- 25/06/2024

- Posted by: ilana.czerwinski

- Categories: Alcoholic beverages, Articles, Beer, Consumer Goods / FMCG, Foodservice, Kenya, Online Panels, Retail, SagaCube, Social media and communication, Supermarkets

Who are the young Kenyan consumers, particularly upper-class men? What influences them the most? What are the consumption trends in Kenya for this segment? Thanks to SagaCube, the consumer habit tracker in Africa and our online panel in Kenya, we delve into the profile of Kenyan male consumers aged 18 to 25 from the highest social classes (SEC AB). By comparing these Kenyan young adults with people aged 26 and over from the same social classes, we can draw up a distinct profile to understand how these young men buy, spend and live.

Young Kenyan consumer trends: more adventurous & price sensitive shoppers

Male Kenyan consumers aged 18-25 show distinct buying behaviours compared to those aged 26+. They are more experimental, with 83% willing to try new products versus 71% of the older group. They are also more price-sensitive, with 48% prioritising price when shopping compared to 43% of older consumers. This combination of experimentation and pragmatism highlights the unique factors influencing their purchasing decisions.

While ¾ (75%) of young Kenyan shoppers have recently visited chain supermarkets (in the last 7 days), they do so less frequently than the 26+ group (83%).

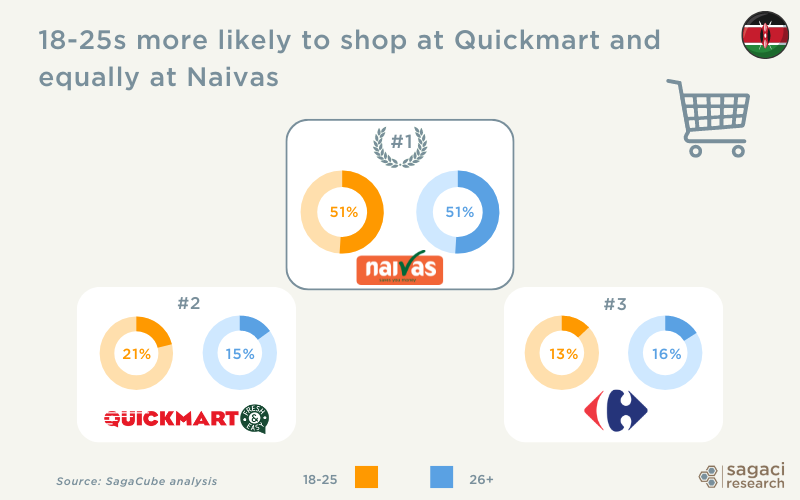

The three favourite supermarkets in Kenya for the 18-25 male shoppers are:

- Naivas: 51% of both 18-25 and 26+ age groups shop at the Kenyan supermarket

- Quickmart: more popular with the 18-25 (21%) than the 26+ (15%)

- Carrefour: less favoured by the Kenyan Gen Z male consumers (13%) than by the 26+ age group (16%)

Differences in F&B consumption among young Kenyan men

Regarding the food and beverage consumption habits of Kenya’s male Gen Z population (18-25), the results reveal some distinct patterns.

Younger male consumers tend to eat dinner out more at fast food restaurants than the older group (55% vs. 43%) and have a stronger preference for KFC as their favourite foodservice brand (54% vs 46%).

Alcohol consumption also varies by age: 24% of the younger group enjoy cider versus 18% of the older group. Ready-to-drink beverages (RTDs) are favoured by 25% of younger adults, while only 19% of the older group prefer them. Conversely, beer is more popular with the older group, with 67% consuming it compared to 49% of the younger adults.

