- 12/08/2025

- Posted by: Monique Sperandio

- Categories: Articles, Beauty & Personal Care, SagaProduct

When you think of popular personal care brands in Africa, global giants often come to mind. Yet, many of the most widely available products on the continent come from African personal care brands proudly rooted in local markets.

Local roots, continental reach for African personal care brands

Manufacturers like Dream Cosmetics, NP Gandour, Amka, Sivop, Movit, and TPPL may have started locally (in Côte d’Ivoire, South Africa, Uganda, or Tanzania), but today, their products are lining store shelves from Dakar to Dar es Salaam.

Here’s a look at their growing footprints, starting with key players from Côte d’Ivoire.

- Dream Cosmetics (Côte d’Ivoire): Strong in Francophone West Africa, Dream products are widely sold in Côte d’Ivoire, Senegal, Mali, Burkina Faso, and have made inroads into Central and East Africa down to Mozambique. For example, in our SagaProduct database, we find brands such as Day by Day and Babymed, and Blackstar have a significant presence in the Southern African country.

- NP Gandour (Côte d’Ivoire): A stalwart since 1965, NP Gandour stands out with its in-house R&D center, ISO 9001 quality certification, and rigorous supply-chain control. Known for trusted brands like Pharmaderm (antiseptic) and Reflex (mouthwash), it serves not just Côte d’Ivoire but also belt-wide markets like Senegal, Mali, Cameroon, and DR. Beyond Africa, NP Gandour extends its reach to America and Asia, targeting the African diaspora.

- Sivop (Côte d’Ivoire): A major player in West and Central Africa, Sivop is distributed in over 15 countries, including Togo, Benin, Nigeria, Cameroon, and the DRC. Its flagship brand across the continent, Sivoderm, spans multiple sub-categories, including body lotion, face care, skin care, and depilatories.

Leading personal care manufacturers from Southern and East Africa

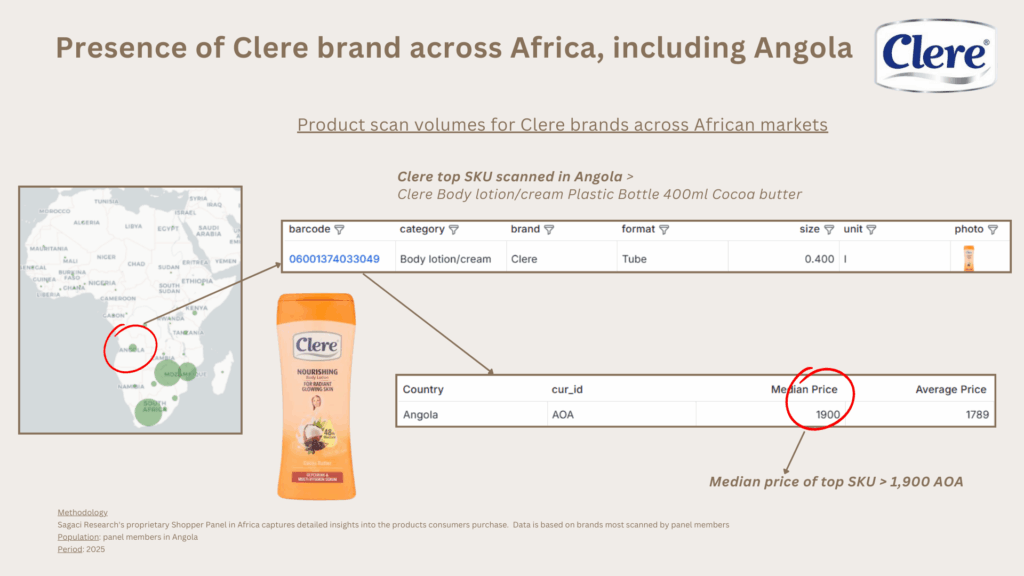

- Amka (South Africa): A powerhouse in Southern Africa, Amka’s personal care range (including brands like Soft ‘n’ Free and Clere) is present in South Africa, Namibia, Zambia, Botswana, and in markets such as Angola.

Exploring the personal care market in Angola with SagaProduct reveals that Amka’s flagship body lotion brand, Clere, trails key competitors. Leading the market is India’s Lykis (with brands like Lykis and Vogly), followed by NP Gandour, Dream Cosmetics, Beiersdorf, and Sivop.

- Movit (Uganda): A dominant force in East Africa, Movit is highly popular in its home market of Uganda, as well as in neighboring Kenya, Tanzania, and Rwanda. The brand has also expanded into the DRC, South Sudan, and Zambia, with hair food, conditioners, and petroleum jelly as its core categories.

- TPPL (Tanzania): TPPL leads the Beauty and Personal Care market in Tanzania by the number of scanned products. It outpaces competitors like Chemicotex, Unilever, Movit, and Beiersdorf. Its products (including flagship brand Vestline) are sold across Tanzania and East Africa, as well as in Mozambique, Zambia, Zimbabwe, and parts of Central and West Africa.

Why African personal care brands are winning hearts (and bathroom shelves)

Their secret? A deep understanding of local beauty standards, price points that work for mass-market shoppers, and products that actually work in African climates.

They’re not trying to adapt foreign formulas — they’re starting with African realities and building products from there. Whether it’s skincare that handles heat and humidity or haircare that embraces natural textures, these brands are made for here.

Consequently, across various categories, local FMCG brands in Africa often enjoy stronger consumer preference than their global counterparts.

Could the future of the beauty market be African?

While the global multinationals fight for market share, these African champions are winning consumers’ trust, one body lotion, hair pomade, or roll-on at a time.

The rise of pan-African personal care brands signals something bigger: a growing pride in products ‘Made in Africa’. In fact, over 50% of pan-African panel members prefer beauty products made in their own countries (2025 SagaCube data).

While global brands like Nivea, Dove, and Vaseline have the widest continental coverage, the future of Africa’s beauty market may well be driven by African brands.

Further exploring the personal care market in Africa

With SagaProduct, we track Beauty and Personal Care alongside many other FMCG categories across Africa. This powerful database gives FMCG companies fact-based visibility into what consumers are actually buying. Leveraging our extensive product data, it delivers a detailed view of category size, brand and SKU performance, market leaders, and geographical reach. Demographic analysis of these insights helps brands spot growth opportunities and distribution gaps.

Get in touch below to discover which African beauty and personal care brands are winning, and where the market is heading.

Methodology

SagaProduct, Sagaci Research‘s proprietary Shopper Panel in Africa captures detailed insights into the products consumers purchase. Data is based on brands most scanned by panel members in selected countries.

SagaCube consumption tracker leveraging the SagaPoll online panel in Africa.

Question: Preference for beauty products made in my home country (Net Agreement)

Population: SagaPoll panel members across 54 African countries

Base: n = 19,139 across all 54 African markets

Period: 2025