- 21/11/2025

- Posted by: Janick Pettit

- Categories: Articles, FinTech, SagaCube

Mobile money in Africa as a core financial channel

FinTech in Africa is, for many, associated with mobile money, now one of the most widely used financial tools on the continent.

According to recent SagaCube data on telecom usage in Africa, 82% of respondents of our online panel in Africa had used mobile money in the previous week. The latest GSMA figures from its State of the Industry Report indicate that mobile money accounts in Sub Saharan Africa processed 1.1 trillion dollars in transactions in 2024, up 15% compared with 2023.

Yet the FinTech landscape now goes well beyond mobile money, with digital lenders, neobanks, ecommerce payment providers and remittance platforms all building on this foundation.

As this ecosystem grows, the mobile phone remains at its centre, serving as the main financial interface for many Africans. This raises a simple question that this article will explore: what do people actually use their mobile phones for in Africa, and how do FinTech services fit into their everyday lives?

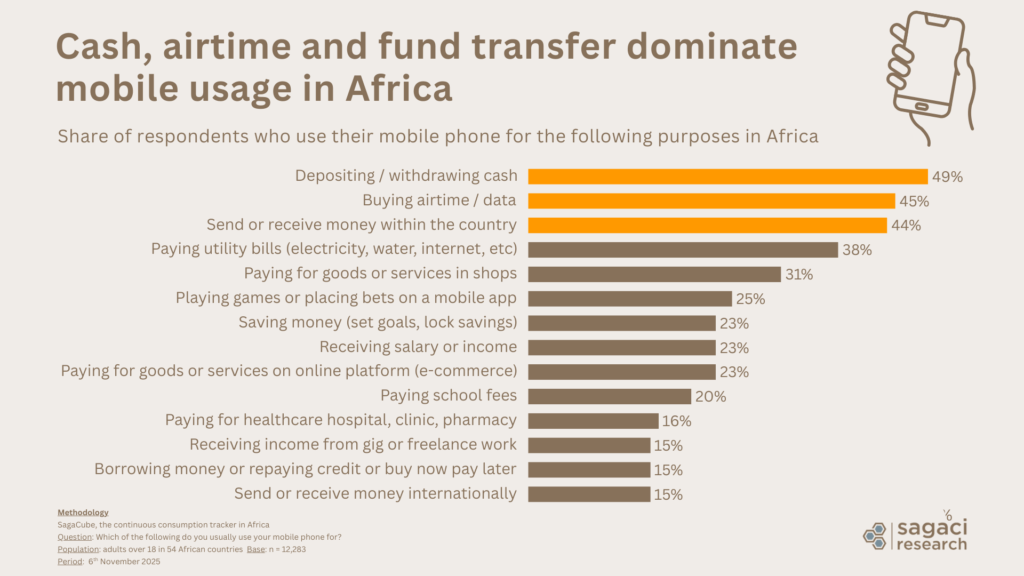

Cash, airtime and fund transfers drive mobile usage in Africa

SagaCube’s most recent data shows that everyday financial tasks dominate how Africans use their mobile phones. Cash deposits and withdrawals lead at 49%, followed by airtime and data purchases (45%) and domestic transfers to friends and family (44%). Payments for utility bills, in shops or online also rank high, confirming the mobile phone’s role as a broad transaction hub across the continent. These behaviours show how mobile activity now extends well beyond basic mobile money to form a wider digital payments ecosystem in Africa.

So how do these mobile uses differ from one African market to another? Examining specific behaviours shows marked country contrasts and some clear front runners.

