- 08/01/2026

- Posted by: Janick Pettit

- Categories: Articles, Consumer Goods / FMCG, SagaProduct, South Africa

South Africa’s FMCG market is one of the most mature and competitive on the continent, combining strong local brands, global manufacturers, and well-established yet evolving consumption habits. Using data collected through SagaProduct, Sagaci Research’s product scan solution powered by our online panel in South Africa, this article ranks the top 30 FMCG products in South Africa based on real consumer scans.

Unlike claimed usage or purchase intention surveys, product scan data captures what consumers physically have at home. This provides a grounded and behavioural view of FMCG consumption, highlighting the brands, categories, formats, and pack sizes that truly dominate South African households.

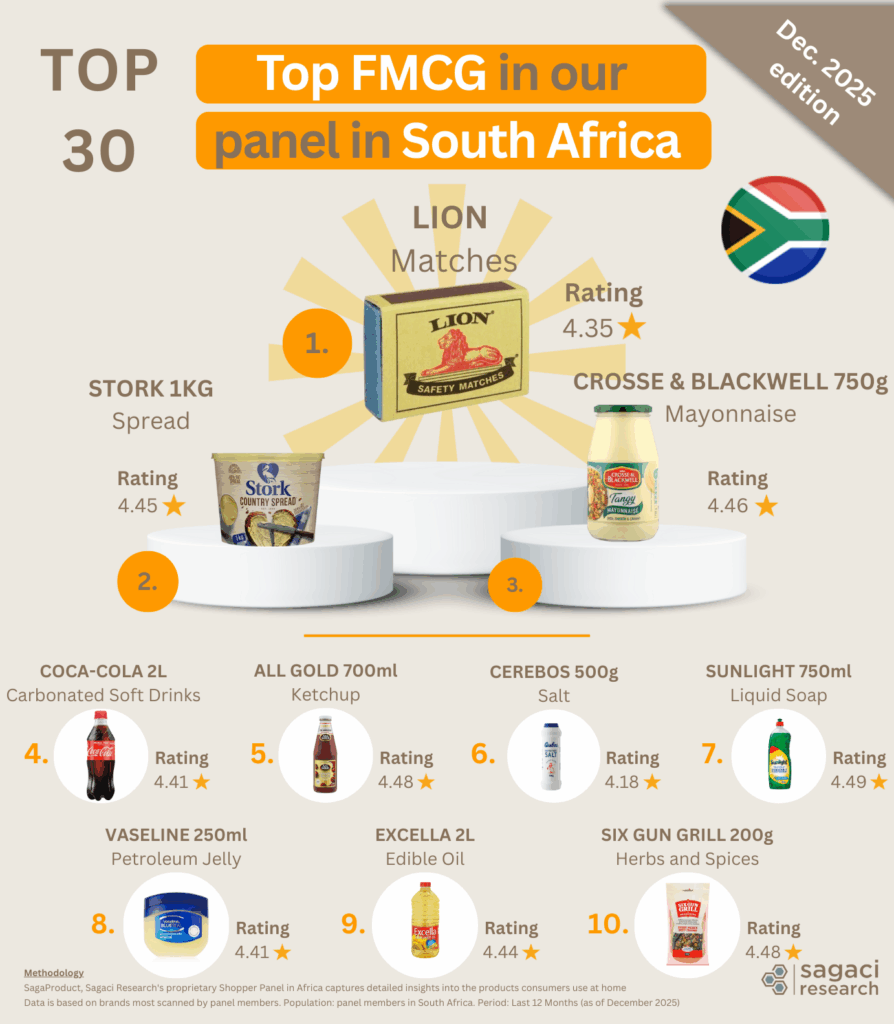

Top 30 FMCG products in South Africa

Let’s explore the Top 30 FMCG in South Africa based on the SKUs most scanned by members of SagaPoll online panel.

Here is the detailed ranking of the top 30 FMCG in South Africa including consumer rating (on a scale from 1 to 5).

| Rank | Brand | Category | Packaging | Size | Manufacturer | Origin | Rating |

| 1 | Lion | Housewares and home furnishings | Paper box | 50 matches | The Lion Match Company | Local | 4.35 |

| 2 | Stork | Spreads, jams and honey | Cup | 1 kg | Siqalo Foods (subsidiary of Remgro) | Local | 4.45 |

| 3 | Crosse & Blackwell | Mayonnaise | Glass bottle | 750 g | Tiger Brands | Local | 4.46 |

| 4 | Coca-Cola | Carbonated soft drinks | Plastic bottle | 2 L | Coca-Cola South Africa | International | 4.41 |

| 5 | All Gold | Ketchup | Glass bottle | 700 ml | Tiger Brands | Local | 4.48 |

| 6 | Cerebos | Salt | Plastic bottle | 500g | Bud Group | Local | 4.37 |

| 7 | Sunlight | Liquid soap | Plastic bottle | 75 cl | Unilever | International | 4.49 |

| 8 | Vaseline | Petroleum jelly | Cup | 250 ml | Unilever | International | 4.41 |

| 9 | Excella | Edible oils | Plastic bottle | 2 L | Excella (owned by Wilmar) | Local | 4.44 |

| 10 | Six Gun Grill | Herbs and spices | Bag | 200 g | Crown National | Local | 4.48 |

| 11 | Nola | Mayonnaise | Plastic bottle | 750 g | RCL Foods | Local | 4.41 |

| 12 | Aromat | Herbs and spices | Plastic bottle | 75 g | Unilever | International | 4.49 |

