- 21/07/2025

- Posted by: Janick Pettit

- Categories: Articles, SagaCube

As the sports business in Africa gains momentum, new data from SagaCube, Sagaci Research’s pan-African consumption tracker, offers a fresh look at how people across the continent engage with sports, both on and off the field.

From favourite sports and top leagues to beverage consumption linked to physical activity, the data paints an updated picture of the sports industry in Africa from a consumer perspective. Whether it’s football fandom, viewing behaviours, or lifestyle choices, these trends illustrate the place sports hold in the lives of millions across Africa.

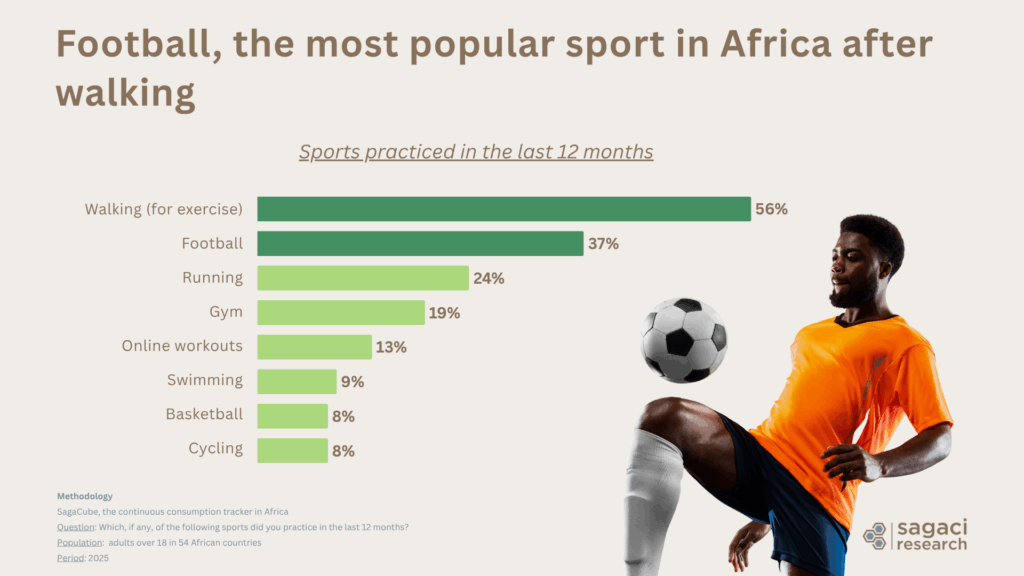

How Africans stay active: top sports in Africa

Across Africa, sport is more than entertainment: it is embedded in daily routines for a majority of people. A striking 72% of respondents from our online panel in Africa say they enjoy practicing sports in their free time.

Walking tops the list of sports activities in Africa, with 56% choosing it for exercise, highlighting the appeal of accessible urban fitness. Football, deeply rooted in African culture and communities, remains highly popular, with 37% having played it in the past year. Other activities include running (24%), gym (19%), online workouts (13%), swimming (9%), and both basketball and cycling at 8%.

