- 14/04/2025

- Posted by: flore.demaigret

- Categories: Articles, Automotive, SagaBrand, SagaCube, South Africa

In this article, we explore the top car brands in Africa, focusing on Toyota‘s continued leadership across the continent. We also examine car ownership trends to uncover where the largest automotive markets are emerging.

Who owns cars in Africa in 2025?

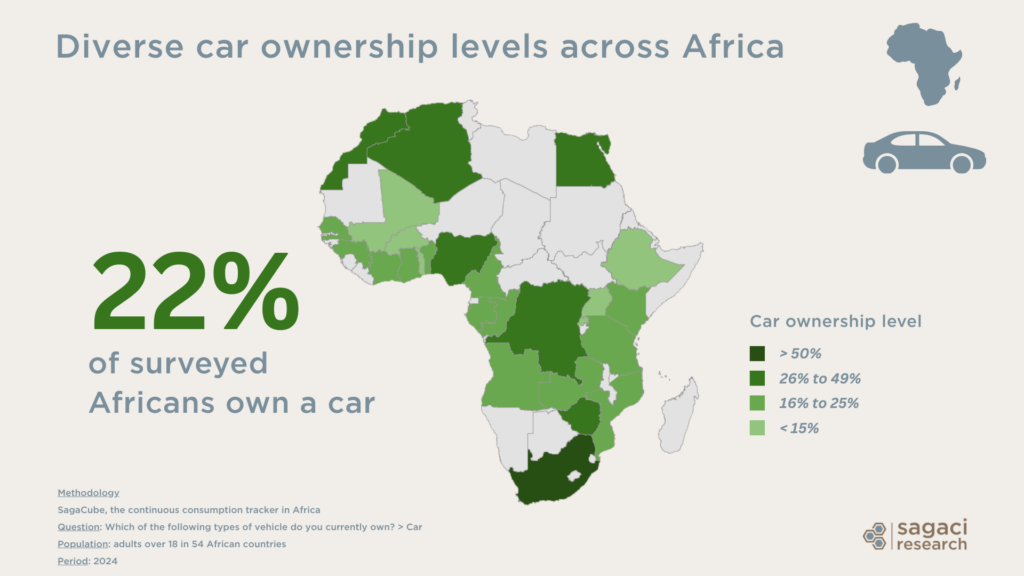

According to SagaCube African consumption tracker, fewer than 1 in 4 Africans (22%) owned a car in 2024. Given the continent’s lower purchasing power, high vehicle and fuel costs, limited infrastructure, and widespread reliance on affordable informal transport, this comes as little surprise. However, ownership levels vary significantly by region, revealing key insights into the automotive market dynamics across Africa.

Car ownership by country

South Africa, Africa’s largest automotive manufacturing hub, tops the continent with a 50% car ownership rate, significantly surpassing the regional average. Nigeria follows at 35%, Egypt at 33%, Zimbabwe at 29%, and Algeria at 28%. Other countries like Morocco, DRC, Benin, and Kenya also report figures above 20%. However, several nations in East and West Africa have much lower levels, with countries such as Burkina Faso, Ethiopia, Rwanda, and Uganda below 13%. These numbers highlight the uneven spread of vehicle ownership and suggest growth potential in less motorized markets.

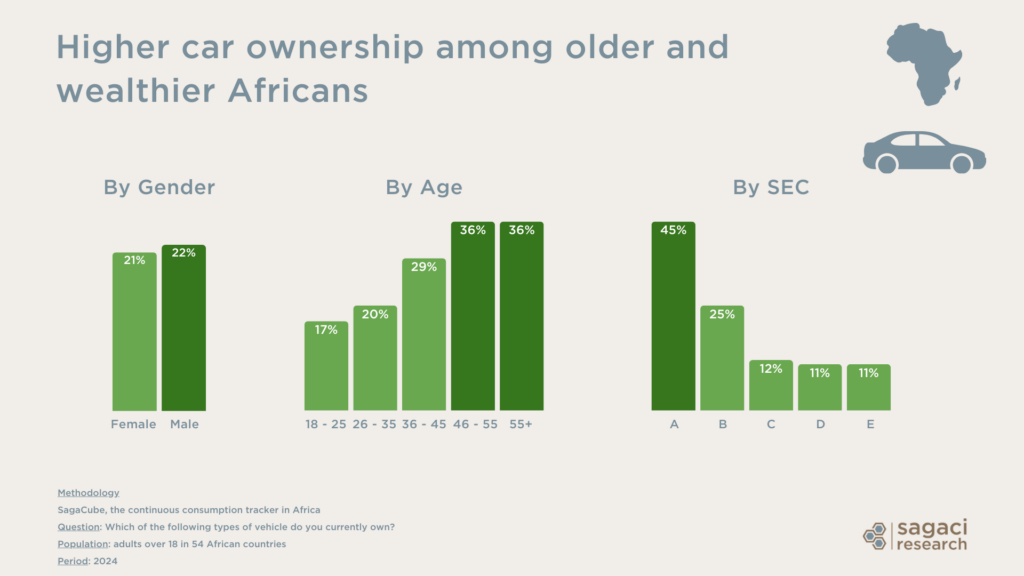

Car ownership by demographics

Car ownership patterns also vary greatly by age and socio-economic status. While the gender gap is minimal — with 22% of men and 21% of women owning a vehicle — wealthier individuals are far more likely to own a car. Among the highest income group (SEC A), 45% own a vehicle, while only 11% of those in lower-income groups (SEC D/E) do. Additionally, car ownership increases significantly with age, rising from 17% for 18–25-year-olds to 36% for those aged 46 and above.

