- 21/01/2026

- Posted by: Janick Pettit

- Categories: Articles, Consumer Goods / FMCG, Pet care, SagaCube, SagaProduct

This article explores pet care in Africa, drawing on recent data from SagaCube, the continuous consumption tracker across the continent. This survey captures pet ownership, attitudes, and pet care related purchasing behaviours, offering insight into how the pet food market in Africa is structured. We also explore top pet care brands based on SagaProduct, Sagaci Research’s FMCG brands and SKUs tracking across African markets.

Pet ownership in Africa

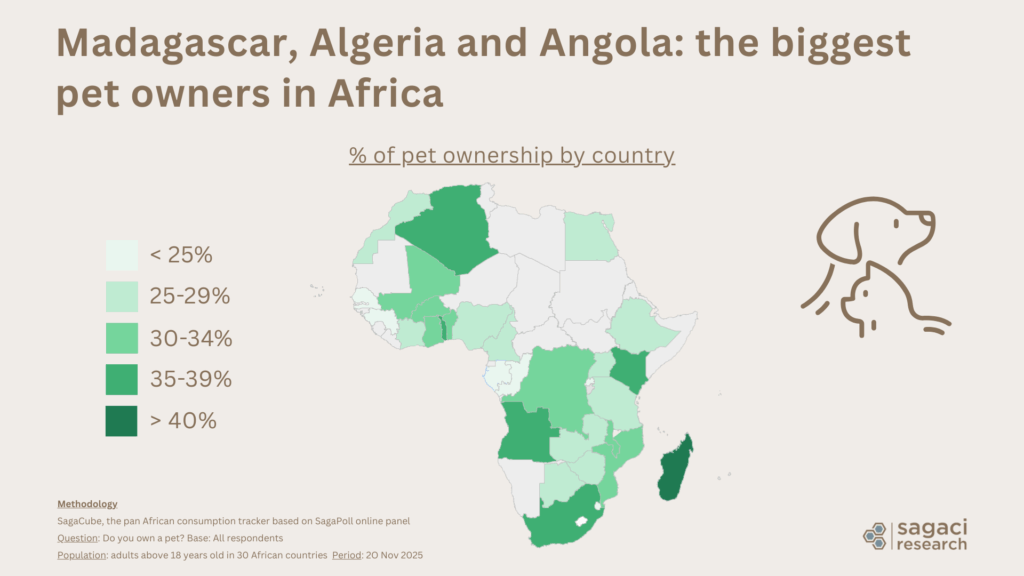

About a third of African households (29%) declare owning at least one pet, confirming that the category is not marginal. Ownership is highest among SEC A consumers, highlighting a clear socio economic dimension to pet adoption. At country level, ownership varies significantly, with Madagascar, Angola, Kenya and South Africa standing out as the markets with the highest pet ownership levels.

In terms of animal types, ownership is strongly concentrated around dogs and cats, which are by far the most common household pets across Africa. Other animals remain marginal and are more often associated with functional or traditional uses rather than care.

How Africans relate to their pets

Beyond ownership, the data highlights a strong emotional relationship with pets. 58% of respondents say they see their pets as family members, similar to any human member of the household. This perception provides important context for understanding pet care behaviours.

Motivations for owning a pet reinforce this emotional dimension. Love for animals is the leading reason cited, ahead of protection, companionship, and family related considerations. Together, these elements show that pets occupy a relational role within households, rather than being kept solely for practical purposes.

