- 05/02/2026

- Posted by: Janick Pettit

- Categories: Articles, Bank, Financial Services, SagaBrand, South Africa

Top banks in South Africa remain closely watched as customer expectations evolve and competition between established players and challengers intensifies. The latest wave of our ongoing SagaBrand tracker provides an updated view of how leading institutions perform today, highlighting shifts in customer satisfaction, brand strength and perception across the market. While this article focuses on a selection of core indicators such as awareness, satisfaction and brand image, the analysis forms part of a broader framework of more than 40 KPIs tracked to understand how consumers perceive and experience financial institutions across Africa.

Drawing on data collected through the SagaPoll online panel in South Africa, this analysis explores how consumers evaluate the banks they know and use, offering a current view of the sector and highlighting where momentum is building and where challenges are emerging.

Top rated banks in South Africa

Recent SagaBrand findings show that visibility and customer experience are not always moving in the same direction across South Africa’s banking sector. While the largest banks remain highly recognised, changes in satisfaction suggest that customer sentiment is shifting and that competitive positions are becoming less predictable.

This analysis compares the most recent wave of data collected in December 2025 with a previous wave from November 2024, allowing us to track how bank performance is evolving over time.

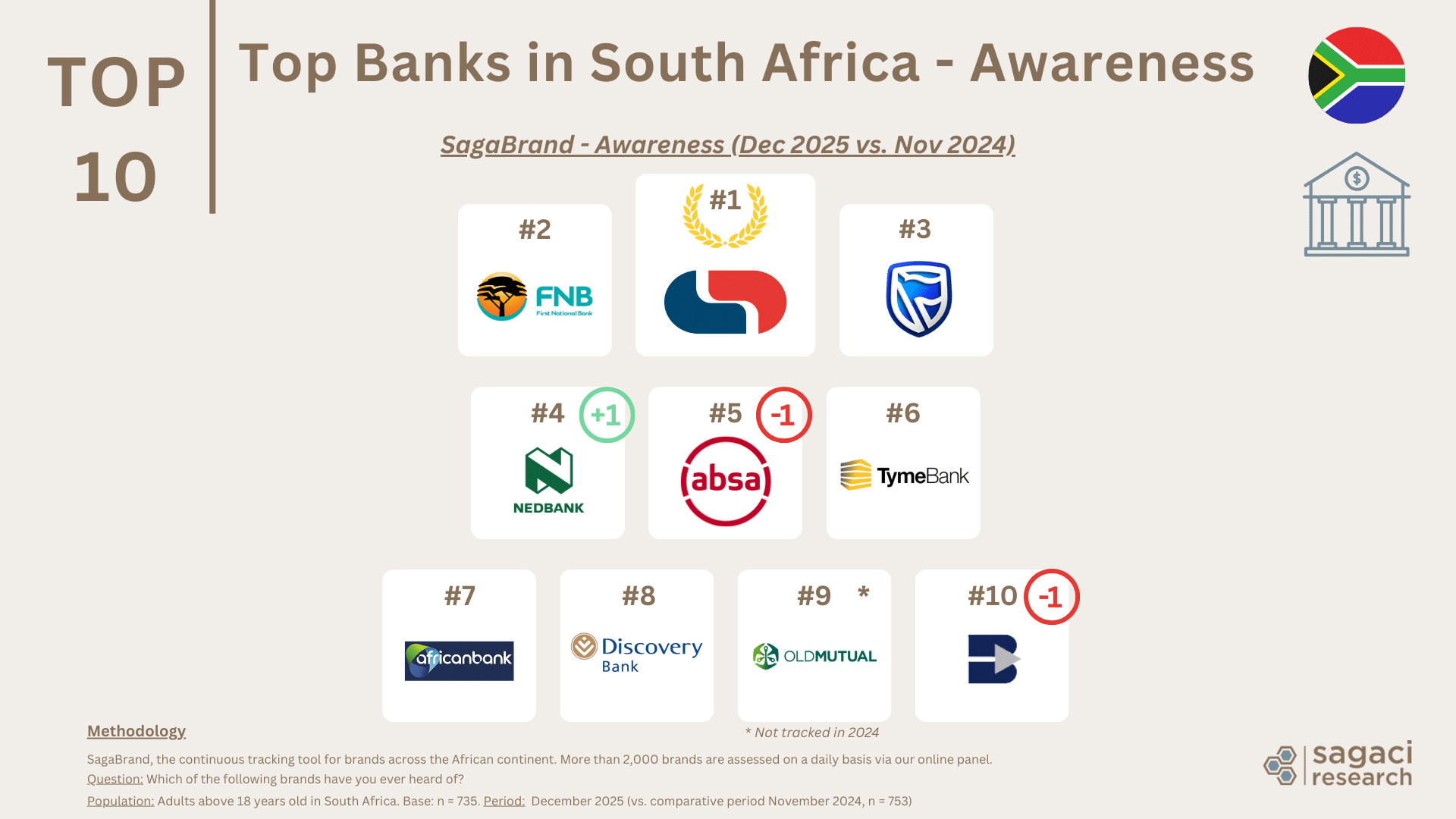

Ranking of the best banks in South Africa based on Awareness

