- 01/07/2025

- Posted by: Janick Pettit

- Categories: Articles, SagaCube, Telecommunication

Telecom usage in Africa is evolving, with mobile-first solutions playing a central role in how people connect, communicate, pay, and play. A recent SagaCube study identified which mobile solutions Africans use to access the internet at home, and uncovered broader insights into how digital tools shape everyday life. From internet access and mobile communication to mobile money and mobile gaming, this article breaks down some key consumer behaviours and highlights emerging trends shaping the African telecom landscape today.

Telecom usage in Africa: home internet

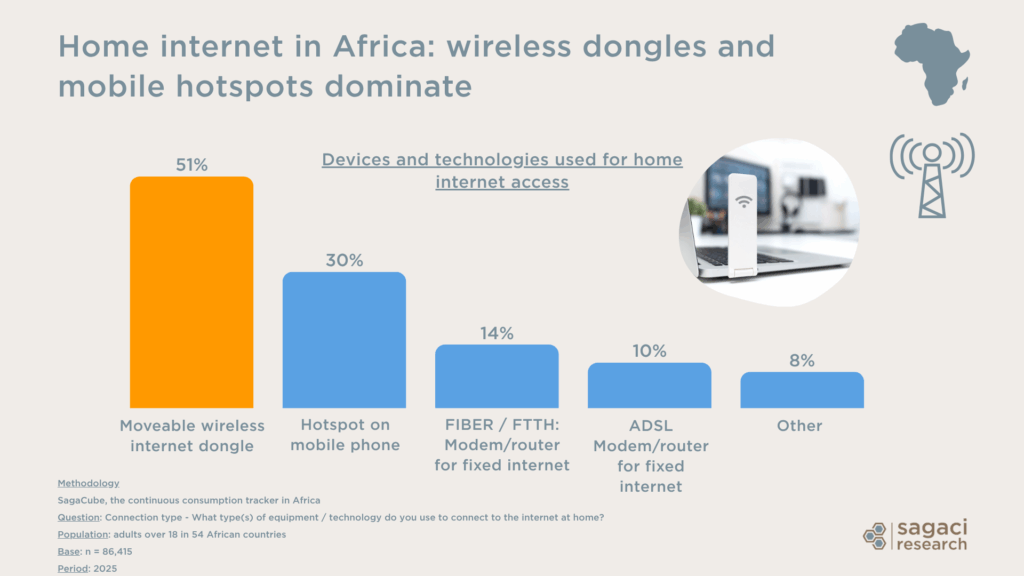

The most common internet connection method at home is the 3G/4G/5G wireless dongle, used by 51% of respondents, followed by mobile phone hotspots, chosen by 30%. In contrast, only 14% of users reported having access to fiber (FTTH), and 10% use ADSL. These figures highlight the ongoing dominance of mobile-first connectivity across Africa, with fixed internet infrastructure still trailing behind in terms of adoption.

Mobile and digital platforms as key information sources in Africa

77% of respondents say they browse the internet to stay informed about the latest trends (equivalent roughly to 2 in 3 people), confirming the growing role of digital platforms as a primary source of information across the continent.

Meanwhile, over half of panelists (54%) say they couldn’t get through the day without mobile communication, underlining the strong integration of mobile phones into Africa’s everyday routines.

