- 11/09/2025

- Posted by: Janick Pettit

- Categories: Articles, Consumer Goods / FMCG, Kenya, SagaProduct

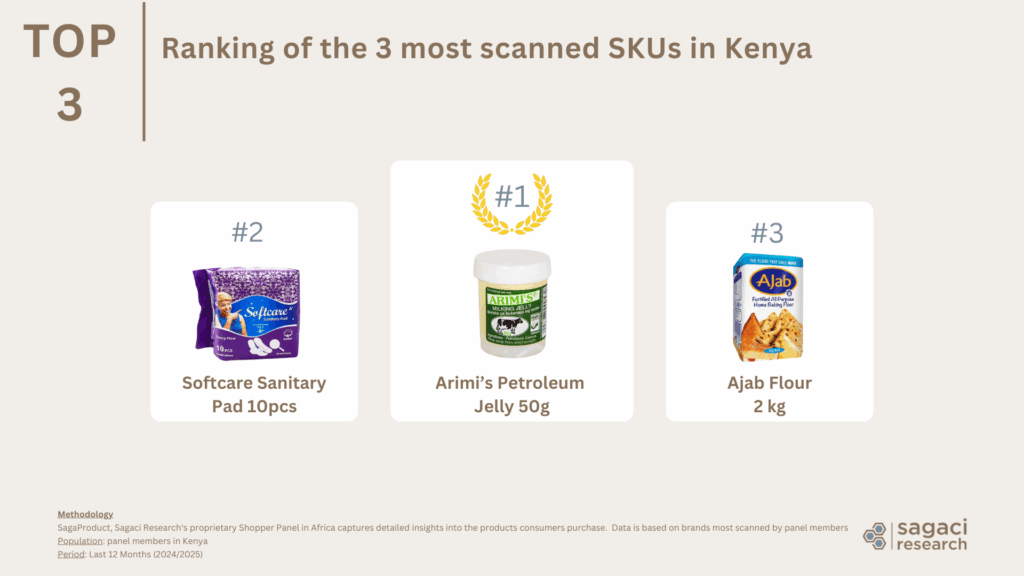

Which products truly define Kenyan households today? Thanks to SagaProduct, Sagaci Research’s proprietary Shopper Panel in Africa leveraging our online panel in Kenya, we can answer this question with precision. By tracking thousands of consumer product scans at home and in pantries, SagaProduct reveals what people actually use, not just what they say they buy. This approach provides a unique ranking of the most popular consumer goods in Kenya over the last 12 months (2024/2025).

Ranking of Kenya’s top 30 consumer goods

Here are the top 30 consumer goods most frequently scanned by Kenyan households:

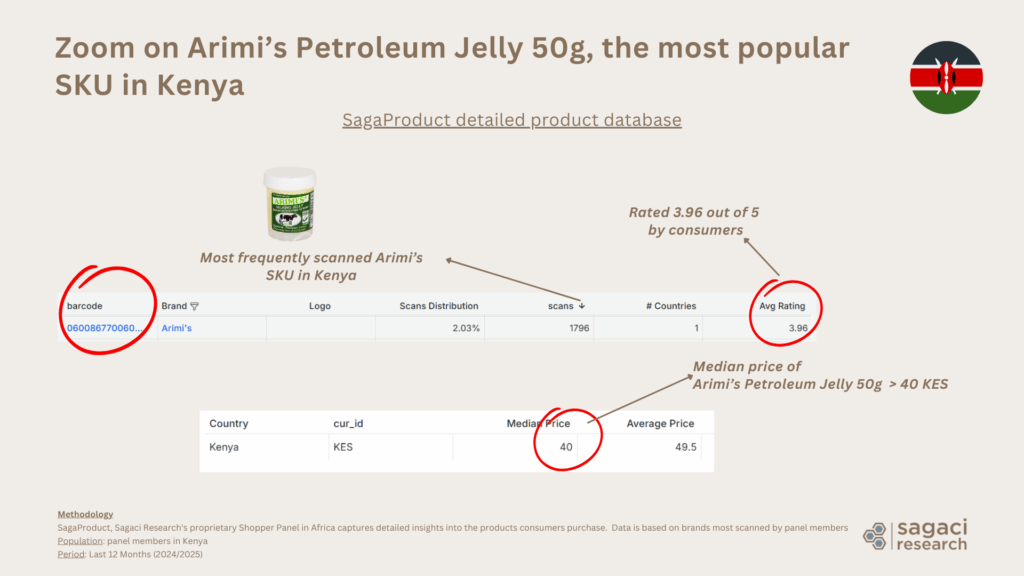

- Arimis’ Petroleum Jelly 50g (by Tri-Clover Industries, from Kenya)