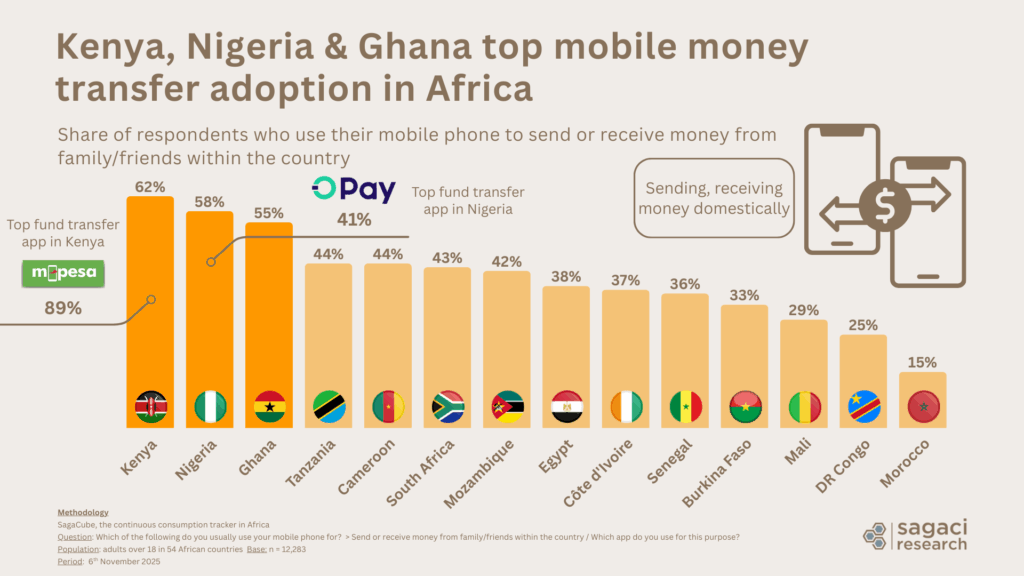

Money transfers in Africa

For sending or receiving money from family and friends domestically (one of the top three mobile uses in Africa), Kenya, as the pioneer of mobile money in the mid 2000s, shows the highest engagement at 62%. Historical player M-Pesa leads by far, used by 89 percent of those sending or receiving funds in Kenya.

Nigeria (58%) with main player Opay and Ghana (55%) follow closely, showing that mobile transfers are now embedded across the continent, not just in East Africa.

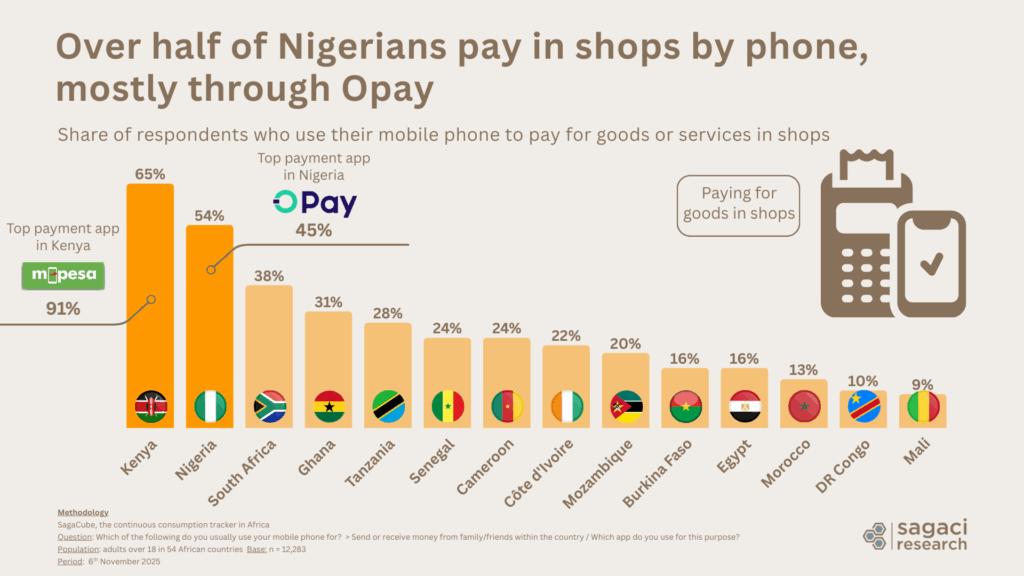

Mobile merchant payments in Africa

Paying for goods in shops by mobile phone is gaining real scale, with Kenya (65%) and Nigeria (54%) in the lead. South Africa (38%) follows, pointing to a growing appetite for mobile based merchant payments alongside traditional card and cash.

These trends echo what we see in our research on e-commerce and social commerce in Africa: whether purchases happen in physical shops, on marketplaces or via WhatsApp and Facebook, payments increasingly flow through the same wallets and apps rather than cash alone.