Mobile money usage and everyday payments in Africa

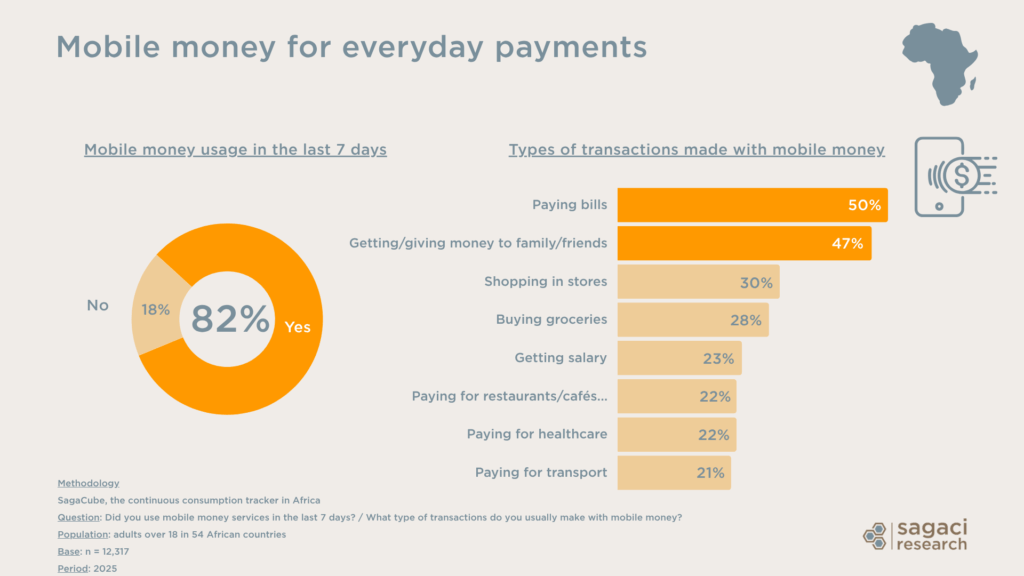

Mobile money plays a major role in the everyday financial habits of African consumers. Over 4 in 5 respondents (82%) have used mobile money recently (last 7 days). Half of them rely on it to pay bills such as rent, electricity, or internet, making bill payment the most common type of transaction.

47% send or receive money from family or friends, highlighting its importance for personal financial support. Other frequent uses include shopping in stores (30%), buying groceries (28%), and receiving salaries or payments (23%). Consumers also regularly use mobile money to pay for transportation, healthcare, and food vendors. These results confirm the strong adoption of mobile money in Africa as a practical, trusted, and flexible tool for everyday expenses and peer-to-peer transfers.

Top mobile money services in Africa

Countries like Kenya, Ghana and Nigeria lead the mobile money market in Africa in terms of adoption, innovation and integration of mobile money into daily economic life. Among the biggest players we find M-Pesa, the pioneering and most influential mobile money service in Africa launched by Safaricom in Kenya in 2007. Other major operators include MTN Mobile Money (Momo), the largest by geographical reach (15 markets) and Airtel Money also widely used especially in Francophone Africa.

Mobile gaming trends in Africa: daily use, limited spend

According to SagaCube, 35% of respondents play mobile games daily, while 16% play weekly. Despite high engagement levels, only 16% report spending money on in-app purchases, indicating that while gaming is popular, monetization remains limited.

However, as highlighted in our recent article about gambling and betting in Africa, mobile apps are already the most common platform for placing bets and participating in gambling activities across the continent. This shows that African consumers are willing to spend money on mobile-based entertainment when the right incentives and user experiences are in place.

These recent findings suggest there is room for growth in in-app monetization and mobile gaming development tailored to the African market. As smartphone usage in Africa continues to rise, so too does the potential for expansion in the mobile gaming sector.

Further consumer insights into telecom usage in Africa

This data, drawn from our online panel in Africa, reveals key insights into telecom trends in Africa, from how people connect to the internet at home, to mobile communication habits, mobile money transactions, and mobile gaming behaviours. We regularly publish similar findings across a wide range of sectors and African markets.

Whether you’re looking for detailed data on the African telecom market, insights on digital payments, we have the data you need. So for more information on these telecom topics or other specific research needs, please email us at contact@sagaciresearch.com or click below.

Methodology

This analysis is powered by SagaCube, Sagaci Research’s consumer tracker in Africa.

Questions:

- What type(s) of equipment / technology do you use to connect to the internet at home?

- Agreement with the following statements :“I surf the internet and other places to be aware of the latest trends” / “I couldn’t get through the day without mobile communication”

- Did you use mobile money services in the last 7 days?

- What type of transactions do you usually make with mobile money?

- How often do you play mobile games?

- Do you spend money on in-app purchases in mobile games?

Population: adults in Africa above 18 years old across 54 countries

Base: varies across questions but n = minimum 12,040

Period: 2025