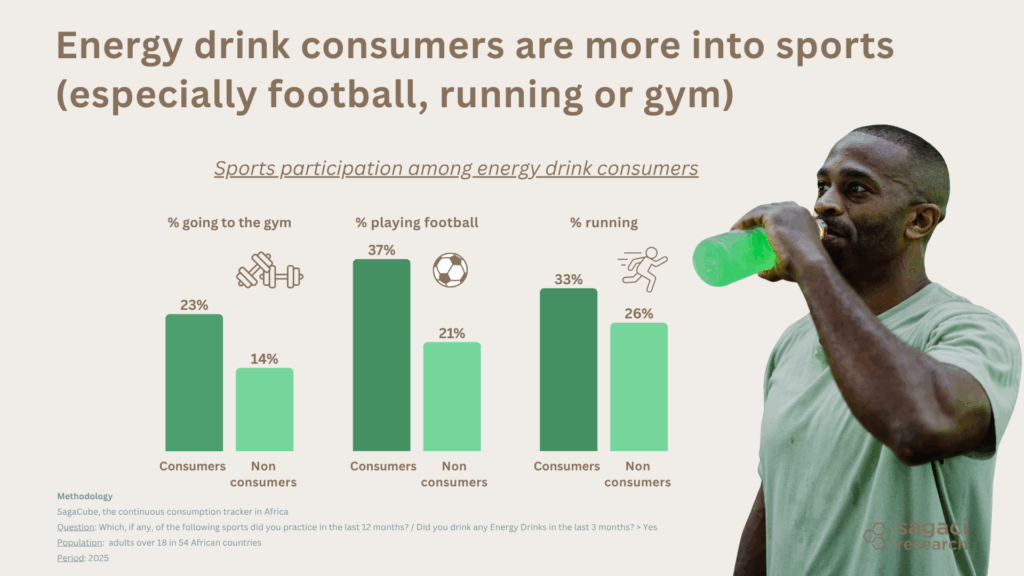

Link between energy drink consumption and sports activities in Africa

Recent data shows that energy drink consumption is rising in Africa, driven by a young, active population and growing sports culture. These beverages are closely linked to sports for their perceived energy and performance benefits. But does the data confirm this, and which sports show the strongest connection?

It certainly does, especially when it comes to football.

Africans who have consumed energy drinks in the last 3 months are significantly more engaged in sports than non-consumers. Over a third of them play football (vs. 21% of non-consumers). They are also more likely to go running or work out at the gym. This pattern highlights a clear opportunity for brands of energy drink to target a large, physically active consumer base through strategic positioning and targeted campaigns.

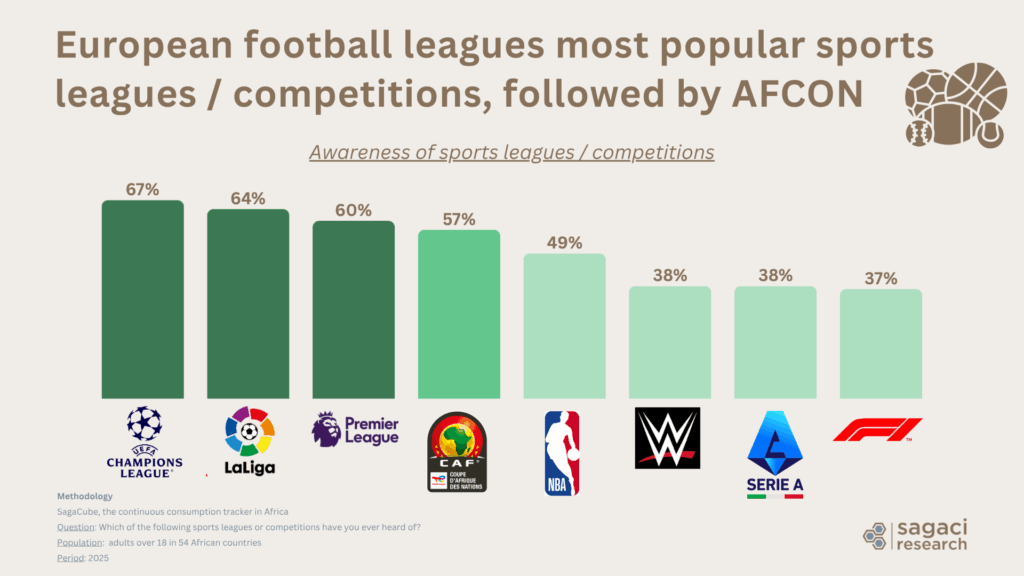

What are the most popular sports leagues or competitions in Africa?

Survey results indicate that European football leagues dominate the landscape of sports fandom in Africa. They are followed closely by the prestigious African Cup of Nations (AFCON) and further down by the NBA.