Capitec remains the most recognised banking brand in South Africa, maintaining its leadership position ahead of FNB and Standard Bank. The strong presence of these three institutions confirms the continued dominance of major retail banking players in consumers’ minds.

Top 10 banks in South Africa on awareness:

- Capitec Bank

- FNB – First National Bank

- Standard Bank

- Nedbank

- ABSA

- TymeBank (newly rebranded as GoTyme Bank)

- African Bank

- Discovery Bank

- Old Mutual

- Bidvest Bank

Other banks tested in this wave include Postbank, Investec, Ubank, Sasfin and Access Bank.

Compared with November 2024, the latest wave shows some movement within the awareness ranking rather than a fundamental reshaping of the landscape. Nedbank moves up one position, while ABSA and Bidvest Bank shift slightly lower in the order.

TymeBank maintains a stable mid-tier presence, while African Bank, Discovery Bank, and Old Mutual remain positioned further down the awareness ranking, illustrating the ongoing gap in visibility between newer or more specialised propositions and the country’s largest banking brands.

Note that these changes reflect relative positioning among competitors rather than underlying performance levels. Actual detailed performance numbers are available upon request.

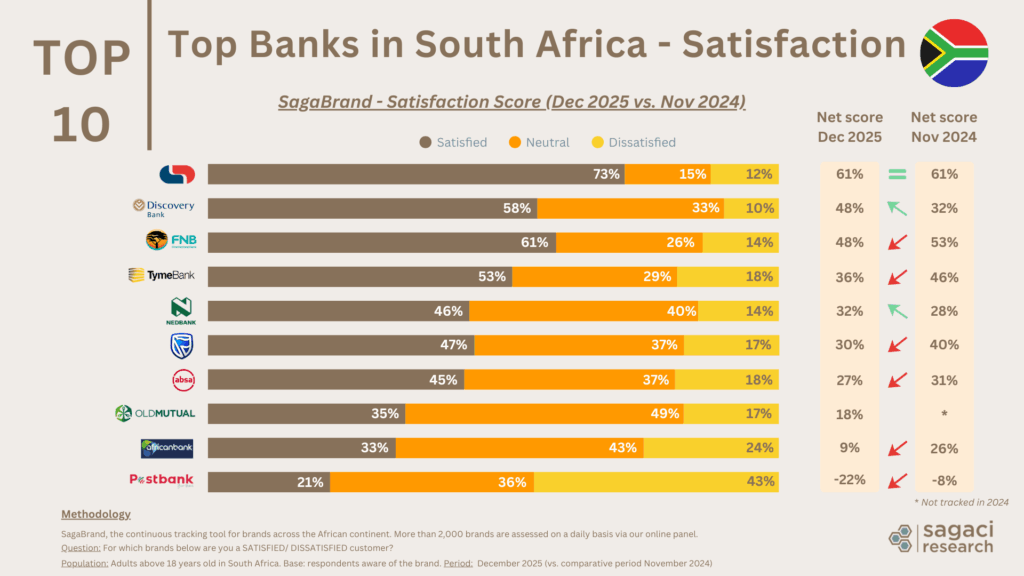

Ranking of top banks in South Africa based on Satisfaction

Customer satisfaction remains highly polarized across South African banks, with Capitec consolidating a strong lead while several traditional players experience notable declines between the end of 2024 and the end of 2025. The sharp drops for Standard Bank, FNB, and Absa reflect rising expectations around everyday banking experience, while gains from Discovery Bank and Nedbank highlight a growing competitive advantage driven by perceived service and digital performance.

