- 19/05/2025

- Posted by: flore.demaigret

- Categories: Alcoholic beverages, Articles, Beer, SagaCube, Wine & Spirits

Alcohol consumption in Africa varies widely across countries. Factors such as cultural and religious norms, market availability, and affordability all contribute to distinct patterns in consumption levels and preferences. Yet, recent data from the SagaCube panafrican consumption tracker reveals that one beverage consistently ranks as the top choice across the continent.

What is the most popular alcoholic beverage in Africa?

Beer takes the top spot. According to data collected via the SagaPoll mobile panel, 26% of respondents reported consuming beer in the past four weeks, followed by wine (15%), spirits (8%), cider (6%), and ready-to-drink beverages (5%).

Across much of the continent, beer is more than just a drink, it is embedded in everyday social life, from traditional ceremonies and communal gatherings to informal settings. In many countries, the use of local grains like sorghum, millet, or maize in home-brewed beer has fostered a longstanding familiarity. This cultural grounding, combined with the wide availability of commercial brands, helps explain beer’s continued dominance in African alcohol consumption.

Beyond beer: Africa’s other favourite alcoholic drinks

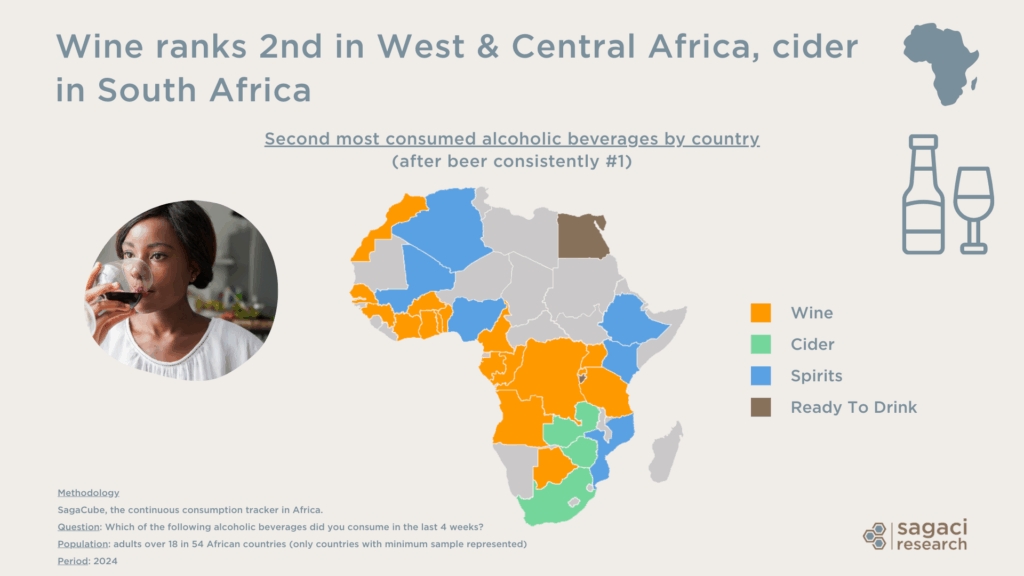

Preferences for other alcoholic beverages vary across the continent, reflecting cultural tastes and market dynamics. In countries like Morocco, Côte d’Ivoire, Cameroon, the Democratic Republic of Congo, and Tanzania, wine takes the second spot after beer. In contrast, spirits are the next most popular choice in countries such as Mali, Nigeria, Kenya and Mozambique.

Unsurprisingly, South Africa stands out for its strong preference for cider, supported by a well-established local industry. Brands like Savanna, Hunter’s Dry, and Strongbow (all produced locally by Heineken) enjoy widespread popularity.

Most consumed alcoholic beverages in Africa after beer

What are the top beer brands in Africa?

Through the SagaPoll app, panel members across Africa report through their mobile phones hundreds of FMCG products they purchase and consume each day. So, what insights does this rich consumer data reveal about the most popular beer brands on the continent?

Ranking of the most popular beers brands in Africa

These are the top-rated beer brands across African markets, ranked by average consumer rating (on a 1 to 5 scale), based on a minimum of 2,000 product scans per brand.

