- 08/09/2025

- Posted by: Monique Sperandio

- Categories: Articles, Cote d'Ivoire, Retail, SagaBrand, Supermarkets

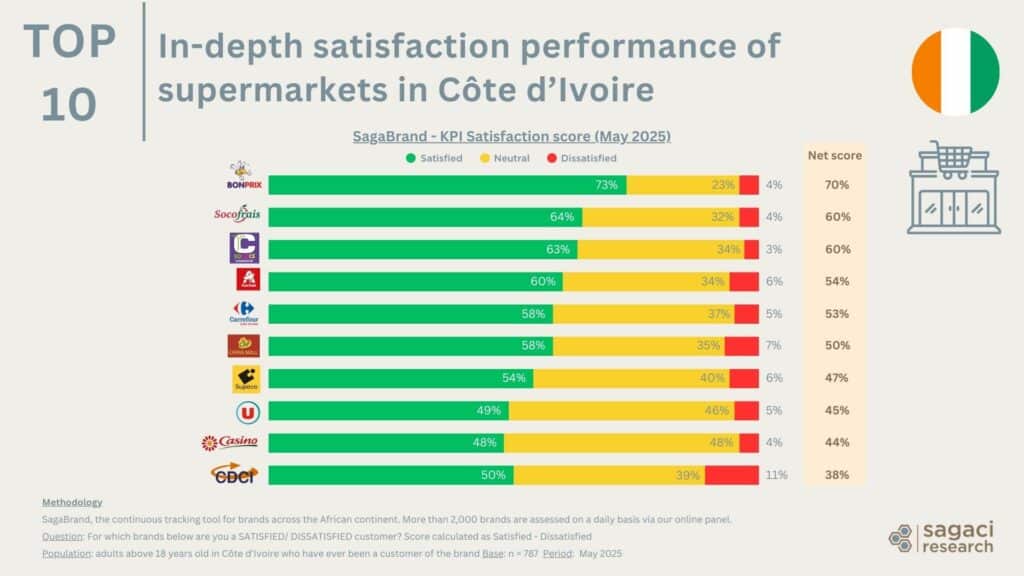

A recent SagaBrand study (our continuous brand health tracking tool across Africa) reveals the ranking of the best supermarkets in Côte d’Ivoire based on consumer satisfaction. We asked members of our online panel in Côte d’Ivoire to rate the supermarkets they have shopped at, identifying which ones they are satisfied or dissatisfied with. Read on to find out which are the most popular supermarkets in Côte d’Ivoire right now.

Ranking of the top supermarkets in Côte d’Ivoire

While awareness and recommendation might get shoppers in the door, customer satisfaction builds loyalty. To capture this, we use SagaBrand’s satisfaction score, calculated as the percentage of satisfied customers minus those dissatisfied.

Below is the list of top-rated supermarkets in Côte d’Ivoire based on the Customer Satisfaction score:

- BONPRIX (by Groupe Prosuma from Côte d’Ivoire) – 70%

- SocoFrais (from Côte d’Ivoire) – 60%

- Club Sococé (by Groupe Prosuma from Côte d’Ivoire) – 60%

- Auchan (by French Auchan Retail ) – 54%

- Carrefour (by CFAO Consumer Retail) –53%

- China Mall (by Chinese investment) – 50%

- Supeco (by CFAO Consumer Retail French Group Carrefour) – 47%

- Super U (by Groupe Prosuma from Côte d’Ivoire) – 45%

- Casino (by Groupe Prosuma from Côte d’Ivoire) – 44%

- CDCI (from Côte d’Ivoire, backed by Moroccan investor Retail Holdings) – 38%

Which supermarkets are standing out in Côte d’Ivoire in 2025?

Where international retailers Carrefour and Super U led in customer satisfaction in 2021, 2025 sees a striking change: the top three spots are now occupied by local players: BonPrix, Socofrais and Club Sococé.

These results indicate that supermarket shoppers in Côte d’Ivoire are now favouring medium-sized stores located in working-class neighborhoods (not just in Abidjan but also in secondary cities) with products priced affordably for the mass market.

Prosuma dominates Ivorian retail with BONPRIX leading customer satisfaction

The BONPRIX chain of mini-markets clearly leads the ranking with a 70% satisfaction score. It outperforms its closest competitor, SocoFrais, by 10 points. Owned by Prosuma, Côte d’Ivoire’s largest modern retail operator, BONPRIX is part of the group’s broader portfolio of hypermarkets, supermarkets and convenience stores.

Prosuma also appears in the ranking with Sococé (tied with Socofrais with 60%), while its larger-format supermarkets, Super U and Casino, rank lower, in 8th and 9th place respectively.

This contrast within Prosuma’s own portfolio highlights a clear consumer trend: Ivorian consumers now tend to value more convenience and locally adapted retail experiences over large-format, international supermarkets.