Top leagues / competitions by awareness among African sports fans:

- UEFA Champions League (67%) – The most widely recognized competition, thanks to its global prestige and likely the strong presence of African players in top European clubs.

- La Liga (64%) – Spain’s top league is also highly familiar, boosted by iconic teams like Real Madrid and Barcelona.

- English Premier League (60%) – Known for its strong media presence across Africa, making it a staple among fans.

- African Cup of Nations (AFCON / CAF) (57%) – Africa’s leading football tournament will take place later this year in Morocco. Held every two years, it draws large audiences, extensive media coverage, and features the continent’s top national teams. Brands like Danone, and Tecno have already been confirmed as official partners of the event.

- NBA (49%): it is the top non-football league in Africa boosted by a growing African representation with stars like Joel Embiid and Pascal Siakam (both from Cameroon). Additionally, the NBA Academy Africa and Basketball Africa League (BAL) are nurturing future talent, further strengthening the league’s ties to the continent.

Live sports on TV: PayTV subscription leads as Africa’s top viewing choice

Among live sports viewers in Africa, 42% watch via PayTV, making it the most popular platform, followed by 25% who use traditional free-to-air TV, and 21% who stream events for free on live websites.

Because most major sports championships are exclusively broadcast on PayTV platforms like DStv, many viewers subscribe to gain access to premium live sports content unavailable on free-to-air channels.

So who are the main PayTV players when it comes to broadcasting sport events?

- SuperSport, owned by South African MultiChoice, the leading PayTV provider in Africa and available through DStv, dominates the market with broadcasting rights to top football leagues like the Premier League, UEFA Champions League, CAF Champions League.

- Qatari beIN Sports broadcasts La Liga, Serie A, Ligue 1, and some CAF events.

- Chinese owned StarTimes, one of the leading digital TV operators and PayTV service providers in Africa, covers the CAF Confederation Cup as well as local African leagues, and select international football.

- French broadcaster Canal+ Afrique focuses on French Ligue 1, CAF competitions, and basketball.

Meanwhile, local free-to-air broadcasters air national leagues and major tournaments such as the FIFA World Cup and Africa Cup of Nations, depending on the country.

Sports business in Africa: engagement through play but also betting

Another way to engage with sports is online and via mobile apps. According to a recent Sagaci Research survey on gambling and betting in Africa, one in three respondents has recently engaged in money-related games or bets. Among them, sports clearly dominate, with 65% placing their bets on sporting events. Within sports betting, football stands out, accounting for an overwhelming 97% of online wagers.

More on the sports market in Africa

With SagaCube, we continuously track real-time consumption and engagement across Africa’s vibrant sports ecosystem leveraging our extensive panafrican online panel. Our data enables sports brands, broadcasters, and sponsors to monitor fan behaviour, media consumption, and product usage trends across the continent.

These insights create valuable opportunities for strategic partnerships and targeted marketing to connect with Africa’s growing sports audience.

If you want to explore more specific consumer trends and sports marketing strategies, we have the data to support you. To learn more about the sports business in Africa, contact us at contact@sagaciresearch.com or click below.

Methodology

This analysis on the sports business in Africa is powered by SagaCube, the continuous consumption tracker across the African continent.

Questions:

- To what extent do you agree or disagree with the following statement :“I like to practice a sport activity when I have free time”

- Which, if any, of the following sports did you practice in the last 12 months?

- Which of the following sports do you bet on most often?

- Which of the following sports leagues or competitions have you ever heard of?

- Which of the following methods do you usually use in order to watch live sports events?

- Did you drink any Energy Drinks in the last 3 months?

- Which of the following sports leagues or competitions is your FAVOURITE?

Population: adults in Africa above 18 years old across 54 countries

Base: n = from 4,202 to 101,097 depending on the questions

Period: from 2023 to 2025