- 04/04/2025

- Posted by: flore.demaigret

- Categories: Articles, Beauty & Personal Care, Consumer Goods / FMCG, SagaCube

The hair care market in Africa is experiencing a shift towards natural styles driven by growing health concerns over chemical treatments. With data from SagaCube, Africa’s largest consumption tracking platform, here are some quick insights on the latest trends in women’s hair care in Africa.

Key insights into the hair care market in Africa

Exploring the behaviours, needs, and spending habits of African women is key to understanding the beauty industry in Africa.

- Key insight #1: Hair care is the leading category in Africa’s women’s beauty segment, with 60% of women using hair care products in the past year.

- Key insight #2: According to our recent survey, shampoo usage in Africa remains limited, with only 36% of women having used shampoo in the past four weeks.

- Key insight #3: Hair salon visits in Africa are part of many women’s routines, with two out of three visiting a hair salon at least once a month. This shows an interesting insight into female grooming trends in Africa.

- Key insights #4: While most women visit hair salons regularly, their spending per visit remains low. In fact, 71% spent less than $10 on their last visit, underscoring the strong demand for affordable hair care products in Africa.

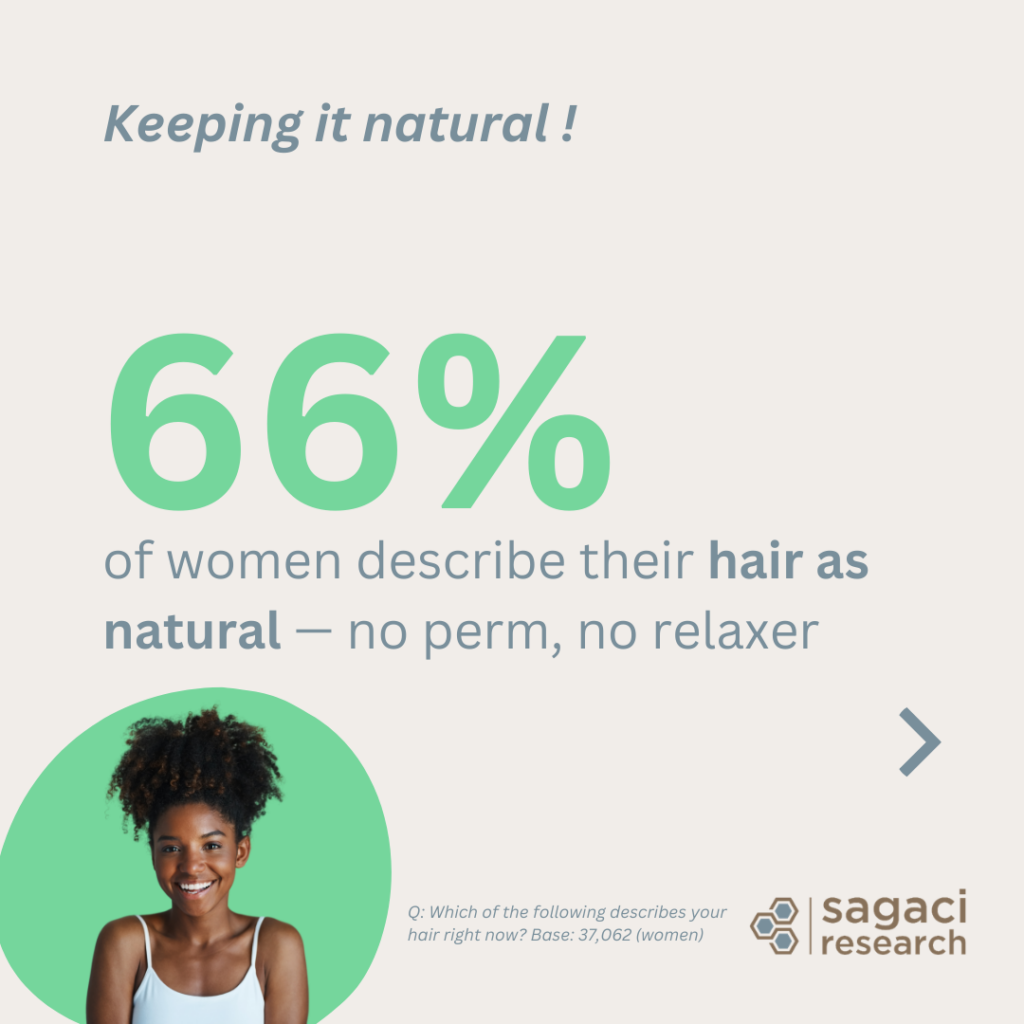

- Key insight #5: The natural hair movement in Africa is strong, with 66% of women wearing their hair without perms or relaxers, highlighting a clear shift towards natural styles.

In conclusion, the hair care market in Africa is driven by affordability, salon routines, and a strong shift toward natural styles. This presents a clear opportunity for brands to offer cost-effective hair products that align with the needs and spending habits of African women.

More insights on the Beauty and Personal Care market in Africa

Beyond hair care products, our SagaCube pan-African consumption tracking platform, offers valuable insights into the broader personal care category, both at the continent and country level. We regularly analyze this category, for example through our Beauty report in Africa or from a brand perspective with the The Top 20 Beauty and Personal Care Brands in Africa in 2024.

Explore our platforms for detailed data on the hair care market, beauty trends, women’s grooming habits, product usage. Discover the growing demand for affordable hair care solutions across the continent. To learn more about personal care consumer behaviour in Africa, contact our team at contact@sagaciresearch.com or click below.

Methodology

SagaCube, the syndicated category consumption tool across the African continent leveraging our online panel in Africa.

Consumption / usage:

- Which of the following beauty and personal care products did you use in the last 12 months? Base: 137,961 (women)

- Which of the following hair care products did you use in the last 4 weeks? Base: 137,961 (women)

- How often do you go to a hair salon / hair dresser? Base: 32,189 (women)

- How much did you spend the last time you went to the hair salon / barber shop? Base: 16,268 (women)

- Which of the following describes your hair right now? Base: 37,062 (women)

Population: Women above 18 years old across 26 African countries

Period: 2024