- 17/02/2026

- Posted by: Janick Pettit

- Categories: Articles, Kenya, Pasta, SagaTracker

Examples of retail audits in Kenya reveal how FMCG brands actually win or lose at shelf level, where distribution gaps, pricing execution and channel strategy often determine performance more than demand alone. In markets where traditional trade remains dominant, sales data alone rarely reflects true performance.

Without reliable retail tracking, brands risk navigating complex retail environments without clear direction, much like driving without GPS, missing distribution gaps and execution realities across fragmented channels.

What is a retail audit in Africa?

A retail audit measures how FMCG products perform in store by tracking execution across modern and traditional trade. In African markets, where retail structures are fragmented, reliable in-store measurement is essential to understand real distribution and competitive dynamics.

Retail audits typically monitor:

- Numerical distribution and availability across outlet types

- Market share and competitive presence in store

- Price positioning versus competitors

- Shelf visibility and secondary placements

- Promotional execution and point of sale material

Continuous retail tracking solutions such as SagaTracker standardise these indicators across categories and markets, enabling FMCG teams to compare performance and identify distribution or execution gaps over time.

Why FMCG brands need retail data to navigate African markets

Retail landscapes across Africa evolve quickly. New outlets appear, product assortments change and price competition intensifies. Without ongoing retail data, it becomes difficult to understand whether performance shifts come from demand, execution or competitive pressure.

The GPS analogy reflects this reality. Retail audits provide direction by showing where products are present, where gaps exist and how competitors behave at shelf level.

Insights into the Pasta category in Kenya

A recent retail audit conducted in Kenya in the pasta category illustrates how retail audits uncover execution realities that aggregated market data alone cannot reveal.

- Category leadership in the pasta market in Kenya is strongly channel driven, particularly for more modern or premium FMCG categories. Pasta remains relatively premium compared to traditional staples, which partly explains its stronger presence in supermarkets and minimarts than in kiosks / small dukas and grocery stores / large dukas across traditional trade in Kenya.

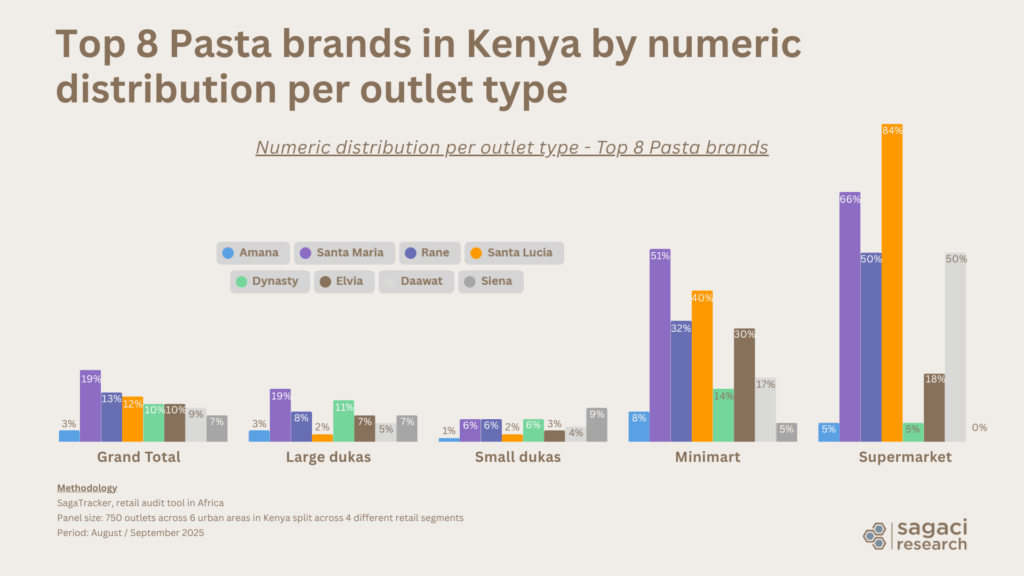

- Retail audit data in Kenya makes these distribution dynamics visible. Santa Lucia reaches 84% distribution in supermarkets but only 2% in large dukas. Santa Maria performs strongly in minimarts at 51% yet drops to 6% in small dukas. In the Kenyan FMCG retail landscape, brand strength often reflects prioritised channel execution rather than true nationwide penetration.

- This highlights a key strategic question for FMCG brands operating in Kenya (and beyond): how do newer categories expand beyond modern trade into traditional retail? Without a structured retail audit in Kenya, brands may appear well distributed when analysing modern trade alone, while remaining largely absent from the outlets that still drive everyday FMCG access. Continuous retail tracking provides the outlet level visibility needed to identify structural gaps and unlock incremental growth in both modern and traditional trade.

From one off retail audits to continuous retail tracking

Many FMCG brands still rely on periodic retail audits that offer only a snapshot of in store performance.

In fast evolving African retail environments, where assortments and pricing change quickly, this approach limits visibility.

Periodic audits show presence. Continuous retail tracking reveals momentum. It introduces a more dynamic view of distribution, market share and execution, helping brands understand trends as they emerge rather than after the fact.

How SagaTracker supports retail audits in Kenya and beyond

SagaTracker turns retail audits into a continuous decision making framework, giving FMCG teams consistent visibility across modern and traditional trade in complex African retail environments.

By delivering comparable data on distribution, pricing, shelf execution and competitive activity, it enables FMCG teams to benchmark performance consistently and uncover actionable insights across categories and markets.

Looking to move from snapshot retail audits to continuous retail tracking? Learn how SagaTracker provides structured, comparable retail data to support smarter FMCG decisions across African markets.