What are the top car brands in Africa?

Toyota, African consumers’ favourite car brand

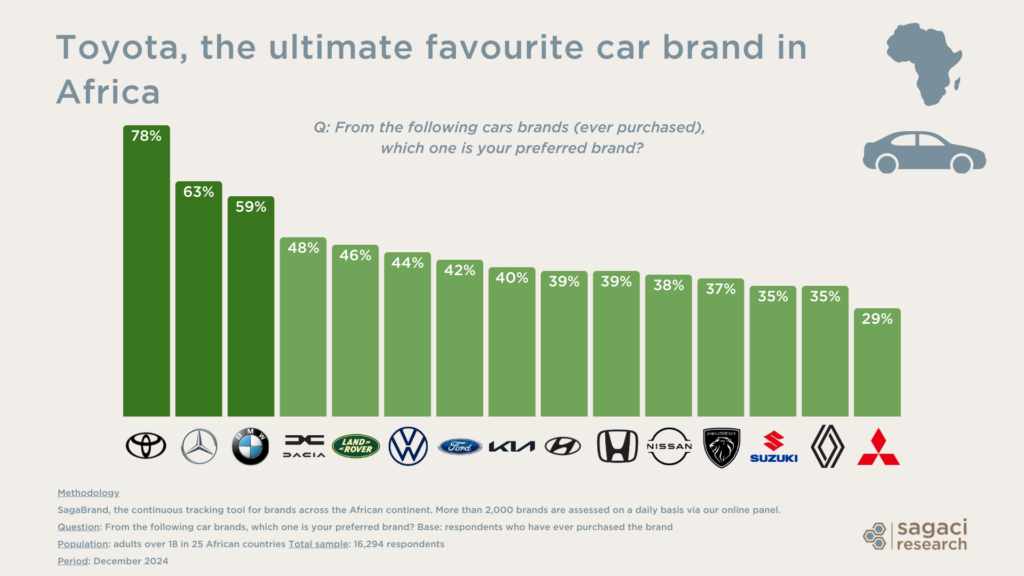

Based on SagaBrand brand health tracking tool, Toyota remains the most preferred car brand across Africa, with 78% of consumers who have ever owned a Toyota naming it as their favourite.

This strong preference is driven not only by Toyota’s reputation for durability and reliability (ideal for Africa’s challenging road conditions) but also by the widespread availability of spare parts.

In part thanks to its integration with CFAO, a leading distributor and business group in Africa, Toyota has built an extensive network for manufacturing, sales, and parts distribution, particularly in West and Central Africa. This extensive presence makes maintenance more accessible and plays a key role in Toyota’s strong appeal among most African consumers.

As the African automotive sector continues to evolve, local manufacturing and assembly projects (such as Dacia’s operations in Morocco) are gaining traction and contributing to a more competitive landscape. Still, Toyota remains in the lead, followed by Mercedes (63%) and BMW (59%). Other well-known brands like Land Rover, Volkswagen, Ford, Kia, Hyundai, Honda, Nissan, Peugeot, Suzuki, Renault, and Mitsubishi are also making their mark.

Toyota leads top car brands in Africa, with one notable exception

While Toyota leads in most Sub-Saharan countries, South Africa presents an interesting exception.

Although South Africa is a strategic hub for Toyota on the continent, supporting both domestic sales and regional exports, Suzuki holds a slight edge in brand preference within the country. Among Suzuki owners, 66% name it as their favourite brand, compared to 63% for Toyota owners.

Other exceptions appear across North Africa and select West African markets. In Morocco, Dacia (produced locally by Renault) takes the lead. Volkswagen ranks first in Algeria, while BMW tops the list in Egypt, Mali, and Guinea.

You might also like these earlier insights on the Automotive sector in Africa.

Conclusion

These insights, powered by Sagaci Research’s tracking tools SagaBrand and SagaCube, highlight Toyota’s continued dominance in the African car market, along with regional variations in ownership. Could this suggest significant growth potential for Africa’s automotive industry particularly in these underserved markets?

For further consumer insights on the consumer equipment sector or other market data in Africa, reach out to us on contact@sagacirearch.com or click below.

Methodology

- SagaBrand, Africa’s leading online Brand Health Tracker, tracks consumer perceptions of approximately 2,000 brands daily across the continent. It monitors 40 key performance indicators (KPIs).

- Question: From the following car brands, which one is your preferred brand?

- Base: respondents who have ever purchased the brand

- Population: adults over 18 in 25 African countries

- Total sample: 16,294 respondents

- Period: December 2024

- SagaCube, Africa’s premier consumer habit tracker, leverages our extensive online panel to monitor over 150 consumer categories (including consumer equipment) and 800+ usage and attitude segmentation variables.

- Question: Which of the following types of vehicle do you currently own?

- Population: adults over 18 in 54 African countries

- Period: 2024