- Softcare Sanitary Pad 10pcs (by Chinese Softcare)

- Ajab Flour 2kg (by Grain Industries, from Kenya)

- Predator Energy Drink 400ml (by Coca-Cola Beverages Africa)

- Chapa Mandashi Baking Powder 100g (by Kapa Oil Refineries from Kenya)

- Kensalt Salt 500g (by Kensalt from Kenya)

- Arimis’ Petroleum Jelly 200g

- Kensalt Salt 1kg

- Blue Band Spread 500g (by Dutch Flora Food Group)

- Blue Band Spread 250g

- Arimis’ Petroleum Jelly 90ml

- Brookside Milk 500ml (by Kenyan Brookside Dairy)

- Nescafé Coffee 1.5g (by Nestlé)

- Indomie Instant Noodles 120g (by Indomie Kenya)

- Mount Kenya Milk 500ml (by Meru Dairy from Kenya)

- Vaseline Petroleum Jelly 25ml (by Unilever)

- RingOz Corn Rings 12g (by Norda Industries from Kenya)

- Kensalt Salt 2kg

- Blue Band Spread 100g

- Blue Band Spread 1kg

- Softcare Baby Wipes 80pcs

- Fanta Blackcurrant 2L (by Coca-Cola Beverages Africa)

- Coca-Cola 2L (by Coca-Cola Beverages Africa)

- Supa Loaf Bread 400g (by Mini Bakeries from Kenya)

- Kabras Sugar 1kg (by West Kenya Sugar from Kenya)

- Kensalt Salt 200g

- Blue Band Spread 30g

- Royco Bouillon Beef Flavour 40g (by Unilever)

- Ajab Flour 1kg

- Fresh Fri Cooking Oil 1L (by Pwani Oil from Kenya)

Key insights from the most popular consumer goods in Kenya

Food staples are the backbone of Kenyan consumer goods

The ranking clearly shows that food staples dominate Kenyan households. Brands like Kensalt (with four SKUs), Ajab flour, and Kabras Sugar are central to everyday cooking and pantry needs. Their repeated presence demonstrates the importance of affordable, essential food products in shaping household consumption.

Spreads and cooking essentials: Blue Band leads the way

Blue Band is one of the most visible brands, appearing five times across different pack sizes. This reflects its deep household penetration in Kenya due to a strong heritage as well as the role of spreads in everyday diets. Similarly, Fresh Fri cooking oil and Chapa Mandashi baking powder show how cooking essentials consistently appear in the top ranks.

Beverages in Kenya: Predator energy and global soft drinks

The list also highlights the role of beverages. Predator energy drink is a standout, underlining the growing popularity of energy drinks in Kenya. Alongside it, global soft drink giants Coca-Cola and Fanta maintain strong positions in household consumption. Together, they show how beverages cut across both everyday refreshment and functional energy needs.

International vs local FMCG brands in Kenya

The most popular consumer goods in Kenya reveal a balance between local champions (Arimi’s, Ajab, Kensalt, Supa Loaf, Kabras, Fresh Fri) and multinational FMCG players (Flora Food Group with Blue Band, Unilever with Vaseline and Royco; Coca-Cola; Nestlé; and Indomie, from Nigeria). Local brands excel in staples and affordable essentials, while global brands dominate beverages, spreads, and packaged snacks.

Pack size variety and affordability drive shopper choices

Another clear insight is the prevalence of multiple pack sizes. From small sachets (Nescafé 1.5g, Blue Band 30g) to large family packs (2kg flour, 2L soft drinks), brands adapt to consumer needs for affordability and flexibility. This pack-size strategy helps brands remain relevant across income levels as well as occasions. For example, the smaller Arimi container (50g) can easily fit in a handbag, making it convenient for use on the go.

How SagaProduct consumer panel data helps brands grow in Kenya

Discover how consumer panel data in Kenya can drive brand growth in the fast-moving consumer goods (FMCG) market. This ranking of the most popular consumer goods in Kenya shows that SagaProduct goes beyond surveys and retail sales estimates by tracking the products that actually reach consumers’ pantries. The database delivers granular SKU-level insights, including product prices, consumer ratings, and detailed scanning behavior. With SagaProduct consumer panel data, brands can monitor SKU performance, track competitor activity, and uncover new growth opportunities in Kenya’s dynamic FMCG sector.

Get in touch with Sagaci Research today to learn how our Shopper panel in Kenya can guide your strategy.

Methodology

SagaProduct, Sagaci Research‘s proprietary Shopper Panel in Africa captures detailed insights into the products consumers purchase. Data is based on brands most scanned by panel members

Population: panel members in Kenya

Period: Last 12 Months (2024/2025)