Pet food purchasing patterns in Africa

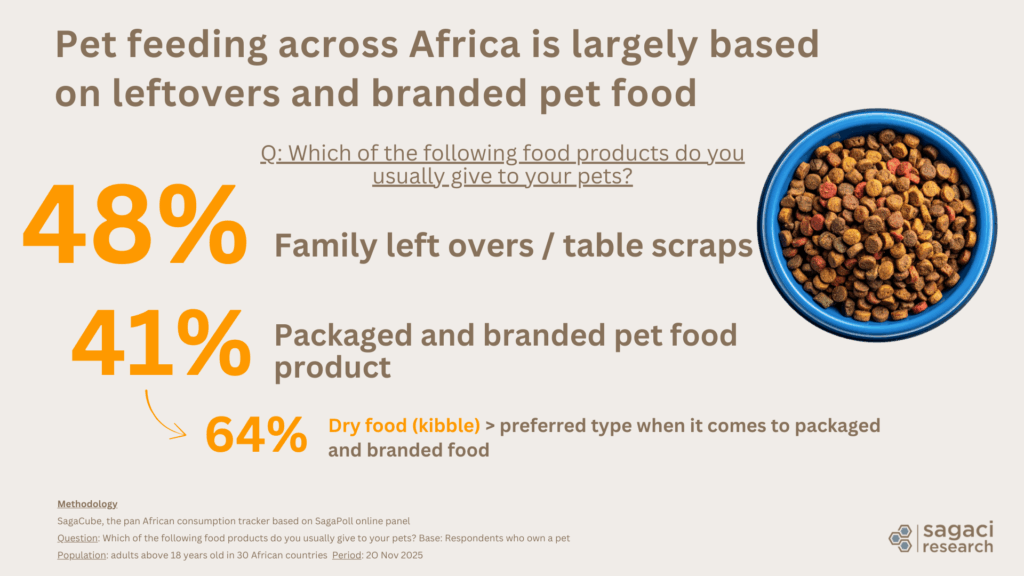

Pet food practices in Africa follow a mixed model, with households combining informal feeding and packaged products.

- 48% of pet owners use family leftovers or table scraps

- 41% buy packaged and branded pet food.

- Among packaged options, dry food is the dominant format, preferred by 64% of buyers

Pet food purchases are frequent, positioning the category firmly within FMCG dynamics. Almost half of pet owners buy pet food at least once every two weeks. Channel choice remains strongly anchored in traditional retail, with local markets leading ahead of pet stores or vets and supermarkets. Online accounts for just 3% of purchases, underlining the continued importance of proximity retail in this category.

What drives pet food choice in Africa

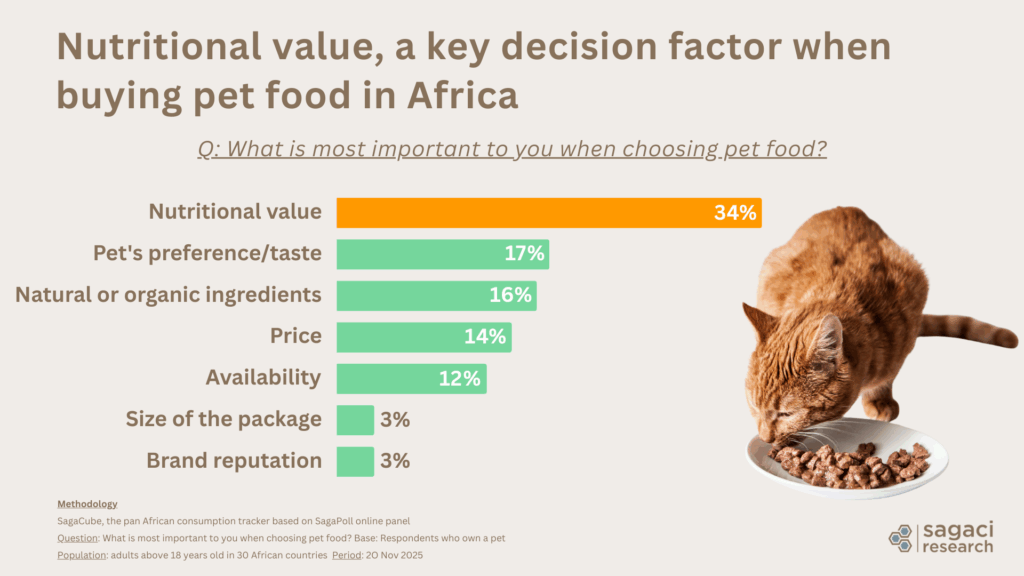

What are the key choice drivers when choosing pet food? Pet owners in Africa clearly prioritize health for their favourite animals.

- Nutritional value – 34%

- Taste – 17%

- Natural ingredients – 16%

- Price – 14%

- Availability – 12%

- Pack size – 3%

- Brand reputation – 3%

For pet care brands, this indicates that brand name alone plays a limited role in purchase decisions. Growth will come less from price competition or brand storytelling, and more from clearly demonstrating functional benefits. Success will depend on offering products that fit existing feeding practices, are available in dominant channels such as local markets, and communicate nutritional value in a simple and credible way. Rather than forcing a rapid shift away from informal feeding, opportunities lie in incremental adoption, where packaged pet food complements everyday practices.

Top pet food brands in Africa

Based on SagaProduct, Sagaci Research’s product and SKU level tracking tool, the ranking of the most scanned pet food brands in Africa highlights a strong presence of regional manufacturers alongside a smaller number of global players. The current top brands include:

- Marltons (South Africa)

- Pamper (by Bob Martin, South Africa)

- Purina (by Nestlé)

- Montego (South Africa)

- Husky (by Bob Martin, South Africa)

- Bob Martin (South Africa)

- Bobtail (South Africa)

- Beeno (by Bob Martin, South Africa)

- Pedigree (by Mars, United States)

- Miglior Gatto (by Morando, Italy)

This ranking shows that pet food visibility in Africa is largely driven by locally manufactured brands, with global players present but not dominant, reflecting the importance of local production and distribution reach in the category.