- Desperados (by Heineken)

- Castle Lite (by AB InBev)

- Heineken

- Guinness (by Diageo)

- Cuca (by Castel Group in Angola)

- Eka (by Castel Group in Angola)

- Doppel Munich (by Castel Group)

- Castel Beer (by Castel Group)

- Beaufort (by Castel Group)

- 33 Export (by Heineken)

Most popular beer brands in Africa based on consumers rating

Based on these consumer ratings, the top-ranked beer brands reflect a mix of global reach and strong regional presence. International brewers like AB InBev (Castle Lite), Heineken (Heineken, 33 Export, Desperados), and Diageo (Guinness) perform well thanks to their broad distribution and established reputations. The Castel Group also features prominently with several highly rated brands (Cuca and Eka from Angola, as well as Doppel Munich, Castel Beer, and Beaufort) demonstrating the group’s strong foothold, particularly in Central and West Africa.

Beer consumption in Africa: demographics, occasions and location

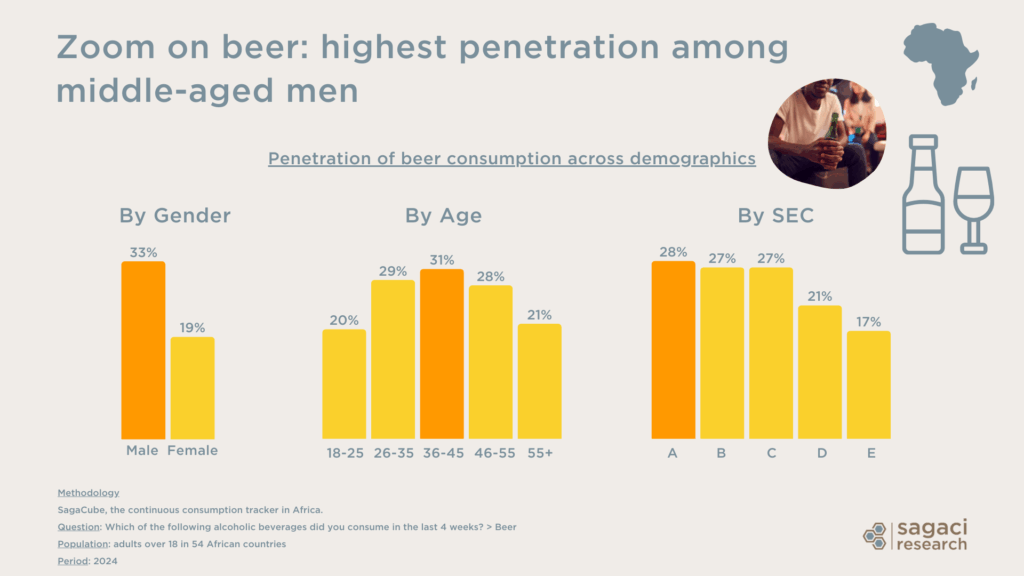

In Africa, beer consumption is notably higher among men (33%) than women (19%). It peaks among adults aged 36 to 45 (31%), while only 20% of 18 to 25-year-olds report drinking beer. The data also shows a clear correlation with income: the lower the income bracket, the less likely individuals are to consume beer.

Demographics of beer consumption in Africa

Alcohol is most commonly consumed at home, particularly wine and spirits, which are often shared during meals or personal moments. Beer, on the other hand, is equally popular at home and in social venues like bars and pubs. Across the board, alcohol consumption is closely linked to special occasions and well as casual gatherings with friends and family.

Further consumer insights on beverages in Africa

This data, drawn from our online panel in Africa, highlights key contrasts in alcohol consumption across Africa. We regularly share this type of insights across many FMCG categories and African markets. For example, our reports on the energy drinks market in Africa and top soda brands in Algeria in 2024 provide in-depth breakdowns of consumer habits and brand preferences on other beverage categories.

For detailed insights into alcoholic beverage consumption or the beer market in Africa, whether by country, alcohol type, or key players in your category, we have the data you need.

So for information on our research tools or specific research needs, please email us at contact@sagaciresearch.com or click below.

Methodology

This analysis is powered by two of our tools:

SagaCube, the continuous consumption tracker across the African continent

SagaProduct, the largest product database in Africa providing insights into products being purchased / consumed across the continent.

- Questions:

- Which of the following alcoholic beverages did you consume in the last 4 weeks?

- On which occasions do you ever drink beer / spirits / wine / champagne or sparkling wine?

- Where do you drink beer / spirits / wine / champagne or sparkling wine most often?

- Base: Minimum base size per country displayed

- Population: adults in Africa above 18 years old

- Period: 2024