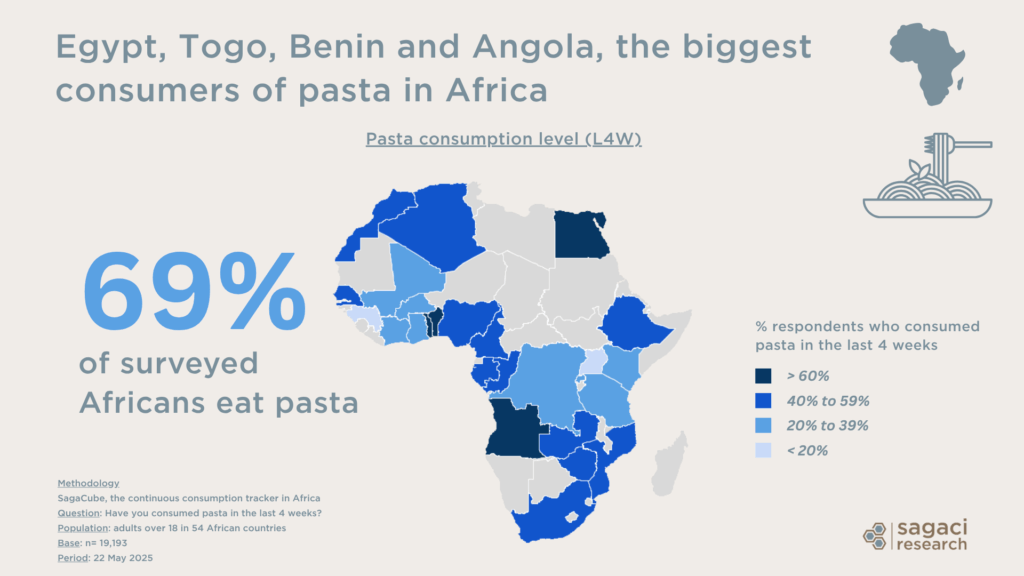

According to SagaCube data, 69% of surveyed Africans have consumed pasta recently, confirming its widespread popularity across the continent. This figure excludes instant noodles, which represent a large and distinct category in some countries. We’ll be sharing separate insights on instant noodle consumption in an upcoming article.

Despite its broad popularity across Africa, pasta consumption differs markedly between countries. Markets such as Egypt, Angola, Togo and Benin show the highest pasta consumption rates, with over 60% of the adult population having eaten pasta recently. In contrast, some countries report much lower consumption rates; below 20% in places like Guinea and Uganda where limited wheat availability and different food habits may be a contributing factor.

Pasta consumption habits in Africa: occasions and locations

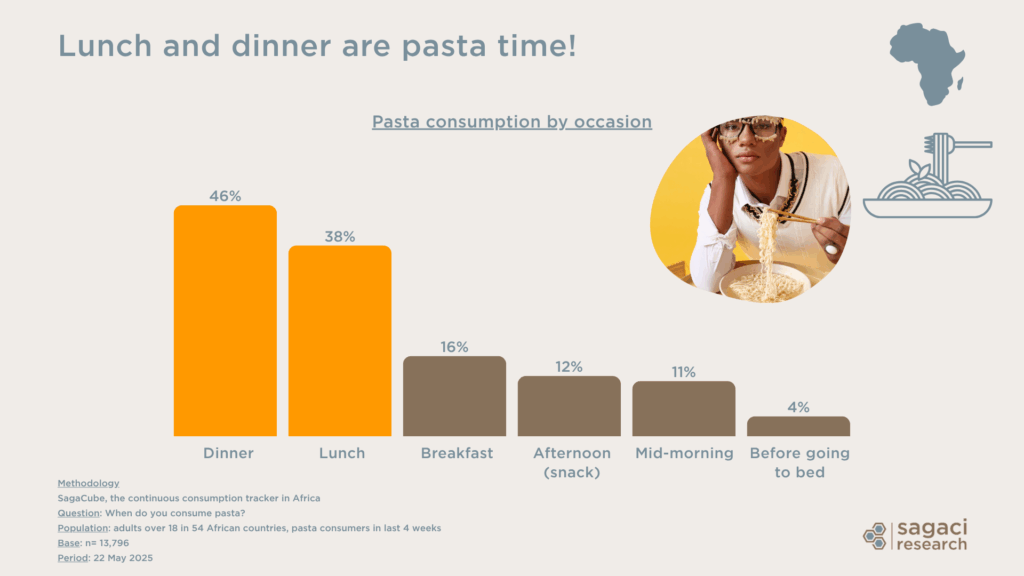

Pasta is mainly consumed in Africa during dinner (46%) and lunch (38%), making it a staple for main meals. A smaller share of respondents reported eating pasta for breakfast (16%), afternoon snacks (12%), or mid-morning (11%).

