- 29/10/2025

- Posted by: Janick Pettit

- Categories: Articles, Consumer Goods / FMCG, Online Panels, SagaCube, SagaProduct

Africa’s middle class is feeling the strain. According to a recent Sagaci Research online survey, 56% of our panel members report higher household spending over the past 12 months, and for more than a quarter (27%), the increase has been significant.

How is this shaping the way people shop? And how are brands and retailers responding?

This article examines the contrast between Africa’s rising middle-class narrative and the everyday reality of shrinking budgets, and how consumers, brands, and retailers are adapting to new financial constraints.

How African consumers adapt their purchasing behaviour

Across Africa, inflation rates vary widely. From low single digits in some markets (around 3–5% in South Africa) to over 20% in others, such as Nigeria. Yet regardless of the rate, most consumers feel the impact on their daily budgets.

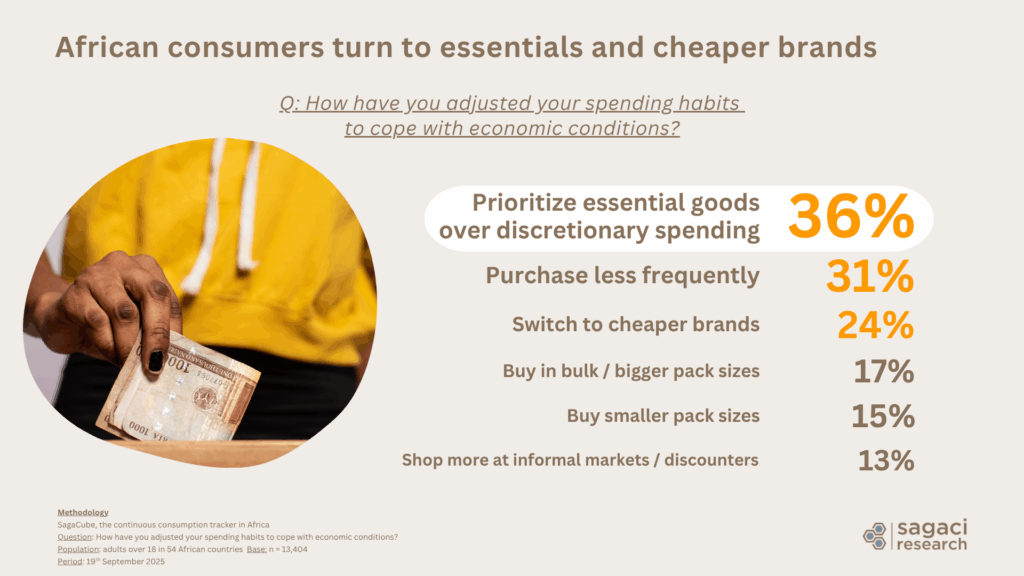

The September 2025 survey by Sagaci Research’s online panel in Africa reveals how shoppers are adjusting their spending habits to cope with these pressures.

- 36% of respondents say they now prioritize essential goods over discretionary spending

- 31% report that they shop less frequently

- 24% have switched to cheaper brands to stretch their budgets

These shifts highlight a clear trend: African consumers are adapting pragmatically, redefining priorities and seeking value in every purchase.

How Africa’s middle class is cutting back on spending

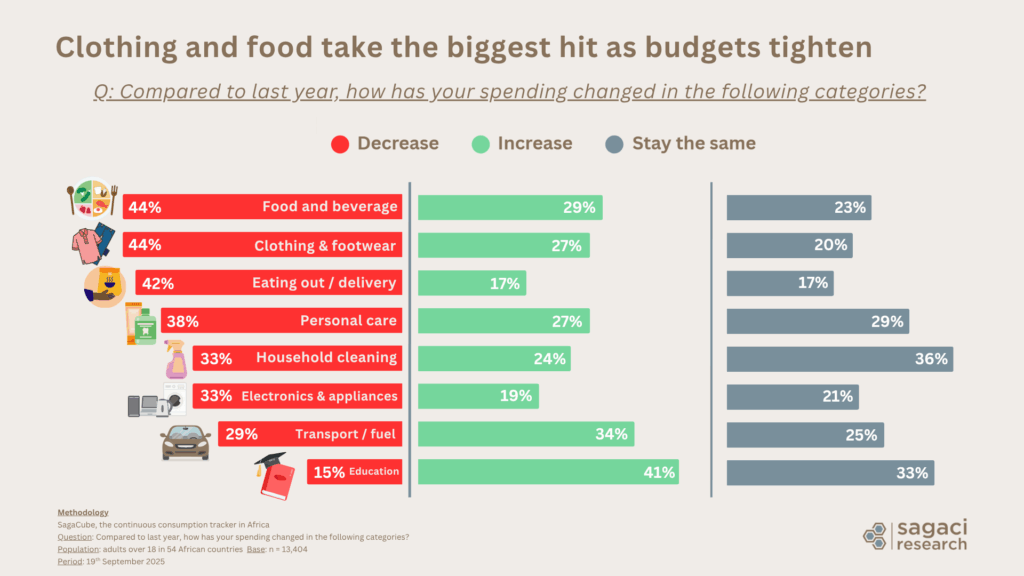

Our recent Sagaci Research survey highlights the categories where African consumers have reduced their spending the most over the past year.

Categories with the sharpest spending declines:

- Food and beverages: 44% (of respondents have reduced spending in this category)

- Clothing and footwear: 44%

- Eating out and food delivery: 42%

- Personal care: 38%

- Electronics and appliances: 33%

Meanwhile, household cleaning expenses have largely remained stable, with 36% of respondents reporting no change.