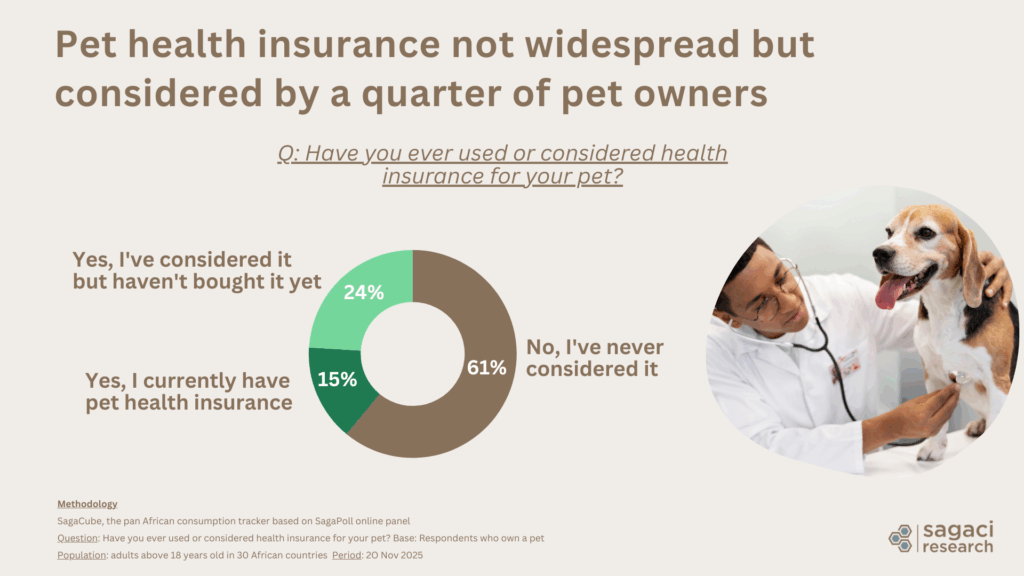

Pet health insurance: early stage but notable interest

Pet health insurance is beginning to register on African pet owners’ radars. In the survey data, 24% of pet owners say they have considered pet health insurance but have not bought it, and 15% currently have a pet health insurance plan, while 61% have never considered it.

This suggests that while the majority of pet owners have not engaged with insurance yet, almost four in ten have either bought or at least thought about it — a sizeable minority indicating early interest.

For insurance companies, this signals a growing opportunity to develop pet-specific insurance products and educational messaging that can convert consideration into uptake as pet ownership and care sophistication grows.

What’s next for the pet care sector in Africa

For brands, distributors, and service providers in the pet care industry in Africa, the next step goes beyond understanding pet care behaviours to translating insight into action. In practice, differences between countries, channel structures, and care practices all shape how products should be positioned and distributed.

Extending this analysis to additional pet care topics and drilling down at country level helps FMCG players identify where growth potential is strongest and how portfolios can be adapted to local realities. Sagaci Research’s consumer and product tracking tools support this deeper exploration and enable more informed go to market decisions across African markets.

Methodology

- SagaCube, online consumption tracker in Africa based on our online panel in Africa.

- Q: Do you own a pet?

- Q: What type of pet do you have?

- Q: To what extent, if at all, do you agree or disagree with the following statement: “Pets are as much a part of their family as a human member”?

- Q: What is the main reason why you decided to have a pet?

- Q: Which of the following food products do you usually give to your pets?

- Q: How often do you buy pet food?

- Q: Where do you usually buy pet food?

- Q: What is most important to you when choosing pet food?

Base: panel members from 30 African countries

Period: 20th Nov 2025

- SagaProduct, largest online shopper panel in Africa. Scans from panel members across the continent. Period: from Nov 2024 to Nov 2025

FAQ

Pet care in Africa goes beyond ownership to include how households feed their pets, where they buy pet food, what drives their choices, and how often they purchase care related products. Deep emotional bonds, mixed feeding habits, and the prevalence of traditional retail are currently driving African pet care market trends. In this article, we analyze how these specific consumer behaviors and local shopping preferences are structuring the pet care sector in Africa today.

Pet food choices in Africa are primarily driven by perceived functional benefits. Nutritional value is the leading decision factor, ahead of taste and natural ingredients. Price ranks lower, and brand reputation plays a limited role. This means pet food consumption in Africa is less about brand image or low price, and more about whether products are seen as suitable and beneficial for pets within everyday feeding practices.

The pet food market in Africa reflects a mixed model. While many households still rely on family leftovers, a significant share already buys packaged and branded pet food, with dry food being the most common format. Purchases are frequent, and local markets remain the main purchase channel. The market is largely driven by locally manufactured brands, alongside a smaller number of global players, as shown by SagaProduct tracking of top pet food brands in Africa.

© Images by Freepik