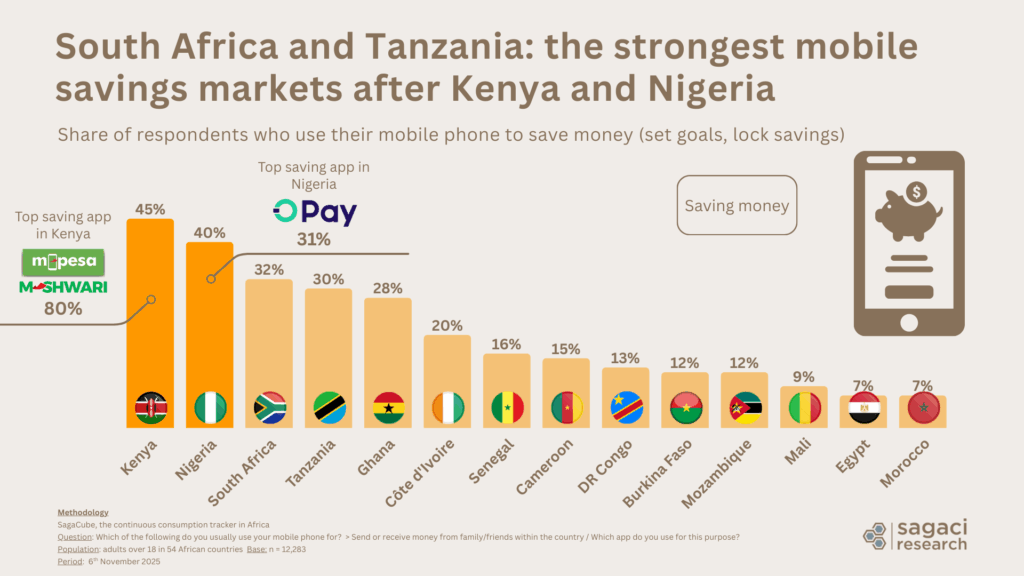

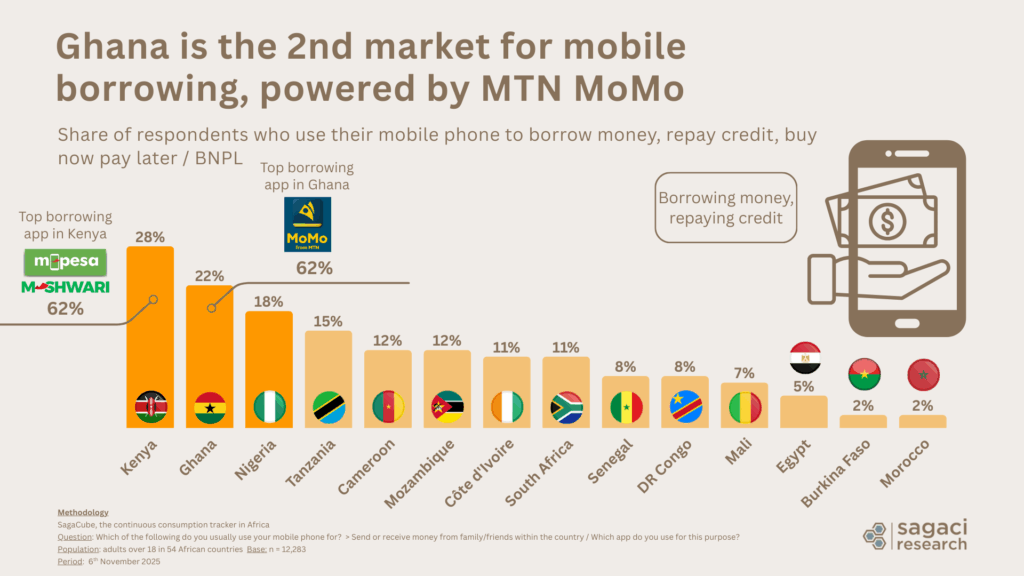

Mobile saving and lending in Africa

Many adults in Africa remain unbanked or underbanked, with low or irregular incomes that make traditional banking hard to access. Mobile based FinTech services now offer simple ways to hold money, build small savings and access short term credit.

Our recent consumer survey shows that mobile saving is highest in Kenya, supported by the M Shwari service available to M Pesa customers. Nigeria is another major market, where large mobile money and wallet ecosystems build on relatively high smartphone use and dense agent networks. Ghana, where MTN MoMo is the main player, also posts strong levels of digital lending, supported by high mobile money penetration and a proactive regulatory framework.

MNOs (Mobile Network Operators) have traditionally used airtime purchase and repayment data for credit scoring to power their lending services. Today, African FinTech apps and MNOs are increasingly adopting AI-driven credit scoring models that use a broad range of alternative data. This includes mobile transactions, behavioral analytics, and network usage, making small loans quickly available to people without traditional credit histories.

Understanding Africa’s FinTech ecosystem

Daily use of mobile money has created familiar digital habits and infrastructure that make it easier for new FinTech services to take hold across Africa. As a result, many providers are now expanding well beyond basic transfers into savings, credit, health insurance (eg. PalmPay in Nigeria), partnerships with banks (eg. Senegal-based Wave), or cross border services.

As the FinTech ecosystem in Africa continues to grow, decision makers need granular, up to date consumer insights to understand where opportunities are emerging. This is where Sagaci Research can help. Get in touch on contact@sagaciresearch.com or by clicking below.

Methodology

SagaCube, the continuous consumption tracker in Africa

Questions: Which of the following do you usually use your mobile phone for? Which app do you use for this purpose?

Population: adults over 18 in 54 African countries

Base: n = 12,283

Period: 6th November 2025