Influential factors shaping consumer behaviour among Kenyan male youth

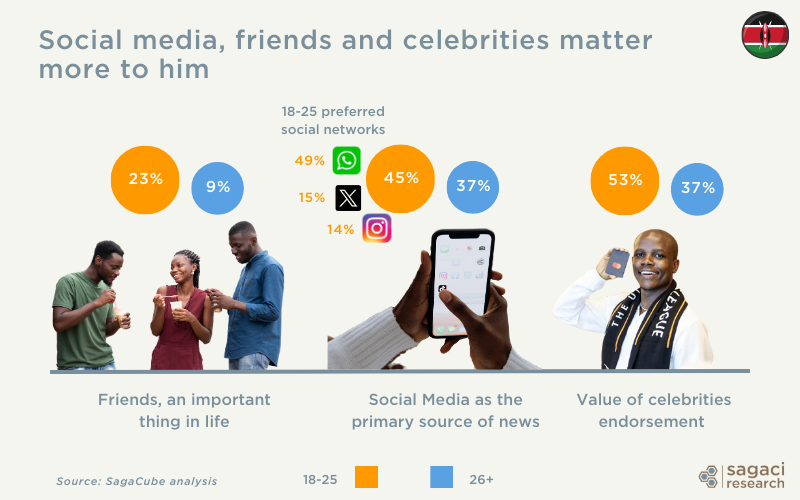

- While family and work remain consistently important across all ages, friendships hold even greater significance for Kenyan males aged 18-25. Among this group, 23% consider their friends one of the most important aspects of life, compared to 9% for those aged 26 and older. This emphasises the influence of social ties and peer relationships on their attitudes and decisions.

- Social media platforms like WhatsApp, TikTok, and Instagram are pivotal, serving as the primary source of information for 45% of young men (versus 37% for older demographics), highlighting a preference for instant and interactive content delivery.

- Celebrities impact the purchasing decisions of 53% of young men in this age group (compared to 37% for older groups), with influencers like Crazy Kennar, a prominent Kenyan YouTuber with 640,000 followers, playing a significant role.

Marketers targeting young adult men aged 18-25 in Kenya should prioritise social media platforms for interactive and visually appealing content that aligns with peer-driven influences. Collaborating with local influencers and emphasising social connections in campaigns can enhance engagement and brand loyalty among this demographic.

Climate Change Scepticism among Kenyan Youth

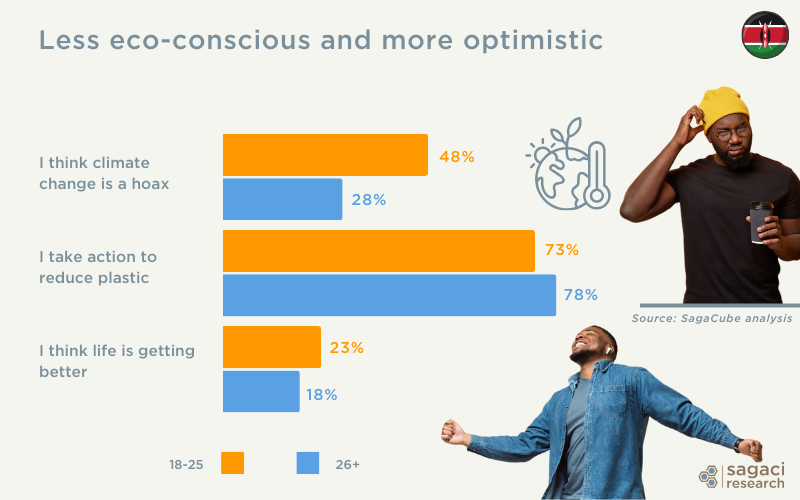

The attitudes of Kenyan males aged 18 to 25 towards the environment reveal that they are more likely to doubt climate change. Indeed, nearly half of this group consider it a hoax (compared to 28% of older males). Additionally, they are less proactive in reducing plastic use, with 73% of Gen Z taking action compared to 78% of those aged 26 and above.

Regarding their outlook on life, young Kenyan men exhibit greater optimism, with 23% believing life is improving, in contrast to 18% of the older age group. However, these numbers remain relatively low amidst current dissatisfaction among Kenyan youth with the political landscape.

Leveraging online market research in Africa

These insights are derived from SagaCube, the African consumer profiling tool, which spans over 140 categories across 26+ countries, encompassing 400+ usage & attitude variables and thousands of brands.

SagaCube is leveraging our representative online panel in Africa, SagaPoll. Mobile based, it ensures deep reach and fast turnaround times. It enables us to reach thousands of highly engaged respondents across the continent, providing comprehensive insights into consumer attitudes and behaviour not only in Kenya but across all African countries. This allows us to deliver detailed answers to virtually every consumer related question, with results available within a few days.

To conclude, if you would like to know more about consumer behaviour in Kenya or how to do market research online, please send an email to contact@sagaciresearch.com or click below.

Methodology

SagaCube, the consumer habit tracker in Africa, compares Kenyan male 18 to 25 from SEC AB (target group) with Kenyan male aged 26+ also from SEC AB (control group).

The data comparisons shown in the report indicate significant statistical differences.

Base: Adult population above 18 in Kenya. Representative sample with mini N = 130 for men 18 to 25 SEC AB (Target Group) | mini N = 363 for men 26+ SEC AB (Control Group)

Period: 2023/2024