Socofrais: traditional products meet convenience

Socofrais, a relatively newer player in the Ivorian retail landscape, ranks 2nd in customer satisfaction with a 60% satisfaction score. Its innovative hybrid model blends the vibrancy and product variety of traditional markets with the standards of modern retail. Think fresh produce, spices, dried fish, and even frogs, all showcased in a clean, air-conditioned store setting. Its success shows that Ivorian consumers’ have a strong attachment to familiar local products while also valuing a comfortable retail experience.

Two CFAO brands rank among Côte d’Ivoire’s top retailers

CFAO Consumer Retail also performs well, with Carrefour in 5th, Supeco in 7th position. While Prosuma leverages deep local knowledge and neighborhood convenience formats, CFAO focuses on international brand expertise and modern retail concepts.

Although the group has started scaling back its low-cost Supeco cash-and-carry model (recently exiting Supeco and Carrefour in Senegal), it is doubling down on traditional hypermarkets and supermarkets under the Carrefour brand in Côte d’Ivoire. Carrefour is also expanding independently in other markets, notably with the July 2025 opening of its first hypermarket in Kinshasa, DRC, through a partnership with the local group Hyper Psaro.

Carrefour strengthens its presence in Côte d’Ivoire but struggles with shopper perception

In Côte d’Ivoire, Carrefour’s strategy focuses on large flagship stores to anchor a growing network of smaller supermarkets. One example is the recently renovated PlaYce Palmeraie in Abidjan, now home to West Africa’s largest Carrefour (3500m²). This aims to strengthen the group’s bargaining power with suppliers, boost local sourcing, broaden product variety, while also capturing further growth in new Ivorian cities.

One thing to note, however, is that Carrefour records a relatively high share of consumers feeling neutral about the brand (37%) compared to BonPrix (23%), which may reflect a weaker emotional connection or less distinct positioning in shoppers’ minds. Combined with a much lower Satisfaction score, this directly contributes to its weaker overall ranking against market leaders.

Auchan: top international retailer in Côte d’Ivoire’s supermarket ranking

In fourth place in our Top 10 best supermarkets in Côte d’Ivoire and first international brand in the ranking, Auchan achieves a 54% Quality Score. Since entering the market in June 2022, the French retailer has grown to fifteen supermarkets by 2025 focusing on proximity stores in low-income neighborhoods. With assortments tailored to urban consumers and a strong reliance on local sourcing (90% of its products come from Côte d’Ivoire) Auchan has found an effective formula to compete in a market increasingly dominated by local players. Building on this success, the French retailer, part of the Mulliez Group, aims to expand to 80 neighborhood outlets.

China Mall’s low-cost strategy disrupts traditional retail in Côte d’Ivoire

China Mall ranks 6th in overall satisfaction score, just behind major players like Auchan and Carrefour. Launched as part of China’s One Belt, One Road initiative to develop trade between China and other countries, the chain has rapidly expanded across several African countries including Côte d’Ivoire. It follows a high-volume, very low-cost strategy offering mostly imported household goods, electronics, clothing, and everyday essentials. While China Mall has increased consumer access to affordable products, its model has disrupted traditional intermediaries. Shoppers now buy directly from the stores, forcing some local traders to adapt by purchasing in bulk from China Mall and reselling on local markets or online.

CDCI: historic Ivorian retailer faces challenges in consumer satisfaction

As one of Côte d’Ivoire’s historic market leaders, CDCI ranks 10th on our list, posting the highest dissatisfaction rate at 11%. Targeting the mass market with a hard-discount approach the retailer runs a large network of wholesale (CDCI Gros), semi-wholesale (CDCI Demi-Gros), and retail stores (King Cash). Backed by recent funding from its parent company, Morocco’s Retail Holding, CDCI is executing an ambitious expansion plan to grow its footprint across the country while modernizing its infrastructure to compete with both local and international players. However, despite these investments, consumer experience has yet to catch up, keeping satisfaction lower than that of its competitors.

More on Côte d’Ivoire’s retail landscape in Africa

Overall, Côte d’Ivoire’s supermarket sector is evolving rapidly, featuring diverse formats, from hybrid traditional/modern stores and discount outlets to more sophisticated retailers, while placing greater emphasis on local sourcing, proximity, and shopper convenience. The competitive environment is marked by both strong local brands dominating customer preference and international groups investing heavily to grow and adapt within the market.

SagaBrand data provides actionable insights for retailers seeking to understand their competitive position and improve performance in Côte d’Ivoire’s retail market. This example is one of the 25 KPIs we track on an on-going basis for various categories.

For more insights and data on supermarket performance in Côte d’Ivoire, or any other African market, get in touch with us. Email contact@sagaciresearch.com or click below to connect.

Methodology

This analysis is powered by SagaBrand, the continuous tracking tool for brands across the African continent. More than 2,000 brands are assessed on a daily basis via our online panel.

Question:

- For which brands below are you a SATISFIED/ DISSATISFIED customer? Score calculated as Satisfied – Dissatisfied

Base: n = 787

Population: adults in Côte d’Ivoire above 18 years old who shopped at the brand

Period: May 2025

Images: © Facebook BONPRIX / China Mall CI / Socofrais / Auchan