- 28/07/2025

- Posted by: Janick Pettit

- Categories: Articles, Fashion, Retail

Fashion in Africa is evolving, and consumer preferences are influenced by much more than just global trends.

New data from SagaCube, Sagaci Research’s pan-African consumption tracker, reveals how fashion in Africa is increasingly personal, local, digital, and value-driven.

Here’s what you need to know about what’s shaping African fashion consumers in 2025.

Fashion as self-expression

For many Africans, fashion is identity. A striking 78% of adults across 54 African countries consider clothing as a form of creative self-expression, highlighting fashion’s emotional and cultural significance across the continent.

This personal connection to style is strongly linked to digital engagement. More than half of African consumers (52%) say they actively keep up with fashion trends, using a mix of traditional and digital platforms to stay informed. The trend is especially strong among fashion-minded consumers, who are heavier users of social media platforms like Snapchat and TikTok, using these channels to express their style and stay updated on fashion trends.

How accessible retail channels drive fashion in Africa

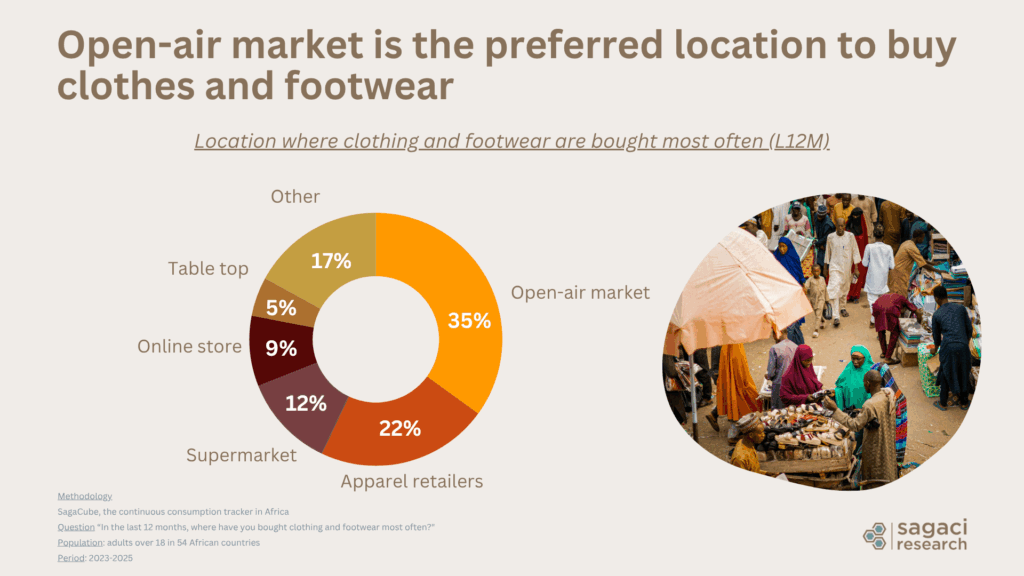

When it comes to where people shop for clothing and footwear, traditional channels still dominate. The strong prevalence of open-air markets as key shopping destinations for clothing and footwear (35%) reflects how much African consumers value accessibility and affordability in their fashion choices.

Online fashion shopping in Africa remains low at 9% compared to traditional retail channels. Yet fashion and apparel are already among the key segments driving e-commerce growth on the continent. Fueled by a young, tech-savvy population and ongoing improvements in internet penetration, e-commerce infrastructure, and digital payment systems, this figure is expected to rise steadily in the coming years.The rise of social commerce in Africa is also reshaping how people buy and sell, particularly in categories like apparel and footwear, which are among the most traded on social media platforms like Facebook Marketplace and WhatsApp.

Price sensitivity and the second-hand fashion economy

Across Africa, value is a top priority, even in fashion. This price-conscious mindset fuels the growth of second-hand clothing, both in traditional markets and online. A vast majority of consumers (70%) say saving money is their main reason for buying thrifted apparel. Factors like style, charity, or sustainability play a much smaller role.

South African Digital platform Yaga is meeting this demand by providing a structured, peer-to-peer marketplace for affordable pre-owned fashion. This supports the circular fashion economy, where clothes are reused and recycled to reduce waste and extend their lifecycle.

