- 27/02/2025

- Posted by: flore.demaigret

- Categories: Articles, Financial Services, Insurance, SagaBrand

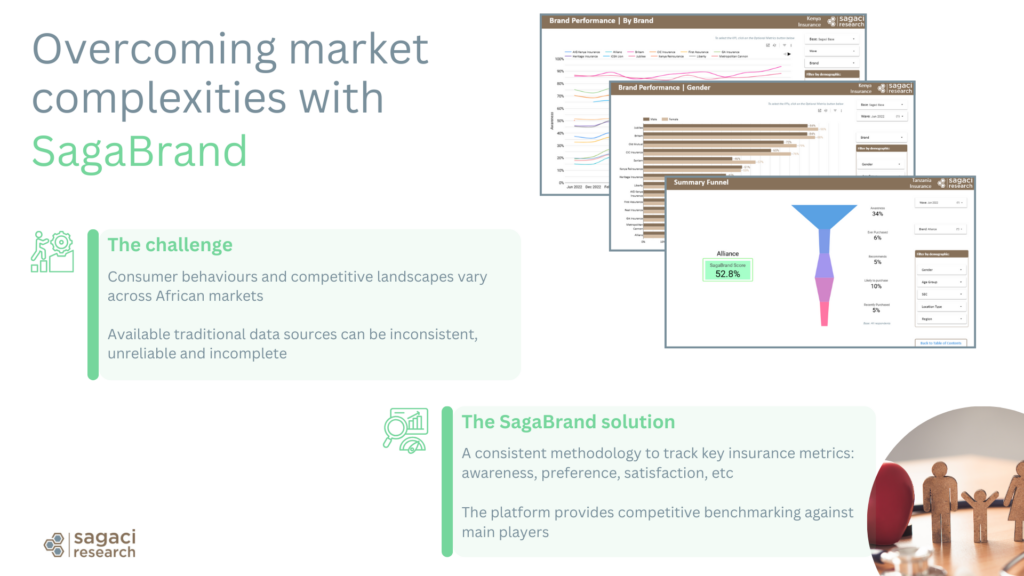

African insurance brands performance is key in Africa’s growing insurance industry, where customer satisfaction and brand recommendation drive long-term success. With growing competition and increasing consumer expectations, insurance companies in Africa must consistently monitor their brand perception to remain competitive.

How can African insurance companies measure brand performance effectively?

SagaBrand, Sagaci Research’s African insurance brands tracking tool, provides a comprehensive solution by tracking key performance indicators (KPIs) such as insurance customer satisfaction and brand preference across multiple African markets. This ongoing measurement enables insurers to assess their positioning, identify market trends, and refine their strategies based on real consumer feedback.

Why is customer satisfaction important for insurance companies?

Customer satisfaction plays a pivotal role in insurance customer retention and word-of-mouth marketing. In Africa, where insurance penetration rates vary significantly by country, understanding what drives satisfaction is essential for insurers seeking to build trust.

SagaBrand’s data highlights how insurance satisfaction levels differ by provider and market, shedding light on areas where companies excel or underperform. Elements such as claims processing time, transparency, and customer service often emerge as key differentiators. Tracking these aspects allows insurers to refine their offerings and improve insurance service quality.

What makes customers recommend an insurance brand?

Recommendation rates provide valuable insights into consumer sentiment. A high brand advocacy score suggests strong brand trust, while a low score may indicate dissatisfaction or weak brand engagement.

SagaBrand’s tracking enables insurance brands in Africa to benchmark themselves against competitors, identify trends, and address weaknesses proactively. By understanding the factors influencing recommendation—whether pricing, service quality, or claim experiences—insurers can fine-tune their customer experience strategies.

Tracking insights to drive strategic decisions

Continuous monitoring of customer experience KPIs equips insurance companies in Africa with actionable insights to enhance their market position. By leveraging SagaBrand’s robust tracking, insurers can:

- Identify strengths and weaknesses in their insurance service offerings

- Benchmark their brand reputation against competitors

- Adapt strategies to shifting African insurance market trends

- Strengthen customer loyalty and retention initiatives

Case study: How African insurers are using SagaBrand to refine their strategies

SagaBrand has helped insurance brands across Africa navigate market complexities with real-time insights. For instance, recent data showed that an insurer’s satisfaction and recommendation scores rose significantly from Q4 2023 to Q4 2024. This improvement could be linked to strategic initiatives such as enhanced customer service and personalized policy options. Meanwhile, another insurance player demonstrated a stronger presence among younger demographics, highlighting the need for digital engagement strategies to build long-term retention.

Leveraging SagaBrand tracker for deep consumer insights

SagaBrand is powered by Sagaci Research’s online panel in Africa, which ensures access to a broad consumer base for in-depth market research. By continuously gathering feedback directly from policyholders, SagaBrand provides insurers with real-time insights into satisfaction levels, brand perception, and shifting customer expectations. This integrated approach enables insurance companies to develop more targeted and effective strategies while staying ahead of market trends.

As Africa’s insurance market evolves, staying attuned to consumer sentiment is more important than ever. SagaBrand offers a powerful tool for insurers looking to refine their approach and stay ahead in an increasingly competitive industry.

For more details on how SagaBrand can support your insurance brand’s growth, get in touch with our team today.