- 10/10/2025

- Posted by: Janick Pettit

- Categories: Articles, Consumer Goods / FMCG, Kenya, SagaProduct

FMCG innovations in Kenya: how brands are winning consumers

Kenya’s FMCG market remains highly dynamic, with brands regularly introducing new formats, flavours, and packaging to stand out on shelves. Thanks to the Sagaci Research Shopper Panel in Kenya, we can track which new products and packs are entering the market. We can identify the innovations gaining the most traction with consumers.

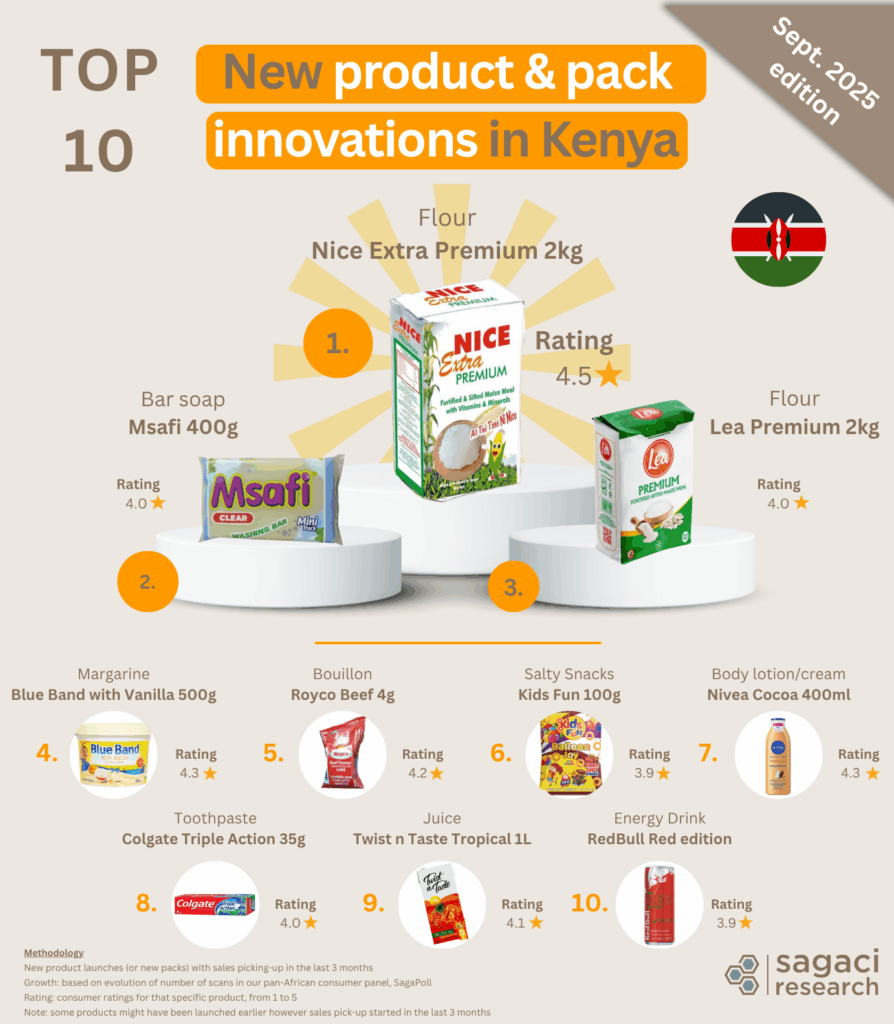

Our September 2025 analysis looks at performance down to the SKU level, highlighting the products whose consumer scans have increased the most over the past three months. This article presents the Top 10 FMCG innovations in Kenya, showcasing both local and international brands that have recently captured shopper attention.

Top FMCG Innovations in Kenya

So what are the top 10 product innovations in Kenya in September 2025? Analysis from our Shopper Panel identified the following FMCG brands and specific SKUs:

- Nice Extra Premium Flour 2kg by Kenyan manufacturer Nice Extra Premium

Nice Extra Premium 2 kg launched around July 2025 with strong out of home visibility, roadshows, customer challenges, and street level sampling. The brand positions its fortified 2 kg flour on quality and nutrition for everyday family cooking, while building presence in open markets and neighborhood shops to drive trial and repeat purchase. Early feedback is positive: on a 5 point scale consumers rate it 4.5. Keeping the activity visible and the product consistently available will be key to sustaining momentum against established flour players.