Conversely, some cost categories are moving in the opposite direction. Education expenses increased for 41% of panel members, while transport and fuel costs rose for 34%, reflecting inflationary pressure on essential daily needs and bringing the overall household budget up.

Focus on value, not just price

Our recent survey indicates that 24% of African consumers are switching to cheaper brands, with price emerging as a major driver of choice. For manufacturers and brands, the key question is how to respond without eroding loyalty.

One effective approach is to offer affordable pack sizes or smaller SKUs that fit tighter household budgets while keeping shoppers within the brand portfolio. Many consumers are not necessarily abandoning trusted names but rather redefining value, seeking products that feel “good enough” in quality, given current economic pressure.

Even middle-class consumers are increasingly choosing second, third, or fourth-tier brands based on price rather than always buying their preferred option. The challenge for brands is to position value as quality-for-money, not simply low cost.

Our Shopper Panel in Africa confirms this trend: smaller SKUs often rank among the most popular consumer goods, as seen, for example, in our recent list of the Top 30 most popular consumer goods in Kenya.

“African consumers are becoming more pragmatic. They’re not necessarily buying less; they’re buying smarter. Understanding this shift is what will separate the winners from the rest.“

— Julien Garcier, Managing Director, Sagaci Research

Innovate for affordability

As household budgets tighten, both brands and retailers must find new ways to stay affordable and relevant. Innovation now means making quality accessible through smarter formats, pricing, and retail models.

Brand strategies for FMCG affordability

For brands, maintaining loyalty means helping consumers stretch their spend without compromising quality. Refill packs, compact formats, and multi-use products lower entry prices while keeping shoppers within the brand.

Retailer strategies for value-driven shoppers in Africa

Retailers are also adapting to a more budget-conscious consumer. In South Africa, the rise of low-cost refill stations and short-dated discount outlets such as Best Before, reflects a structural shift toward more value-driven retail models.

At the same time, retailers are launching loyalty programs and expanding their dealer own brands (DOB) to strengthen their value proposition. According to industry estimates, private labels now account for around 25% of retail sales in South Africa. In categories such as toilet paper, data from our Shopper Panel in South Africa shows that retailer brands from Woolworths, Clicks, Shoprite, Checkers, Spar, and Pick n Pay together represent over a third of all brand scans.

In Kenya, chains such as Naivas, Carrefour and Quickmart are developping their private label range. These initiatives allow retailers to retain shoppers, protect margins, and respond directly to consumers’ search for better value.

CFAO Consumer in West Africa is also adapting its supermarket and hypermarket strategy to serve families with tighter budgets, adjusting offers and promotions toward smaller pack sizes and very low priced items, especially mid month when households have less cash on hand.

Pack deals such as “3 for 2” offers and bulk-buy options are also becoming more common in certain categories within modern retail.

Winning consumer trust with African brands

Consumers under pressure often stay with brands they trust, especially for essentials. The strength of local brands across the continent reflects this behaviour. In personal care, and in spite of intense competition from global brands (L’Oreal, Beiersdorf, etc), several African groups are expanding their footprint across multiple markets. Examples include Dream Cosmetics and NP Gandour from Côte d’Ivoire with distribution across West and Central Africa, Sivop in more than fifteen countries, Amka from South Africa with Clere across Southern Africa, Movit from Uganda active in East and parts of Central Africa, etc.

Data from SagaCube consumer tracker also points to strong country of origin cues. Our pan-African online panel shows that 40% of African respondents are very concerned about country of origin when buying products. Another 49% prefer beauty products made in Africa, underscoring why local champions resonate on the shelf.

In Côte d’Ivoire, Carrefour leaned into local pride with an August “Made in Côte d’Ivoire” event, highlighting homegrown brands, artisans, and ingredients.

For African brands, emphasising local roots to build trust might deliver greater long-term value than competing on price alone.

Rethinking portfolio priorities in Africa

As Africa’s middle class households trim food budgets (with 44% of consumers reducing spending on food and beverages) brands are rethinking where growth will come from. Personal care, by contrast, appears more resilient, with fewer consumers cutting back (38%) and a larger share maintaining their usual spend (29%).

This mirrors a global shift as manufacturers move from low-margin, highly competitive staples toward wellness, hygiene, and self-care, where margins are stronger and consumers still accept a premium for products that help them feel and live better.

Explore the key trends shaping African consumer behaviour

The brands that will win are the ones that read real behaviour and build trust and relevance beyond price.

To understand these shifts, our data solutions can support FMCG companies in Africa to track trends in products, pack sizes, and private label share (Shopper Panel), as well as measure size category trends and consumption patterns (SagaCube).

Ready to uncover the insights that will take your brand and portfolio to the next level in Africa? Contact our team on contact@sagaciresearch.com or click below to learn more.

Methodology

- SagaCube, the continuous consumption tracker in Africa

Questions:

Q: Over the past 12 months, how has your total household spending changed?

Q: How have you adjusted your spending habits to cope with economic conditions?

Compared to last year, how has your spending changed in the following categories?

Population: adults over 18 in 54 African countries Base: n = 13,404

Period: 19th September 2025

- SagaProduct, Sagaci Research‘s proprietary Shopper Panel in Africa capturing detailed insights into the products consumers purchase. Data is based on brands scanned by panel members in South Africa.

Images: © Carrefour Côte d’Ivoire