This focus on affordability is also reflected in how much people are willing to spend on clothing. On average, African consumers report paying:

- $6 for a T-shirt

- $9 for pants

- $14 for shoes

These prices show the critical role of accessible price points in Africa’s garment market.

Global fashion brands and fast fashion on the rise

While there is strong preference for locally made clothing (65%), international fashion brands are expanding rapidly in Africa. They are tapping into demand through affordable fast fashion and varied distribution strategies, from branded stores and online platforms to partnerships with local retailers. Luxury brands like Gucci, Louis Vuitton, and Versace may hold aspirational appeal, but in reality, most consumers opt for more affordable brands that better match their budgets and lifestyles.

Global sportswear giants: Nike and Adidas

Nike and Adidas are among the most recognized and admired international sportswear brands in Africa. They sell their products through a variety of channels: branded flagship stores (especially in South Africa), independent retailers, and multiple online platforms. These include their own e-commerce sites, regional partnerships such as Nutmeg with Adidas in Ghana, and marketplaces like Jumia (pan-African), Kilimall (Kenya), Konga (Nigeria), Takealot (South Africa), and Superbalist.

Diverse retail strategies of international apparel brands

Brands like H&M (in South Africa) and LC Waikiki (in Morocco and Egypt) have expanded through mall-based stores, offering affordable, trend-driven collections aimed at aspirational middle-income consumers. Meanwhile, Spanish group Inditex (owner of Zara, Bershka, and Pull&Bear) takes a more selective approach, operating flagship stores in major cities such as Johannesburg, Casablanca, and Cairo to target higher-income shoppers in key urban centers.

Adding another layer to the retail mix, Kiabi is growing its footprint across Africa primarily through a franchise model. With a hybrid strategy combining physical stores and e-commerce, the brand is now present in markets such as Morocco, Côte d’Ivoire, Senegal, Congo Brazzaville, Cameroon, Gabon, Tunisia, and Algeria. It is also placing greater emphasis on local garment production to support its growth, with Benin emerging as a key manufacturing hub for the continent.

African-born fashion brands gaining ground

Locally founded brands are also gaining popularity. For instance, South Africa–based Pep continues to expand across Southern Africa with its low-price, high-volume model, serving customers both online and through its extensive store network. Similarly, Mr Price, another South African brand, attracts a broad customer base with its affordable, trend-focused fashion and strong presence in shopping malls and high-traffic retail areas.

The expansion of Chinese e-commerce disruptors

Fast-growing Chinese fashion platforms Shein and Temu are gaining a foothold in African markets. Their appeal lies in ultra-low prices, frequent new drops, and targeted social media marketing, especially among Gen Z and young adult women.

Shein has boosted its visibility by partnering with prominent African fashion influencers such as Mihlali Ndamase and Sphokuhle Ntshalintshali (South Africa) while Temu is currently leveraging TikTok micro-influencers to grow its visibility.

More on the fashion market in Africa

Fashion in Africa is bold, expressive, and rooted in culture. Consumers blend global trends with local identity, prioritizing affordability and self-expression.

With SagaCube, we track real-time fashion consumption via our online panel in Africa. Our data helps brands and retailers understand buying habits, channel preferences, and product trends.

Want to dig deeper into fashion trends or retail strategies in Africa? Contact us at contact@sagaciresearch.com or click below.

Methodology

This analysis is powered by SagaCube, the continuous consumption tracker across the African continent.

Questions:

- To what extent, if at all, do you agree or disagree with the following statement: “Clothing is a form of creative self-expression”?

- To what extent, if at all, do you agree or disagree with the following statement: “I keep up to date with current fashion trends”?

- In the last 12 months, where have you bought clothing and footwear most often?

- To what extent, if at all, do you agree or disagree with the following statement: “I prefer to buy clothes made in Africa to support local production”?

- Which, if any, of the following reasons explain why you have bought clothes second hand?

- Thinking about the last time you bought a t-shirt/shoes/pants, how much did you spend? (USD)

- To what extent, if at all, do you agree or disagree with the following statement: “Clothing is a form of creative self-expression”?

- Have you EVER BEEN A USER or ARE YOU CURRENTLY A USER of any of the (social media) brands below?

Population: adults in Africa above 18 years old across 54 countries

Base: n = from 13,320 to 100,700 depending on the questions

Period: from 2023 to 2025