- Msafi Bar Soap 400g by regional Bidco Africa

Msafi, long sold in 1kg and 700g bars, now adds a 400g option. The smaller pack lowers the cash out at purchase, suits quick top ups, and is easier to carry home from kiosks and open markets. It also encourages first time trial before households move to larger bars.

- Lea Premium Flour 2kg by New Paleah Millers

In Kenya’s increasingly competitive flour market, newcomer New Paleah Millers introduced the Lea Premium flour brand in early summer 2025. Since its launch, the brand has been highly visible through roadshows, event sponsorships such as the Thika Cake Festival, and collaborations with influencers. These direct consumer activations have helped boost brand awareness and build a stronger connection with local communities.

- Blue Band with Vanilla 500g by Flora Food Group

Blue Band, one of Kenya’s most established spreads brands and among the top FMCG items in Kenyan households, has expanded its portfolio. It has added products such as peanut butter, instant porridge, and chocolate spread. Most recently, the brand introduced a new flavoured variant of its classic margarine, likely in response to Prestige (by Kapa Oil), which has been offering its Vanilla version for several years.

- Royco Beef 4g sachet by Unilever

Royco has been a trusted seasoning in Kenya for more than six decades and remains one of Unilever Kenya’s leading brands. Our shopper panel in Kenya recently picked up a new Royco reference, a 4 g sachet available individually or in a twelve piece string pack. The string pack is easy for retailers to display at the counter or on hooks. It also meets shoppers’ needs for convenience by allowing small quantity buys and simpler storage and use.

What are the other leading new innovations in Kenya?

Here are five more new product or pack launches in Kenya.

- Kids Fun Salty Snacks 100g by SRK Foods Industries

Our shopper panel in Kenya has picked up a new 100g pack of Kids Fun salty snacks. It complements a range of kid-oriented options that often include a free surprise gift inside.

- Nivea Cocoa Body Lotion 400ml by Beiersdorf

Nivea refreshed one of its top-selling variants with an updated packaging design. It gives it a more modern, premium appearance while keeping the trusted Cocoa formulation unchanged.

- Colgate Triple Action Toothpaste 35g by Colgate-Palmolive

Our shopper panel in Kenya has picked up Colgate Triple Action in a 35g tube. While it is new in Kenya, this small size is already being sold in Angola. The 35g format has also long been present in the Herbal and Total variants. Triple Action now follows the same small format. The 35g pack fits frequent top ups and small store purchases, and offers a simple way for shoppers to try the variant.

- Twist n Taste Juice 1l by PepTang / Premier Foods

Recent panel scans in Kenya show the new juice brand Twist n Taste Juice, released in August 2025. Twist n Taste is part of the PepTang and Premier Foods Limited juice portfolio, alongside PepTang, PEP, and Orchid Valley. The most scanned flavour is Tropical in a 1 liter pack, with Apple launched at the same time.

- Red Bull Red Edition by Red Bull

In the energy drink market in Kenya, Red Bull has recently expanded its range with the Red Edition in watermelon flavour, adding choice to a crowded aisle. The variant competes with Predator, which leads on price, and with Sting from Pepsi, a recent entrant. Sting offers bold flavours and eye-catching packaging at a mass market price, while Red Bull leans on global brand recognition and a more premium position.

Why product and packaging testing matter for FMCG brands in Kenya

These FMCG innovations in Kenya highlight how brands are adapting to evolving shopper expectations. New products or variants, smaller formats, fortified recipes, and refreshed designs remain key growth drivers. On-ground visibility through roadshows, sampling, and activations also plays an essential role in boosting awareness and trial.

To note that before launching a new product or pack, product testing in Kenya and packaging testing in Kenya is critical. It helps brands ensure that the concept, taste, format, and design truly resonate with local consumers. These tests provide practical feedback on purchase intent, visual appeal, and perceived value, reducing risk and improving market success.

Through our Shopper Panel in Africa, Sagaci Research tracks consumer behaviour across the continent, revealing how new launches, packaging updates, and marketing activities translate into real purchase behaviour.

Want to know which innovations are gaining traction in your category? Get in touch with our team below.

Methodology

- New product launches (or new packs) in Kenya with sales picking up in the last 3 months.

- Growth based on the evolution of the number of scans in our pan-African consumer panel, SagaPoll.

- Ratings are included as additional consumer feedback on each product (scale from 1 to 5).

- Note: some products might have been launched earlier; however, sales pick-up started in the last 3 months.

©Image: pch.vector on Freepik