86% of African respondents eat pasta at home, making it the primary location for consumption. Smaller segments report eating pasta at work or school cafeterias (4%), in bars or restaurants (3%), or at a friend’s house (2%).

Preferred pasta types and key purchase drivers in Africa

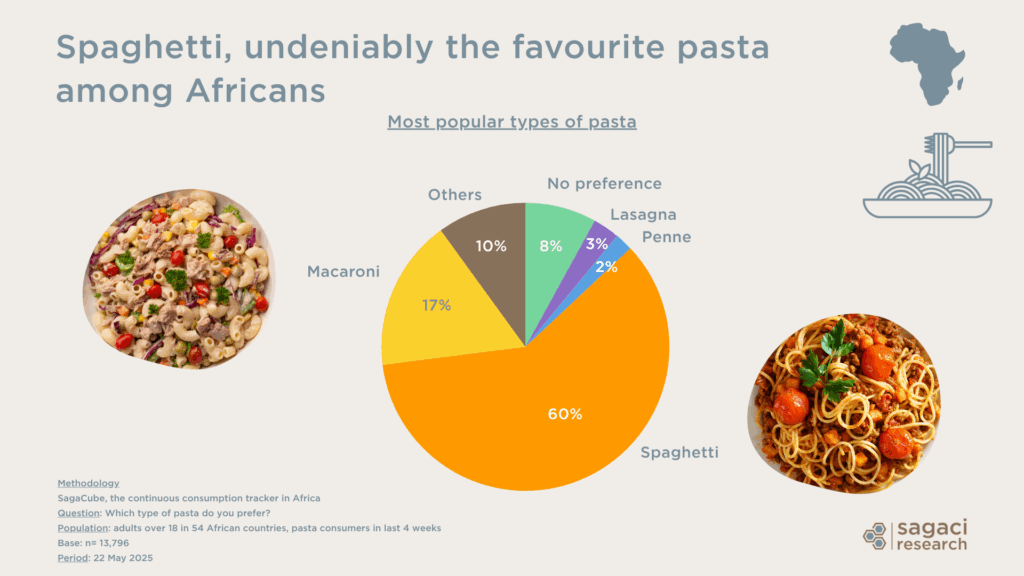

Spaghetti is by far the favourite type of pasta in Africa, with 60% of respondents choosing it over other varieties. Macaroni follows at 17%, while penne, lasagna, and other types remain niche options. When it comes to purchase decisions, quality is the top priority for African pasta consumers, cited by 30% of respondents—surpassing taste (18%) and price (15%). Although factors such as availability, local origin, and brand influence choices, they are less important overall. These insights highlight that brands focusing on high-quality pasta products are best positioned to build customer loyalty and succeed in Africa’s growing pasta market.

Further consumer insights into the pasta market in Africa

This data, drawn from our online panel in Africa, highlights key insights into pasta consumption habits across the continent, from preferred types and meal occasions to brand choices and country differences. We regularly share similar findings across various FMCG categories and African markets. For example, our analysis of the most underrated FMCG brands in Africa revealed that, much like in the pasta category, local brands often lead in popularity.

For detailed insights into pasta consumption in Africa, whether by country, pasta type, or key players in your category, we have the data you need.

So for information on our data tools or to explore your specific research needs, please get in touch at contact@sagaciresearch.com or click below.

Methodology

This analysis is powered by SagaCube, the continuous consumption tracker across the African continent

Questions:

- Have you consumed pasta in the last 4 weeks?

- When do you consume pasta?

- Where do you consume pasta most often?

- Which type of pasta do you prefer?

- Thinking of the last time you bought pasta, what made you choose the brand that you bought?

Population: adults in Africa above 18 years old across 54 countries

Base: n = 19,193

Period: 22 May 2025

Image: © Fatti’s and Moni’s