| 13 | Coca-Cola | Non-alcoholic beverages | Glass bottle | 1.25 L | Coca-Cola South Africa | International | 4.35 |

| 14 | Koo | Table sauces | Can | 400 g | Tiger Brands | Local | 4.45 |

| 15 | Sunlight | Bar soap | Plastic wrap | 500 g | Unilever | International | 4.53 |

| 16 | Oros | Juices | Plastic bottle | 2 L | Tiger Brands | Local | 4.47 |

| 17 | D’Lite | Spreads, jams and honey | Sachet | 1 kg | Willowton Group | Local | 4.19 |

| 18 | Reitzer | Body lotion and cream | Plastic bottle | 500 ml | Reitzer | Local | 4.35 |

| 19 | Jungle | Family cereals | Paper box | 1 kg | Tiger Brands | Local | 4.51 |

| 20 | Vicks | Consumer health | Other | 10 g | Procter & Gamble | International | 4.43 |

| 21 | Lucky Star | Canned seafood | Can | 400 g | Lucky Star | Local | 4.43 |

| 22 | Vaseline | Petroleum jelly | Cup | 100 ml | Unilever | International | 4.41 |

| 23 | Gold Star | Baking powder | Sachet | 100 g | Anchor Yeast (owned by Lallemand) | Local | 4.46 |

| 24 | Zam-Buk | Petroleum jelly | Other | 7 g | Bayer (produced by Interthai) | International | 4.46 |

| 25 | Isoplus | Styling agents and gel | Plastic bottle | 225 g | Marico | Local | 4.30 |

| 26 | Ricoffy | Coffee | Can | 250 g | Nestlé | International | 4.34 |

| 27 | Albany | Bread | Plastic wrap | 700 g | Tiger Brands | Local | 4.50 |

| 28 | Simba | Salty snacks | Sachet | 20 g | PepsiCo | International | 4.36 |

| 29 | Carling Black Label | Beer | Glass bottle | 750 cl | SAB (owned by AB InBev) | Local | 4.27 |

| 30 | Vaseline | Bouillon | Tube | 50 ml | Unilever | International | 4.38 |

Key FMCG consumption insights in South Africa

Several strong consumption patterns emerge from this product ranking, shedding light on how South African households prioritise value, familiarity, and functionality.

Large family formats dominate across categories in South Africa

The ranking tends to be skewed toward large pack sizes, particularly in food and beverages. Two litre soft drinks, one kilogram spreads, two litre edible oils, and one kilogram cereals consistently outperform smaller formats. This reflects shared household consumption and a clear preference for formats that optimise cost per use rather than convenience.

South African FMCG brands remain deeply entrenched

While multinational manufacturers such as Unilever, Coca-Cola, Procter & Gamble, and PepsiCo are well represented, the ranking is largely driven by South African brands. Tiger Brands clearly stands out, with multiple products in the top 30, including All Gold, Albany, Oros, Jungle, Koo, and Crosse & Blackwell.

Other established local brands, such as Lion matches, Lucky Star canned fish, and Reitzer body lotion, further illustrate the enduring strength of South African heritage brands with strong emotional and cultural relevance in everyday consumption.

Affordability and versatility outweigh premium positioning

Products that can serve multiple purposes or stretch across usage occasions perform particularly well. Vaseline appears multiple times in different formats, underlining its role as a versatile household product. Bar soap ranks strongly alongside liquid alternatives, highlighting the importance of affordability and flexibility.

Taken together, the data shows that FMCG consumption in South Africa remains firmly anchored in essentials, with strong loyalty toward brands that deliver consistency, practicality, and value.

What this means for FMCG players in South Africa

For FMCG brands and manufacturers, the data shows that everyday essentials, trusted local brands, and value-driven formats continue to drive household consumption in South Africa.

More importantly, SagaProduct provides a behavioural view of FMCG consumption based on real products present in households, rather than claimed usage. This allows brands to understand what consumers actually buy, in which formats, and at what scale, and to apply the same analysis consistently across more than 30 African markets to inform portfolio, packaging, and brand strategy.

Methodology

SagaProduct, Sagaci Research’s proprietary Shopper Panel in Africa captures detailed insights into the products consumers purchase. Data is based on brands most scanned by panel members.

Population: panel members in South Africa

Period: Year to date / last 12 Months as of December 2025

Frequently Asked Questions

Below are answers to some common questions we receive about FMCG product scan data and rankings in Africa.

What are the most consumed FMCG products in South Africa?

Based on consumer scan data, the most consumed FMCG products in South Africa are everyday essentials such as cooking oils, spreads, table sauces, bread, soft drinks, dishwashing liquid, and personal care staples.

How is this FMCG ranking calculated and why use product scan data?

This ranking is based on product scan data collected through SagaProduct. Consumers scan products they have at home, allowing Sagaci Research to measure real usage and distribution rather than claimed behaviour. This approach reduces recall bias and provides a more accurate view of FMCG consumption than traditional surveys.

Can this data be analysed across multiple African markets?

Yes. SagaProduct uses a consistent methodology across markets, making it possible to conduct the same in depth FMCG product analysis in more than 30 African countries. Similar analyses using this approach have already been carried out in markets such as Zimbabwe, Kenya, and Côte d’Ivoire.

Get in touch with our team on contact@sagaciresearch.com to request your report for your target categories and countries.

© Images by freepik