As consumers increasingly use several banks, direct comparison between providers is becoming more common, with multi banking behaviour further raising expectations across the sector.

How brand perception is shaping customer satisfaction for leading banks in South Africa

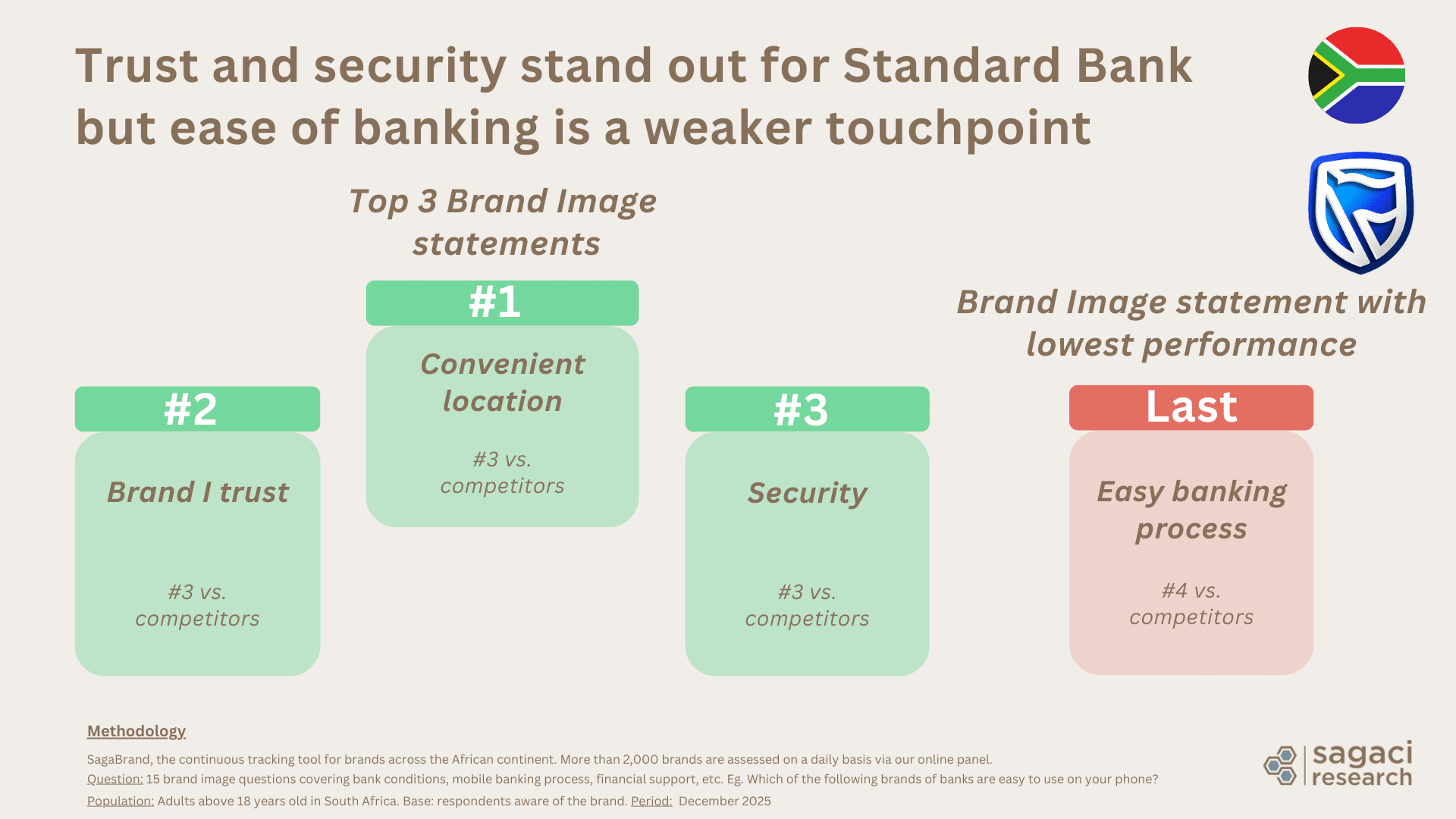

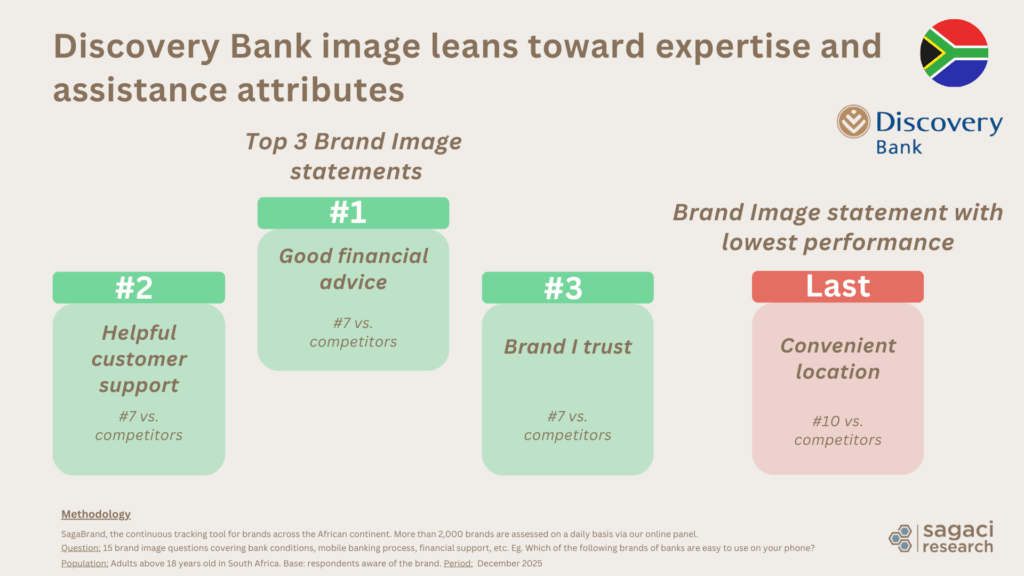

To better understand the drivers behind satisfaction, we also look at brand image across 15 specific statements covering areas such as banking processes, customer support, financial advice, trust, and overall ease of use.

Viewed through this lens, some of the shifts observed for Standard Bank become clearer. Its net satisfaction declines from 40% in 2024 to 30% in 2025 at a time when expectations around digital experience and service simplicity continue to rise. While the bank maintains strong perceptions on trust, security, and accessibility, it performs less strongly on ease of banking-related attributes, suggesting that everyday process friction may be weighing on customer sentiment. The mobile app disruption reported shortly before this wave may have further heightened sensitivity to these experience-driven challenges.

Conversely, Discovery Bank’s rise from 32% in 2024 to 48% in 2025 reflects a strong uplift in customer satisfaction, likely linked to continued focus on digital experience, service responsiveness and customer feedback.

As satisfaction strengthens, this momentum also appears in brand image perceptions, which lean more toward expertise and customer support, with good financial advice and helpful service standing out among its stronger attributes.

More on Financial Services in Africa

This article highlights only a portion of the insights available from this latest SagaBrand wave. Beyond awareness, satisfaction and brand image, we track another 30+ brand health KPIs on a monthly basis.

Note that similar analyses are also available across other African markets, including Morocco, Nigeria, Ivory coast and Kenya, offering a broader perspective on how financial institutions are evolving across the continent.

For marketing, insight and strategy teams looking to benchmark performance or anticipate emerging trends in African financial services, the full SagaBrand reports provide a rich view of brand equity, customer experience and growth opportunities.

Get in touch for further insights on the South African banking sector or other geographies: contact@sagaciresearch.com.

Methodology

SagaBrand, the continuous tracking tool for brands across the African continent. Our online panel in Africa assesses around 2,000 brands on a daily basis.

- Question: Which of the following brands have you heard of?

- Question: For which brands below are you a SATISFIED/DISSATISFIED customer?

- 15 brand image questions covering bank conditions, mobile banking process, financial support, etc. Eg. Which of the following brands of banks are easy to use on your phone?

Base: n = 735 total sample / Respondents who are aware of the brand for Satisfaction question with a minimum base per brand

Population: members of our online panel in South Africa above 18 years old

Period: Dec 2025